Ursula von der Leyen is seeking a second term as head of the European Commission, and her first term has been marked by challenges such as the COVID-19 pandemic and Russia's invasion of Ukraine, as well as efforts to promote economic growth through initiatives like the NextGenerationEU fund and the EU Green Deal. However, critics argue that poor management and neglect of certain areas, such as the Single Market and labour shortages, have hindered her achievements. The outcome of the upcoming parliamentary elections will determine whether she can continue to lead and enhance Europe's global economic competitiveness.

Ray Dalio, billionaire founder of Bridgewater Associates, warns that China should address its debt and monetary policy issues or risk a "lost decade," highlighting the need for deleveraging, easing of monetary policy, and managing economic and cultural clashes between China and the US to avoid a potential war in the next 10 years.

MyPillow's founder, Mike Lindell, claims that the recent eviction of MyPillow from a Minnesota warehouse is not due to financial problems but rather the landlord's desire to retake the property.

The US advertising market is projected to grow by 9.2% to $369 billion in 2024, according to media investment company Magna, driven by factors such as the improving macro-economic outlook, the momentum of digital media formats, and major cyclical events like the 2024 election cycle. Social media advertising and longform streaming ad revenue are also expected to see significant growth. However, entertainment and technology sectors may experience stagnating or declining advertising activity.

China aims to be a driving force for world economic recovery by promoting high-quality growth, opening its markets to foreign investors, and focusing on technological innovation, according to Zhao Leji, the chairman of the Standing Committee of the National People's Congress. China's import and export of goods is expected to exceed $32 trillion in the next five years.

The Australian economy is showing signs of slowdown as retail sales remain subdued, job vacancies continue to fall, and the number of businesses going into administration increases, despite a boost in spending from Taylor Swift fans in New South Wales and Victoria.

U.S. Treasury Secretary Janet Yellen plans to warn China about its clean energy subsidies, stating that they create unfair competition and hurt American and global firms and workers. She believes these subsidies will lead to oversupply and market distortion, particularly in industries such as solar panels, electric vehicle parts, and lithium-ion batteries. Yellen aims to convey her concerns during her scheduled visit to China in April.

Several New England universities and colleges, including Yale, Tufts, and Boston University, will have undergraduate tuition and costs exceeding $90,000 for the upcoming academic year, reflecting the rising cost of higher education that surpasses average inflation rates.

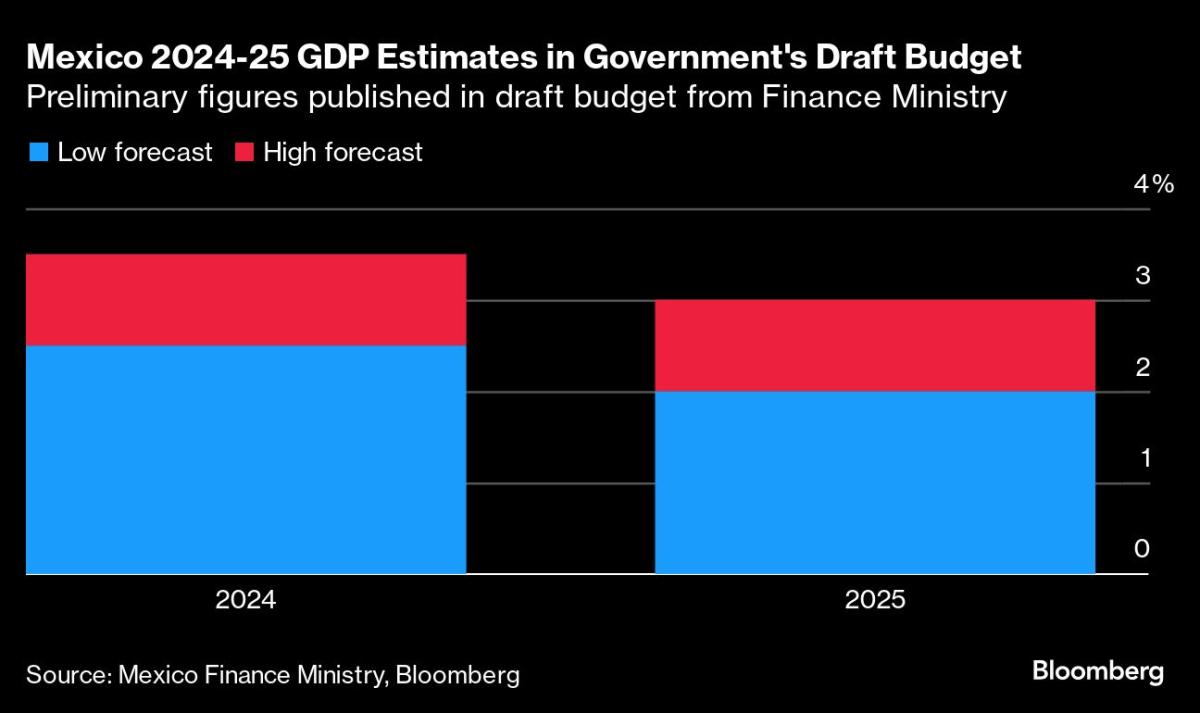

Mexico's economy is projected to grow 2-3% in 2025 with a fiscal deficit of 2.5% of GDP, while inflation is expected to decrease to 3.3% by the end of 2025, according to government estimates.

The Inflation Reduction Act (IRA) offers rebates and tax credits to help Americans purchase electric vehicles, solar panels, and electrical appliances, with a savings calculator available to determine eligibility and incentives.

Deputy Federal Reserve Governor Christopher Waller believes that recent disappointing inflation data supports the decision to maintain the current interest rate for now, but does not rule out the possibility of rate cuts later in the year.

US Treasury Secretary Janet Yellen is concerned that China's industrial-production push in the clean energy industry could destabilize the global economy by oversupplying markets with cheap green energy products.

California's economy is struggling due to high taxes, burdensome regulations, and poor governance, resulting in a high unemployment rate, an exodus of businesses and citizens, and a massive deficit, while the state's efforts to address issues like homelessness and minimum wage increases have proven to be ineffective.

Former President Trump's proposed 10 percent tariff on imported goods could lead to a cost of $1,500 per year for U.S. households, according to an economic analysis, with the tax impacting various sectors such as food, oil, automobiles, clothes, electronics, and furniture.

Cities across the United States are preparing for the economic boost from the upcoming total solar eclipse, with businesses in Ohio hoping to double or triple their sales and hotels already sold out ahead of the event.

Treasury Secretary Janet Yellen stated that reducing inflation-driven energy and healthcare costs is the top economic priority for the Biden administration, with efforts including the release of oil from the Strategic Petroleum Reserve and tax cuts for middle- and low-income workers. Yellen emphasized the impact of high energy prices on American families, particularly lower-income and middle-class households, and highlighted the administration's focus on lowering healthcare expenses through initiatives such as capping insulin costs and negotiating drug prices.

Private equity investments in the media sector in the US have led to layoffs and financial strain on companies, as wealthy owners prioritize profit over the well-being of employees and journalism as a whole, similar to the housing crisis of 2008. The trend of layoffs and downsizing continues, with shadow banks acquiring media companies, squeezing revenue, and cutting staff to maximize profits. The involvement of private equity firms in the media industry highlights a broader issue of corporate greed and the failure of regulatory systems to protect journalism.

A new study linking climate change and inflation is being promoted by liberals, but economists argue that the true causes of inflation are the massive government interventions in the economy aimed at combating climate change.

President Bola Tinubu has approved the establishment of the Presidential Economic Coordination Council (PECC) and the creation of the Economic Management Team Emergency Taskforce (EET) in order to bolster the nation's economic governance frameworks and ensure coordinated economic planning and implementation.

The Chief U.S. economist at UBS, Jonathan F. Pingle, points out several indicators suggesting an upcoming economic slowdown, including increased household leverage, elevated spending, and tight credit conditions.

The golden era of billionaires in India has led to extreme income inequality, surpassing even that of colonial times, with the top 1% now holding 22.6% of national income and 40.1% of national wealth, according to a study by the World Inequality Lab.

The Dow Jones experiences its highest one-day gain of 2024 and is on track for its longest streak of monthly advances in over three years.

S&P Global Ratings' global chief economist predicts that the Fed could cut rates up to five times in 2025, as the slowing US economy gives the central bank the opportunity to lower rates by 2 percentage points.

The German economy is expected to expand by only 0.1% in 2024, as five leading economic research institutes have revised their outlook significantly downward, leading to speculation of two ECB rate cuts before the August holiday break.

Investment analysts expect Treasury yields to remain relatively flat over the next year, with the 10-year Treasury yield predicted to be 4.18 percent, as the market anticipates possible cuts and interest rate hikes by the Federal Reserve wind down.

Europe is expected to have record-high natural gas inventories at the end of the winter season, reducing the risk of price spikes next winter and allowing for lower prices as the region diversifies its gas supply sources.

A Chinese supermarket faced backlash after advertising that it was only hiring cashiers between the ages of 18 and 30, highlighting the challenges faced by older job seekers in a competitive job market with a high unemployment rate for youth, adding to concerns over age-based discrimination and the "Curse of 35."

Egypt's devaluation of its currency, interest rate hike, and new funding deals have put the country on track to recover from its economic crisis, with lowered default risk and increased investor confidence.

Switzerland's economy is expected to have shown slight improvement in the first quarter of 2024, with the service sector driving moderate growth while manufacturing remains stagnant due to weak global demand and the Swiss franc exchange rate.

Germany's economic outlook has been revised down to 0.1% growth due to low domestic demand and high energy prices impacting exports, as leading economic research institutes express concerns about the country's ailing economy.

Treasury Secretary Janet Yellen criticizes China's increased production in green energy, electric vehicles, and batteries, calling it unfair competition that distorts global prices and harms American firms and workers, as well as the Chinese economy itself. She plans to address this issue during her upcoming trip to China.

Egypt has signed a $35 billion deal with the UAE to develop Ras el-Hekma, which has helped pull the country back from the brink of economic crisis, but it raises questions about the UAE's intentions and what it means for Egypt's promised reforms.

Xi Jinping has seemingly taken over economic policy-making in China, with Prime Minister Li Qiang's influence diminishing, as economic matters have been overshadowed by national security concerns and power has shifted to party commissions like the Central Financial and Economic Affairs Commission, resulting in a potential demotion for Li and increased power for Deputy Prime Minister He Lifeng.

India's potential for faster development and economic growth is hindered by a lack of "state capacity," with challenges in governance, education, and health, according to a new book by Karthik Muralidharan of the University of California, San Diego. The book suggests that India needs to focus on personnel management, data collection and accountability, and improving its federal structure to address these issues.

Wall Street firm Russell Investments believes that the US will likely avoid a recession in 2024, but warns of economic uncertainty and potential pitfalls, such as a cooling labor market and increasing default rates in various sectors.

S&P Forecasts Higher 2024 US Growth, 3-5 Fed Rate Cuts If Inflation Falls Despite Tough Labor Market

S&P Global Ratings has increased its forecast for US GDP growth in 2024 based on a strong finish to 2023 and decreasing inflationary pressures, with the agency predicting three interest rate cuts this year and possibly five next year if the labor market worsens.

Chinese President Xi Jinping met with top U.S. executives in Beijing to reassure foreign businesses about the Chinese market and its potential for collaboration, as concerns remain about regulatory crackdowns and rising costs.

Credible Operations provides tools and information to help individuals improve their finances, including current mortgage rates and tips for finding the best rate.

Federal regulators are concerned about the vulnerability of metro Phoenix's economy to disruptions caused by excessive heat, including health-related losses, decreased labor productivity, and increased energy consumption. Lower-income households and people of color are expected to be more vulnerable to these impacts, and the report calls for better planning and investments to mitigate the effects of extreme heat.

India's gold imports are expected to decrease by more than 90% in March due to lower demand caused by high prices, potentially impacting global prices and narrowing India's trade deficit.

BlackRock CEO Larry Fink warns that America's growing debt could lead to a crisis similar to Japan's lost decade, and the recent increase in U.S. Treasury yields is already dangerous, adding an extra trillion dollars in interest payments over the next decade. The rising national debt is also putting upward pressure on consumer prices and making it harder to fight inflation.

The housing crisis is viewed as the biggest risk to the Canadian economy by business leaders, with high housing costs and a lack of supply identified as the top risk, according to a survey by KPMG Canada. The survey also found that housing issues are leading businesses to increase pay and budget for higher labor costs, which is impacting business finances and making it harder to lower interest rates. Business leaders are calling for more public-private collaboration to tackle the crisis.

The Biden administration, concerned about China's heavily subsidized green technology exports, plans to address the issue during upcoming economic talks in Beijing, as Treasury Secretary Janet Yellen warns that China's overcapacity distorts global prices and hurts American firms and workers.

China has failed to fulfill a significant portion of its infrastructure funding allocated to Southeast Asia due to political instability, poor stakeholder engagement, and a declining demand for fossil fuel-powered projects, raising concerns about the future of its Belt and Road Initiative in the region. The unfulfilled funding amounts to US$50 billion, with more than half allocated to projects that have been cancelled or downsized. However, despite challenges, the initiative is expected to evolve into a more sustainable source of financing.

The Kiel Institute for the World Economy (IfW) has revised its economic forecast for Germany, predicting minimal growth of 0.1% this year, due to struggles both domestically and internationally, with political uncertainty continuing to impact investment activity and a poor mood in the country's economy.

Business leaders in Canada see the housing crisis as the biggest risk to the economy, with high housing costs and a lack of supply impacting businesses' ability to attract talent and causing increased labor costs.

Rising food prices in the US have caused low-income consumers to eat less fast food and reduce visits to restaurants, leading fast-food chains to focus on targeted discounts and loyalty apps to retain customers.

The average US household spends $25,513 per year, or 34% of the median household income, on the 10 most common bills, including mortgage, rent, and auto loans, with costs increasing for utilities, mobile phones, and health insurance.

European and British banks are relying on selling new debt, such as covered bonds, to repay Covid-era loans, but concerns are growing that the asset class may reach a saturation point, leading banks to have to sell more expensive types of finance and diversify their funding.

China's central bank chief, Pan Gongsheng, has called for IMF reforms that better reflect China's economic weight and a regional monetary mechanism, highlighting Beijing's desire to have more influence in the international financial system.