Goldman Sachs CEO David Solomon warns that the Federal Reserve's "soft landing" strategy in battling inflation may be challenging due to persistent high inflation levels, expressing skepticism about predictions of interest rate cuts and highlighting the uncertainty in the market.

The exclusion of China from the supply chain for manufacturing batteries using US and ally materials is threatening to increase costs and hinder the development of a competitive EV market in the US, leading automakers like Ford and GM to cut prices and reduce investment in EVs.

A perfect storm threatens progress on youth financial empowerment and the financial wellness of a generation, as the national savings crisis, lack of access to financial services, and budget trends in schools hinder the implementation of financial education and hinder lifelong financial opportunities for young people.

The Wells Fargo Money Study found that the majority of Americans have reduced spending and put life plans on hold due to financial concerns, with inflation and borrowing costs being significant factors.

US stocks hit a record high but may not sustain the rally due to concerns over a possible return to a stagflation scenario resembling the 1970s, characterized by economic stagnation, high inflation, and high unemployment.

Federal Reserve Governor Michelle Bowman expects inflation to continue declining with interest rates unchanged, but she believes it's not yet time to begin rate cuts, citing several risks that could contribute to inflation pressures.

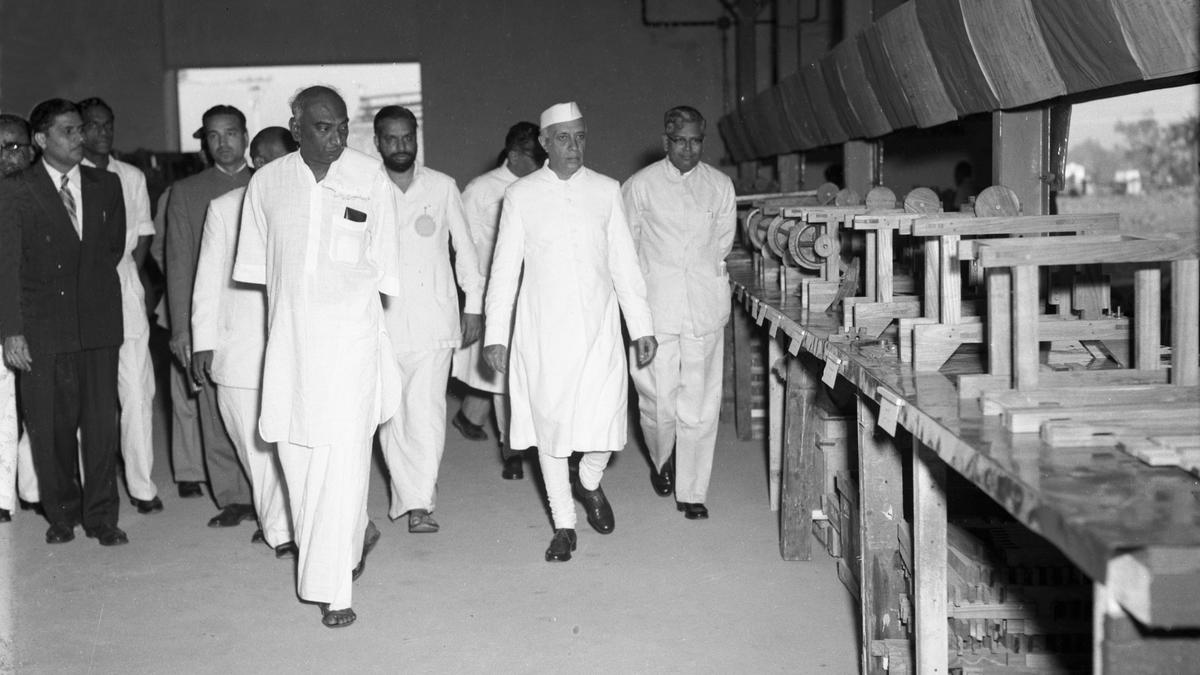

The Guindy Industrial Estate in Chennai, established during India's second Five Year Plan in 1958, played a crucial role in promoting industrialization and housing small-scale industries, and continues to be a hub for diverse industries including IT companies.

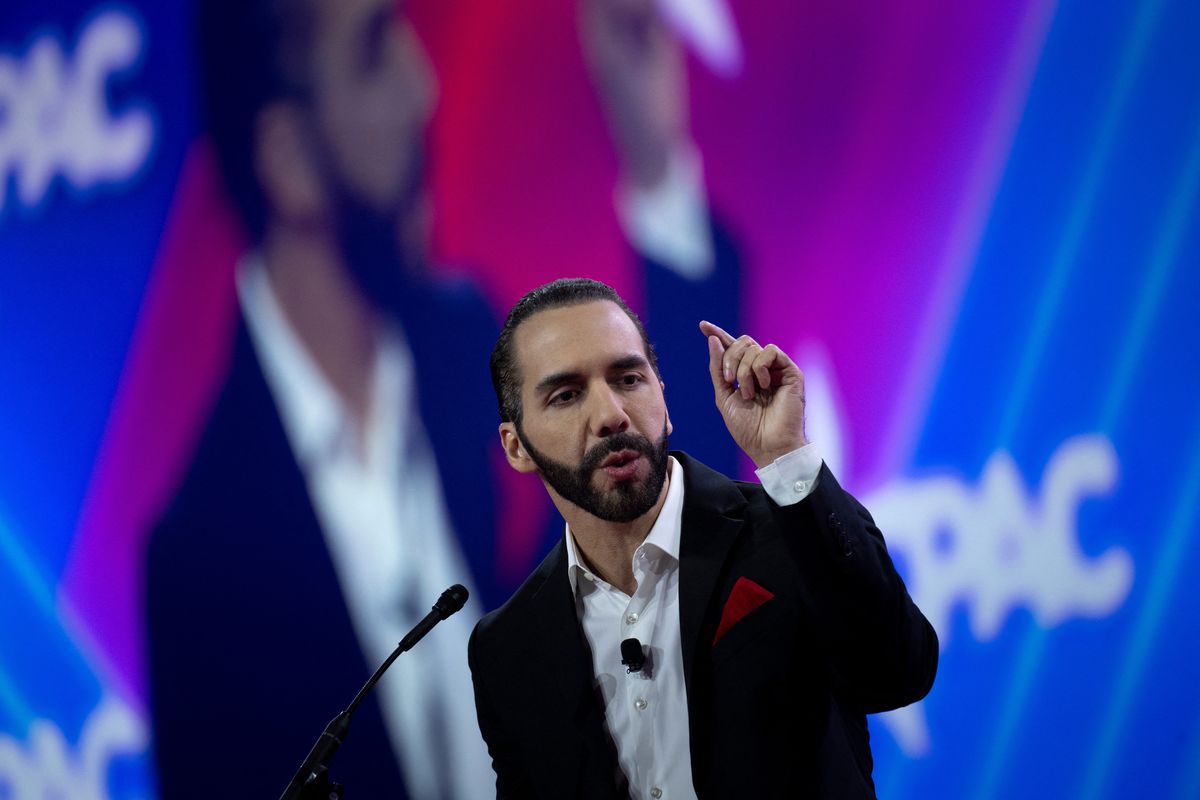

El Salvador President Nayib Bukele predicts that the US dollar is headed for collapse due to its consistent money printing, warning that it will devalue the currency and potentially lead to the downfall of Western civilization. This perspective aligns with the growing global trend of de-dollarization.

Americans' attitudes toward the economy soured in February, with concerns over the job market outweighing a decrease in worries about rising food and gas prices, according to a survey by The Conference Board. The survey also revealed declining confidence in the future outlook for the economy, with inflation expectations decreasing but remaining above the Federal Reserve's target. Despite these concerns, the US economy continues to show strength, with solid job growth and economic growth projections above 3%.

Expedia is cutting approximately 1,500 jobs, about 9% of its global workforce, as part of an organizational and technological transformation due to slowing travel demand following the pandemic and a new CEO.

DoubleLine Capital CEO Jeffrey Gundlach questions the reliability of the 3.7% federal unemployment data, citing a discrepancy between state and federal figures, as 88% of states have reported a rise in unemployment over the past six months.

American consumer confidence declined in February, despite a healthy US economy, as concerns over a possible recession grew.

Strong vehicle sales and rising prices in Canada indicate a growing divide between financially secure and struggling households, as higher-income families have been less affected by the pandemic and continue to make significant purchases.

Despite inflation easing, food prices in the US are at a 30-year high, prompting the CEO of Kellogg's, Gary Pilnick, to suggest eating cereal for dinner as an affordable solution, although opinions on this idea are divided.

Private legal practitioner, Oliver Barker-Vormawor, criticizes the NDC's 24-hour economy policy as empty and argues that Ghana needs political and governance reforms to address the fundamental problem of corruption.

The price of olive oil in Europe, particularly in southern European countries, has skyrocketed due to drought and extreme heatwaves, with Portugal experiencing the highest increase at 69.1% compared to last year.

Top economist David Rosenberg challenges the prevailing narrative of a booming US economy, pointing to indicators such as falling housing starts, declining industrial production, decreased retail sales volumes, contracting aggregate hours worked, and a negative national activity index.

Goldman Sachs analysts predict that the US economy could receive significant benefits from the use of weight loss medications, such as Ozempic and Wegovy, as improved health outcomes resulting from these drugs can potentially lower costs and boost productivity, adding 0.4% to 1% to America's gross domestic product.

A hard-landing recession is inevitable for the US economy due to high interest rates and a tightening monetary policy, despite expectations of the Federal Reserve loosening policy, according to Morgan Stanley's chief US economist, Ellen Zentner.

Consumer confidence in the US dropped in February, driven by concerns over the upcoming presidential election, despite overall improvement in the economy with low inflation, low unemployment, and a booming stock market.

China's leadership is prioritizing economic recovery and is taking measures to break down barriers in consumption, improve the business environment, and push for a unified market, although analysts recommend stronger stimulus; challenges remain in areas such as local protectionism, property market, and subdued consumption.

Orders for long-lasting U.S. manufactured goods dropped significantly in January, primarily due to a decline in bookings for commercial aircraft, suggesting a loss of momentum in the economy at the start of the year, although economists do not predict a recession.

State Street Global Advisors believes that the US economy is not on the verge of a recession, but warns that achieving growth levels of 2023 may be challenging due to the Federal Reserve's expectation to maintain higher interest rates for a longer period.

Home prices rose for the 11th consecutive month in December, driven by low housing inventory, with national prices increasing by 5.5% compared to the previous year, according to the S&P CoreLogic Case-Shiller index, but with a monthly decrease of 0.4%; San Diego had the highest annual gain at 8.8%, while Portland, Oregon, had the smallest gain at just 0.3%.

The possibility of the Federal Reserve not cutting interest rates in 2024 due to unexpected inflation and other outlier risks could lead to a reversal in the equity market rally, impacting small- and mid-cap companies, highly indebted tech stocks, and non-dividend payers, while supporting the dollar and potentially affecting the price of gold and oil.

The Central Bank of Nigeria has raised its benchmark interest rate to a record 22.75%, along with adjusting corridor ranges and increasing the cash reserve ratio, in an effort to tighten monetary policy and control inflation.

The Personal Consumption Expenditures Index, a measure of inflation, is expected to show an acceleration in January, potentially delaying the Federal Reserve's plans to cut its benchmark interest rate and keep borrowing costs higher for longer.

:max_bytes(150000):strip_icc()/GettyImages-2003724854-2aff2851bdba49d3aa4d53a8323cadf8.jpg)

Orders for durable goods experienced a 6.1% decline in January, largely due to a decrease in orders for Boeing passenger planes, but when transportation is excluded, new orders only fell by 0.3%, indicating a more accurate performance of businesses. The measure of business investment remained relatively steady, with core orders increasing by 0.1% in January. While orders for commercial planes dropped significantly, carmakers saw a slight decline. Overall, the industrial side of the economy is showing signs of recovery, supported by robust customer spending and the potential for lower interest rates later in the year.

The Federal Trade Commission's decision to block Kroger's $25 billion bid for Albertsons could potentially benefit President Biden in his fight against inflation and gain support from voters affected by rising prices.

Denmark's success in various industries can be attributed to three factors: building on the country's agricultural legacy, utilizing natural capital (water and wind), and appreciating human and social capital through high taxes and public benefits.

Iran's GDP growth is slowing, with higher government spending and increased oil production being the main sources of remaining growth; however, the reliance on the oil sector and inflation-related government spending is leading to deteriorating living conditions for the population.

The debate over income inequality in the United States continues, with economists Gerald Auten and David Splinter arguing that the rise of the one percent is a statistical illusion, while researchers Thomas Piketty, Emmanuel Saez, and Gabriel Zucman maintain that inequality has indeed worsened; both sides rely on different assumptions and definitions of income, highlighting the complexities and limitations of measuring inequality.

JPMorgan Chase CEO Jamie Dimon is skeptical about the positive outlook for the US economy and warns of potential bumps in the road, including concerns about inflation, government debt, and geopolitical factors, despite the current resilience in the market. However, Dimon is less concerned about a commercial real estate crisis, stating that the sector is better equipped to handle any credit problems compared to the 2008 financial crisis.

Mortgage rates are increasing, with 30-year fixed rates at 7.34% and 15-year fixed rates at 6.76%, but there is a slight drop in 30-year fixed refinance rates at 7.24%; however, predictions of a downward trend in rates are expected.

Michigan's auto industry has declined over the years, losing jobs to other regions and facing competition from foreign automakers, but it still remains a significant part of the state's economy despite the decreased dominance, as the industry supports tech jobs, trucking, and other related sectors; meantime, the healthcare industry is growing due to the state's aging population, while Michigan's population decline, decreasing income, and lower educational attainment pose challenges to the state's future prosperity.

The CEO of the National Association of Home Builders, Jim Tobin, believes that the current housing crisis in the US is not a bubble but a result of self-imposed limitations on supply and other factors, and the only way to alleviate the situation is to build more houses. He hopes that as mortgage rates decrease and more affordable housing options become available, more Americans, including first-time home buyers, will be able to enter the market.

The UK's net zero economy experienced 9% growth in 2023, but the sector's potential for future growth is being jeopardized by government policy reversals, lack of investment, and competition from the EU and US, according to a report by the Energy and Climate Intelligence Unit (ECIU) and the Confederation of British Industry (CBI). Despite this, the report highlighted that the net zero sector is responsible for £74 billion in goods and services production and 765,000 jobs, with hotspots of activity occurring across the country. The report also emphasized the importance of achieving net zero emissions by 2050 for economic and environmental benefits.

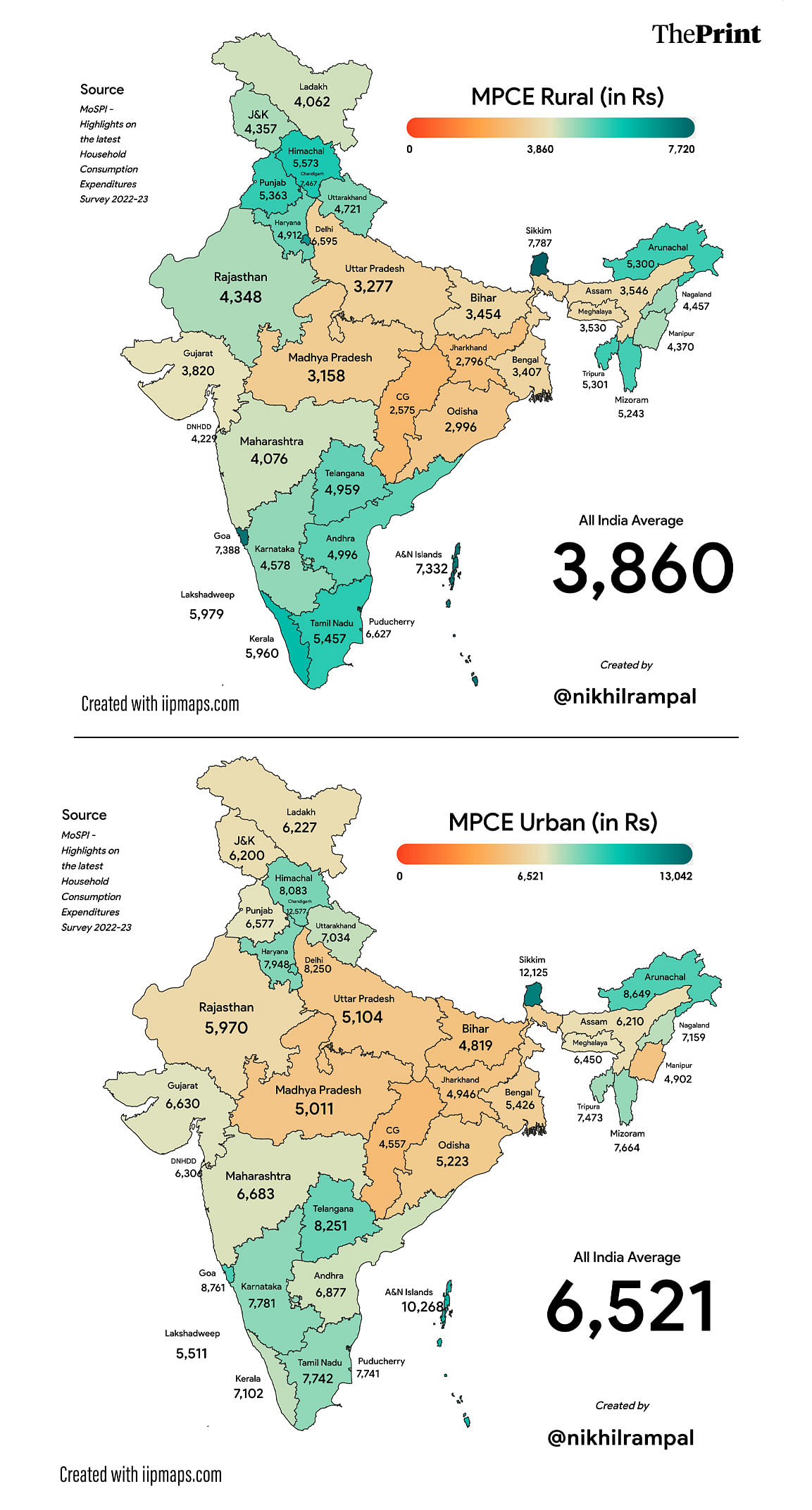

The Ministry of Statistics and Programme Implementation (MoSPI) has released the highlights of the 2022-23 Household Consumption Expenditure Survey, revealing that spending power in India has nearly tripled, rural-urban gaps are decreasing, food spending has come down, there is a 10x gap between the rich and the poor, and South India and the Northeast are the top spenders.

U.S. stocks reached new record highs, but JPMorgan Chase strategists warn that the economy may veer towards a 1970s-style stagflation, which could have significant implications for asset allocation.

The Federal Reserve is expected to lower interest rates at a slow and cautious pace, frustrating investors who anticipated a quicker decline due to easing inflation and a strong economy, with the approach likely resembling the mid-1990s soft landing strategy.

Wall Street is expected to have a subdued open as investors await crucial economic data, including the release of the Fed's preferred inflation gauge, that will shape expectations for interest rate cuts and test the recent market rally.

Bank of Nova Scotia's loan-loss provisions fell short of estimates due to increasing stress in consumer lending and higher delinquencies in its Latin American businesses as the Canadian economy weakens.

A survey in Britain has revealed that about 51% of people have financial regrets, with common regrets including not saving money every month, spending on unnecessary things, and lacking financial knowledge. Additionally, 58% of respondents reported worrying about their current financial situation, which has negative impacts on their mental health. Rising debt, including payday loans and overdrafts, has contributed to these financial worries.

Low-income families in the UK continue to struggle with the cost of living crisis, as 73% of low-income families on Universal Credit experienced food insecurity and 1 in 6 reported turning off their fridge or freezer to save money, according to research from the Joseph Rowntree Foundation (JRF); meanwhile, the government's cost of living payment scheme is set to end in February 2024, leaving many families without a safety net and facing rising costs of essentials like food and energy.

Protesters in Lagos are demanding that the Nigerian government reverse its economic policies, as the country faces its worst economic crisis in a generation, marked by high inflation, rising food prices, and a depreciating currency.

Economist Defends Dire Hong Kong Warning as 'Wake-Up Call,' While China Media Decries 'False Claims'

Economist Stephen Roach defends his article claiming "Hong Kong is over," stating it was a "wake-up call" about the city's future, while Chinese state media criticizes Western news outlets and experts for spreading false claims to "contain China."

The year 2024 will be marked by global events such as elections, geopolitical tensions, and the accelerated development of AI, which will shape and impact business and investment decisions, posing both risks and opportunities for various industries.

Returning migrant workers in China are facing challenges such as low salaries and limited job opportunities as economic conditions worsen, leading to a decrease in factory recruitment and wage reductions in export hubs.

Kansas City Federal Reserve Bank President Jeffrey Schmid remains focused on high inflation and is not in a hurry to cut interest rates, instead preferring a patient approach to monitor the economy's response to policy tightening and wait for convincing evidence that inflation has been controlled.

Food inflation in the UK has slowed to its lowest rate in almost two years, as falling energy costs and a supermarket price war contribute to a dip in prices, providing some relief for households on tight budgets. Despite prices still rising, the rate of increase is significantly lower than the double-digit rises seen in recent years. Overall, shop price inflation dropped to 2.5% in February, while nonfood prices rose by 1.3%.