Brazil has launched investigations into allegations of dumping by China, its largest trade partner, as overproduction of Chinese goods and state subsidies cause concern for other countries.

The number of high-net-worth individuals seeking residency in other countries increased significantly in 2023, with many wealthy Americans making backup plans due to concerns about the political climate, school shootings, and potential tax hikes in the US. However, the US still remains attractive to millionaires, particularly in cities like Austin, Miami, and Scottsdale, but the country's future stability and ability to attract global talent are being questioned.

Eurozone leaders will gather in Brussels to discuss plans to boost investment and the economy, but their ambition for a single market for capital and a joined-up financial sector remains unfulfilled, with France considering alternative solutions.

Canadian grocery giant Loblaw is facing plans for a boycott due to high grocery prices, but the company claims to be "making efforts to lower food prices" by optimizing its store network, introducing new promotions, and providing deeper discounts on everyday items.

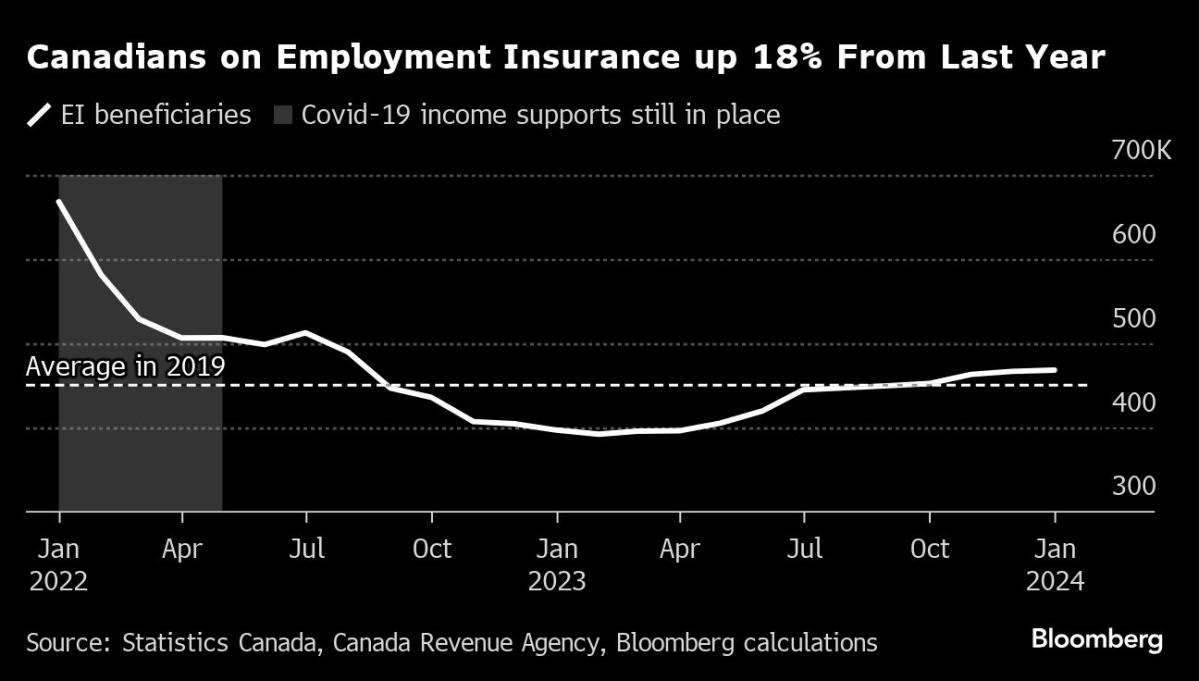

The number of Canadians receiving unemployment benefits in January increased by 18% compared to the previous year, continuing a trend of higher levels since the start of the pandemic.

Former Treasury Secretary Lawrence Summers criticizes the Federal Reserve for wanting to lower interest rates despite a strong economy and projections of high inflation.

Sri Lanka is close to finalizing a debt treatment plan with India and the Paris Club, which may include a moratorium of up to six years and a reduced interest rate during the repayment period.

The number of Americans filing new claims for unemployment benefits unexpectedly fell last week, while sales of previously owned homes increased by the most in a year in February, indicating a strong economy in the first quarter and making it less likely for the Federal Reserve to cut interest rates before June.

Credible Operations aims to help individuals improve their finances by providing tools and confidence, while also offering mortgage rates and information necessary for obtaining the best rate.

Labor productivity in the US is on the rise, and it is believed to be due to factors beyond artificial intelligence, which is good news for the economy and the stock market.

The US Justice Department has filed an antitrust lawsuit against Apple, claiming that the company is illegally abusing its monopoly power in the smartphone market by curating its app store and customer experience to the exclusion of competitors, including restricting cross-platform messaging and payment options and preventing certain apps and technologies from being used on iPhones.

Sales of previously owned homes in the US unexpectedly surged in February to the highest level in a year, indicating a rebound in the housing market, while mortgage rates also increased.

Rising global temperatures and climate change-induced extreme weather events are predicted to cause significant increases in food prices worldwide, affecting both high and low-income countries, with countries in the global south being more severely impacted, according to new research.

The plunge in US office values could surpass the 2008 real estate crisis, as prices continue to decline with no signs of recovery, posing risks to commercial mortgage-backed securities and leading to an increase in delinquency rates.

Michigan's adjusted jobless rate decreased by 1.9% to 3.9% between January and February, with employment up by 2,000 and unemployment down by 4,000 over the month.

The key bond market signal of an upcoming recession, the continuous inversion of the 2/10 Treasury yield curve, has lasted for the longest time ever, surpassing a record set in 1978, despite the U.S. economy's lack of contraction, largely due to the Federal Reserve's management and the economy's positive surprises.

Top economist Mohamed El-Erian believes that the Federal Reserve should wait a couple of years before cutting interest rates in order to allow inflation to fall to the target of 2% and avoid the risk of stagflation.

The U.S. Federal Trade Commission has recommended further investigation into the elevated profits of grocery retailers and promotions offered by consumer products makers to retailers, following concerns about price hikes and unfair practices in the industry.

The U.S. Federal Trade Commission is recommending further investigation into grocery store profits and consumer product promotions that have remained high since the pandemic, as concerns about rising prices and unfair practices persist.

Sri Lanka's economy is gradually improving following its worst economic crisis, with a decrease in inflation and an expansion in the second half of last year, although challenges such as high taxes, currency devaluation, and unemployment persist.

The Federal Reserve plans to maintain interest rates but adjusted its expectations for rate cuts in 2025 due to concerns about inflation, leading to potential delays and a bumpy fight against inflation.

A total of 36 developing countries have expressed their interest in joining the BRICS alliance, aiming to end reliance on the US dollar and promote local currencies for cross-border transactions.

U.S. business activity remained steady in March, but prices rose across the board, indicating that inflation could remain elevated, according to the S&P Global survey, which showed a modest slowdown in the services sector and a growth in manufacturing.

The US current account deficit narrowed in the fourth quarter to the lowest level in almost three years due to an increase in secondary income.

The number of Americans filing for unemployment benefits slightly declined, indicating a strong labor market and job security.

The energy price crisis triggered a significant increase in absolute poverty in the UK, with 600,000 more people falling into poverty, bringing the total to 12 million, due to steep price rises following Russia's invasion of Ukraine.

Turkey's central bank unexpectedly raised its key interest rate by 5 percentage points to combat soaring inflation, which has caused significant economic hardship for households.

The average national credit score in the U.S. has declined for the first time in over a decade, reflecting a shift in attitude toward personal finance and a lack of individual accountability, according to financial coach Jeannie Dougherty, who warns that credit scores have a significant impact on future financial comfort.

The Federal Reserve's decision to leave interest rates unchanged has positively impacted the market, raising questions about why this economic cycle is defying expectations and how to conclude it smoothly, while Vodafone seeks to improve its financial well-being through downsizing, and there is a need for reform in Britain's system for preserving historical buildings.

The US dollar's role in the global economy, its impact on the US manufacturing sector, and its use as a weapon are examined in Saleha Mohsin's book "Paper Soldiers," with three major risks to the dollar's dominance highlighted.

The Swiss National Bank's surprise rate cut and speculation of easing from major central banks have sparked a rally in global stock and bond markets, with record highs being reached in MSCI's all-country stock index and the S&P500 and Nasdaq.

Foreign companies exiting Russia have paid 35.7 billion rubles ($387 million) to Russia's budget as of March 15, 17 times more than Russia had expected for the whole of 2024, with the Russian government making it increasingly difficult for companies to leave by introducing hurdles and demanding steep payments.

The cost of breakfast items like coffee, bacon, eggs, bread, and milk has increased significantly in recent years, with prices rising compared to both the recent peak and five years ago, according to the U.S. Bureau of Labor Statistics.

New Zealand has entered its second recession in less than 18 months, with the country's GDP contracting by 0.1 percent in the October-December period, and economists attribute the downturn to aggressive interest rate hikes and the previous government's "big spending, big taxing" policies.

Prime Minister Shehbaz Sharif plans to include global experts and all stakeholders in a consultative process to improve Pakistan's economic health and financial stability before approaching the International Monetary Fund (IMF) for a fresh program.

Japan's exports increased by 7.8% in February, with growth in cars and electrical machinery, while the trade deficit reached its second straight month at 379 billion yen ($2.5 billion).

Japan's exports increased 7.8% in February, driven by strong shipments of cars and electrical machinery, while imports recorded a 0.5% increase, resulting in a trade deficit of $2.5 billion as demand from China has moderated and prices for key commodities fell.

India's Job Market Struggles with Soaring Unemployment, Falling Wages, and Shift to Low Quality Work

India's unemployment rate reached its highest level in 45 years in 2017-18, and while government data suggests a decrease to 3.2% in 2022-23, private surveys indicate higher rates; concerns have also been raised about the rise in self-employment and stagnant real wages.

Australia's unemployment rate in February dropped to 3.7%, surpassing expectations and the previous figure, leading to a positive reaction in the Australian Dollar.

India has experienced a significant increase in wealth concentration, surpassing the level seen during British colonial rule, with the top 1% now controlling 40.1% of national wealth and 22.6% of national income, according to a report by the World Inequality Lab. This rise in inequality since the early 2000s calls for policy interventions such as tax restructuring and public investments to mitigate the disparity and enable more equitable benefits from globalization.

The article discusses Federal Reserve Chairman Jay Powell's recent statements and the interpretations and speculation surrounding them, emphasizing the importance of his commitment to a 2% inflation target and the potential impact of rising personal borrowing costs on consumer sentiment.

A New Yorker visiting Canada is shocked by the country's high cost of living, prompting concerns about Canadians struggling to afford basic necessities and experiencing financial hardship.

New Zealand has entered its second recession in 18 months after its economy contracted in the last quarter of 2023, with the GDP figures showing a 0.1% shrinkage in the quarter to December and a 0.7% contraction in per capita terms, leading to potential budget cuts, including reducing the number of government workers.

The Federal Reserve officials still anticipate three rate cuts in 2024 despite elevated inflation, signaling confidence in the economy's ability to cool inflation gradually.

The Federal Reserve has paused its rate hikes due to a decline in inflation, which is expected to support further declines in mortgage rates and benefit the housing market. While mortgage rates are not directly controlled by the Fed, its policies set the overall tone, and a slowing economy and easing inflation pressures are prerequisites for lower mortgage rates. Although rising rates may affect affordability, history suggests that home prices and sales tend to be resilient to rate increases. However, a continued decline in mortgage rates could further intensify the shortage of homes for sale. Borrowers are advised to shop around for better rates, be cautious about adjustable-rate mortgages, and consider home equity loans or lines of credit.

Despite the Federal Reserve's announcement of no immediate rate changes and three cuts before the end of the year, homebuyers are unlikely to see relief in terms of lower mortgage rates, as the average rate on a 30-year fixed mortgage is expected to stay above 6% for the rest of the year.

The Dow, S&P 500, and Nasdaq reach record highs as the Federal Reserve maintains its rate-cut outlook during the meeting.

Wall Street's main stock indexes closed at record highs as the Federal Reserve maintained borrowing costs and hinted at potential rate cuts. The Dow Jones, S&P 500, and Nasdaq all surged, with investors reassured by Fed Chair Jerome Powell's comments on inflation.

Fannie Mae has revised its forecast for mortgage rates, predicting that rates will stay higher for longer than previously expected, and fewer homes will be sold in 2024 and 2025 due to elevated interest rates.

The video is playing in picture-in-picture mode, and the Fox Business Channel and Fox News Channel are currently airing various programs. Fox News Radio is also providing live coverage.