Police have warned Canada's leaders of the potential for social and political polarization, economic crisis, ecological meltdown, and territorial disintegration, as well as a generational revolt stemming from economic decline and unaffordable housing.

Vietnam's economy slowed in the first quarter due to uneven growth in exports and factory output, as well as tepid consumption activity, leading to a lower-than-expected GDP expansion of 5.66%.

Pakistan's potential trade resumption with India aims to improve economic stability and reduce dependence on China, but careful diplomacy and consideration of India's economic dominance are necessary.

Consumer price growth in Tokyo moderated in March, but remained above the central bank's inflation target, potentially leading to further interest rate increases in the future.

From April, people on low incomes in England and Wales will be able to apply for Debt Relief Orders (DROs) for free, clearing their existing debts on council tax, energy bills, and rent, with Olu from London expressing her relief and hope for the future knowing that her application will now be prioritized and that the £90 application fee will be waived.

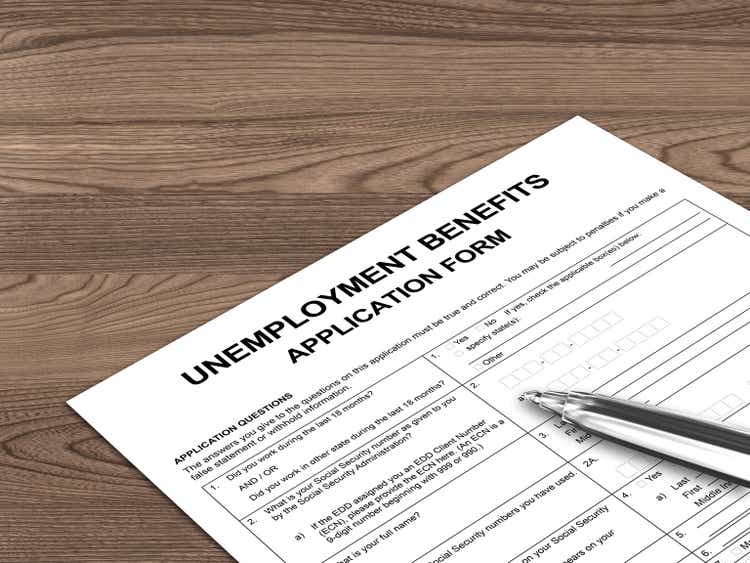

The article discusses the global unemployment rates and the 25 countries with the highest average salaries in the world, highlighting the challenges faced by different economic strata in accessing decent work opportunities and the need for addressing structural imbalances in the labor market.

The collapse of the Francis Scott Key Bridge in Baltimore and the shutdown of the Port of Baltimore are causing supply chain issues that may lead to car shortages and price increases, particularly for European imports, in the next few months.

The labor market in the US is not as robust as the Biden administration suggests, with job growth mostly limited to foreigners doing part-time work, and full-time jobs actually declining over the past year. Native-born Americans have been left behind, with employment for them falling while foreign-born employment has surpassed pre-pandemic levels. The positive headlines on the economy do not align with the underlying realities.

Despite positive economic indicators such as low unemployment and cooling inflation, US consumers are still experiencing economic strain as indicated by negative consumer sentiment.

China's recent Two Sessions conference, traditionally a platform to address economic challenges, offered little guidance and failed to address key issues, signaling a lack of ideas and potentially causing concern among China's leadership.

A 10% tariff on all imports to the US would result in a $1,500 tax increase annually for households and fail to significantly boost US manufacturing and jobs, according to an analysis from the Center for American Progress Action Fund.

Many young Canadians are expressing discontentment with the high cost of living in the country, including affordability issues with housing and the general cost of living, leading to discussions about leaving Canada on platforms like Reddit. Some Canadians are already making plans to move to other countries or provinces within Canada that offer cheaper living options. The dream of owning a home in Canada has been shattered for many, with increasing difficulties in achieving financial stability. As a result, some Canadians are choosing to settle in warmer places like Mexico or Costa Rica, while others are considering moving to cheaper provinces within Canada.

U.S. economic growth in the fourth quarter of 2023 was revised upwards to 3.4%, primarily due to increased consumer spending and nonresidential fixed investment, which could impact the Federal Reserve's decision on interest rates.

The slowdown in core inflation in Tokyo and unexpected slide in factory output raise uncertainty about the timing of the Bank of Japan's next rate hike and may prompt intervention in the market to bolster the yen.

The Canadian dollar strengthened against the US dollar as better-than-expected economic growth reduced the likelihood of interest rate cuts by the Bank of Canada.

The collapse of the Francis Scott Key bridge at the Port of Baltimore is expected to disrupt the global automotive vehicle and coal supply chain, but India's trade is not directly impacted due to minimal automobile exports to the US.

The definition of the middle class in America has dramatically changed over the years, with a comparison showing that making $30,000 a year in 1983 is equivalent to making $164,000 a year in 2023-2024, leading many to argue that the middle class is dead.

The pandemic has led to a shift in customer expectations, with buyers becoming more demanding and agitated, leading to increased challenges for frontline workers and a decline in service quality. Staffing shortages and underinvestment in employees also contribute to these issues.

The British public's expectations for inflation in the short and long term decreased in March, according to a survey by Citi, indicating a positive trend for the Bank of England's monetary policy committee.

The White House's positive message about the economy is not resonating with most Americans, who are feeling the effects of high inflation and rising costs of living, leading to increased reliance on pawn shops and hardship withdrawals from retirement funds. As the economic storm approaches, diversifying with precious metals like gold and silver may provide a shelter for savings.

The content is about a platform that offers live streaming of Fox News and full episodes as well as a radio channel coverage.

Argentine President Javier Milei plans to cut 70,000 government jobs as part of his strategy to reduce government spending and eliminate the national deficit, despite facing backlash from unions and criticism for the layoffs.

The collapse of the Francis Scott Key Bridge in Baltimore is expected to have a significant economic impact, leading to higher prices for groceries, gas, and other goods, as shipping and maritime traffic are disrupted and supply chain problems worsen.

Food prices have increased by 25% during the Covid-19 period, leading to low-income consumers cutting back on fast food and restaurants and causing concern among executives about losing business; this is indicative of a recession.

The U.S. economy experienced strong GDP growth and record-high corporate profits in the fourth quarter of 2023, surpassing expectations due to the impact of pandemic stimulus; however, inflation eased slightly during the same period.

Over 50 countries are projected to experience high to extremely high water stress by 2050, with the Middle East, North Africa, and parts of Southern Europe being the most severely impacted regions, highlighting the urgent need for sustainable water management practices.

China is facing major economic and geopolitical challenges that could lead to a "100-year storm," including a debt problem, internal wealth gap, strained relations with the US, technological competition, and risks of the climate crisis, according to billionaire investor Ray Dalio.

Canada's main stock index, the Toronto Stock Exchange's S&P/TSX composite index, ended the quarter at a new all-time high, driven by gains in resource shares and anticipation of potential interest rate cuts; meanwhile, Canada's GDP rebounded in January, exceeding expectations, and the country has experienced its fastest population growth in 66 years, largely due to temporary immigration.

U.S. consumer sentiment unexpectedly rose in March to the highest level in nearly three years, driven by growing confidence in softening inflation.

Remote work, particularly hybrid or fully remote setups, is becoming increasingly profitable for companies as it has been proven not to impact performance, reduces turnover, and eliminates the need for office space, leading to a potential transfer of value from commercial to residential real estate and the hollowing out of cities.

Economist David Rosenberg warns that the Federal Reserve's interest rate forecasts signal an imminent recession, with a projected 150 basis-point reduction by 2025 and stock investors eagerly awaiting looser monetary policy.

Pending home sales in the U.S. increased by 1.6% in February due to slight rises in inventory and job gains, although sales on a yearly basis fell by 7% due to affordability challenges, according to the National Association of Realtors.

To prevent future issues, please enable Javascript and cookies in your browser and disable ad-blocker if it's enabled.

Higher defence spending and increased government spending masked a deep recession in manufacturing and other sectors of the UK economy, although the recession is expected to rebound this year, and the declining trade data highlights the country's long-term decline, worsened by factors such as the lack of private investment after the Brexit vote and trade restrictions with the EU.

The UK government has decided to halt its effort to use increases in the minimum wage to narrow the wage gap, providing relief to employers after a significant jump in wages this year.

Ghana and Ivory Coast, once dominant players in the cocoa industry, are facing catastrophic harvests due to illegal gold mining, climate change, mismanagement, and disease, potentially leading to a decline in West Africa's cocoa supremacy and higher chocolate prices for consumers.

Credible, a personal finance marketplace, provides tools and information to help individuals improve their finances, including current mortgage rates and tips for getting the best rate.

In Tampa, annual inflation was 3.9% in January, compared to 3.1% nationally, and changes in housing prices, population growth, and regional differences in goods transportation and energy sources all contribute to slight variations in price changes and inflation across different regions of the United States.

Illegal gold mining, climate change, mismanagement, and disease are causing catastrophic harvests in Ghana and Ivory Coast, leading to shortages of cocoa beans and record-high prices for chocolate in the future, potentially signaling the end of West Africa's cocoa supremacy and opening the door for Latin American producers.

The number of Americans filing for unemployment benefits slightly decreased last week, indicating a strong labor market and high job security for most workers.

Initial jobless claims for the week ended March 23 declined by 2K to 210K, beating expectations, indicating a positive trend in the job market.

Canadian economist David Rosenberg believes that the housing market is no longer in danger, as home prices have calmed down and supply is returning, but he still predicts a recession in both Canada and the United States, leading to interest rate cuts by central banks. He also suggests that Canada's ambitious immigration policy may be negatively impacting the housing market and calls for a rethink of immigration policy. Rosenberg emphasizes the need for political reform and expresses his passion and dedication to his work as an economist and strategist.

Canadian economy on track to surpass first-quarter forecasts, bolstering the case for a patient approach to interest rate cuts by the Bank of Canada.

China has lost 155 billionaires due to slowing growth, but still maintains its position as the world's leader in billionaire count with 814, according to the Hurun Global Rich List 2024 report, which also highlights the emigration trend among China's affluent.

Zambia's successful debt restructuring deal with bondholders under the Common Framework raises hopes for similar deals in other countries, although concerns remain about transparency and the efficacy of the multilateral mechanism.

U.S. Secretary of Energy Jennifer Granholm highlighted the impact of economic recovery and development bills in Milwaukee, pointing to companies like Ingeteam and Copeland that have started manufacturing clean energy products as part of the Biden administration's "Investing in America" initiative.

Foreign companies exiting Russia since its invasion of Ukraine in 2022 have lost $107 billion, a 30% increase since August, due to punitive measures imposed by President Vladimir Putin's regime, including discounting assets by 50% and paying 10% of sale proceeds to the federal budget.

Two lucky Georgians won $50,000 each in the Powerball drawing, and there will be another chance to win a jackpot of $935 million on Saturday.

The European Central Bank is considering lowering interest rates as consumer price growth slows down.

Chinese President Xi Jinping's comments on monetary policies, particularly the buying and selling of government bonds, have sparked speculation among traders about the possibility of quantitative easing in China, leading to gains in local stocks, although some analysts believe the remarks were focused on improving open-market operations rather than indicating QE.