The United Arab Emirates has reached an agreement to invest $35 billion in Egypt, which will help alleviate Egypt's foreign-exchange crisis and may lead to a new deal with the International Monetary Fund.

A price cap imposed by the US and other countries on Russian oil has resulted in a $19 per barrel discount and a more than 40% drop in Moscow's oil tax revenue compared to the previous year, according to a Treasury Department analysis.

The Federal Reserve's battle against inflation has led to a cooling job market in corporate America, with job openings dropping from a peak of 12 million in March 2022 to nine million in December 2023, but the unemployment rate is expected to rise further, potentially leading to a mild recession; however, the Fed is aiming for continued cooling of labor demand to drive softer consumer spending and overall inflation.

Bank of America CEO Brian Moynihan predicts a soft landing for the US economy with strong consumer spending, but remains concerned about the uncertain and potentially dire consequences of higher inflation and the country's $34 trillion deficit.

Big retailers, including Macy's and Best Buy, are releasing their earnings reports next week as Wall Street looks beyond inflation and focuses on the strength of the US consumer to understand economic conditions.

Federal Reserve officials are hesitant to start interest rate cuts due to uncertain economic conditions and the need for greater confidence in inflation returning to the 2% target, leading investors to push back expectations of a rate cut to June.

Traders are scaling back their bets on rate cuts as Federal Reserve officials express caution and emphasize the need for patience amid a strong economy and lingering inflationary risks, with no urgent need to ease monetary policy.

Scotiabank partners with Indigenous development corporations and a First Nation to launch Canada's first Indigenous-owned investment dealer, Cedar Leaf Capital Inc.

The US economy could experience significant growth if more people start taking GLP-1 weight loss drugs, with Goldman Sachs estimating that US GDP would increase by 1% if 60 million Americans took these drugs by 2028, as poor health imposes substantial economic costs that limit labor supply and productivity.

A new study reveals that billionaires have become 34% richer since 2020, growing their wealth three times the inflation rate, and certain cities in California are seeing the biggest rise in average household income.

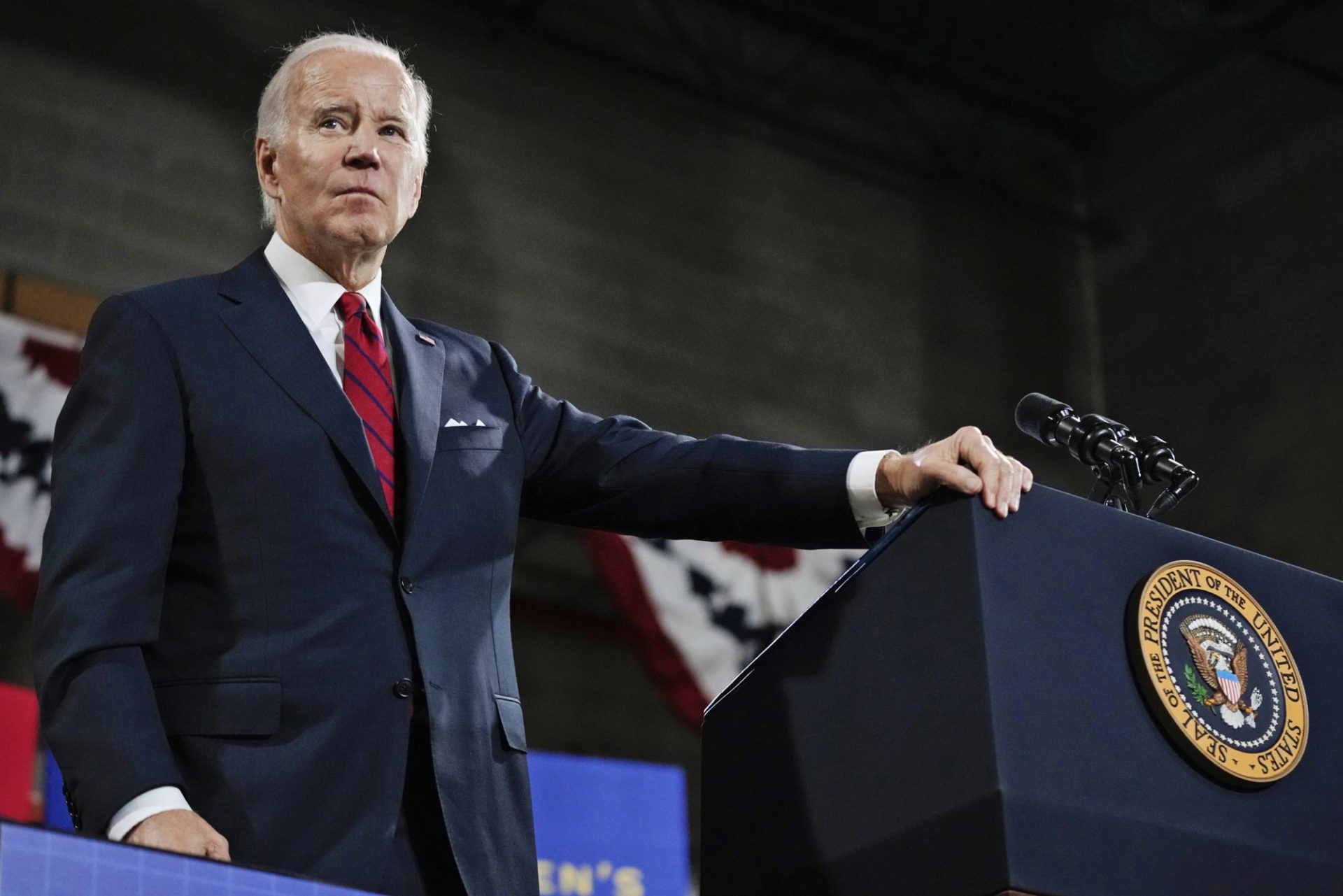

Biden to Call Out 'Shrinkflation' and Corporate Greed Over High Grocery Prices in State of the Union

President Joe Biden is considering addressing high grocery prices and the practice of "shrinkflation" in his upcoming State of the Union address, although some aides are cautious about focusing too much on food inflation given the limited power of the president to lower prices. The White House has been testing messaging on the issue and recent polling has been favorable to Biden's stance against corporate greed and higher prices. Biden is interested in the concepts of "shrinkflation" and "greedflation" as relatable ways to acknowledge financial pressures on Americans. The White House is studying potential policy options and may support legislative efforts to tackle price gouging and shrinkflation.

In some high-cost cities in the US such as San Francisco and Arlington, a salary of $150,000 is now considered "lower middle class," highlighting the increasing income expectations and the diminishing power of a six-figure salary.

Goldman Sachs economists have revised their expectations for Federal Reserve interest rate cuts in 2024 to four from five, with the first reduction now anticipated in June, due to recent comments from Federal Reserve officials indicating a "no rush" approach to rate cuts.

Real wages, which account for inflation, are seen as a crucial indicator of economic health and progress, as they reflect the true purchasing power of workers, and the growth in real wages is currently contributing to a decline in inequality and the Black-white wage gap; however, accurately measuring real wage growth during the COVID-19 pandemic period is challenging due to the rapid change in the composition of the workforce.

Economists have revised down their US recession forecasts due to expectations of strong job market and consumer spending supporting stronger economic growth in the near term.

Governments worldwide rely on taxes to finance investments and services, and creating a fair tax system is a challenge, especially for developing nations that need revenue without discouraging taxpayers or hampering economic activity. According to Wisevoter, tax structures vary greatly among countries, with some African nations like Algeria, Seychelles, and Tunisia having the highest tax burdens.

Lynx Air, a low-cost airline based in Calgary, will cease operations due to financial difficulties, while the RCMP investigates a cyberattack on its networks. The organizer of the "Freedom Convoy" is suing the Canadian government for freezing his bank accounts under the Emergencies Act, and a study suggests that migratory leafhoppers in Quebec could help forecast the impact of climate change on agriculture.

World Bank economist Apurva Sanghi points to the 1MDB scandal and Malaysia's lack of competitiveness as the main factors behind the decline of the ringgit, highlighting the need for significant reforms to boost the country's economy.

Niger, despite facing significant challenges, including a recent coup and exit from ECOWAS, has the highest projection for economic growth in 2024, according to the African Development Bank (AfDB).

Despite efforts to manage her debt, Abigail Turner, like many Minnesotans, faces increasing financial challenges as consumer debt in the United States continues to rise, especially in credit card debt, leading to financial stress among younger and lower-income households.

The Canadian federal government recorded a deficit of $23.6 billion for the April-to-December period of its fiscal year, compared to a deficit of $5.5 billion during the same period the previous year, with increased government revenue attributed to higher personal income tax revenue.

Indian media giant Zee Entertainment is forming an advisory committee to address allegations of financial irregularities and misinformation about the company. The committee, which will be led by a former high court judge, will provide guidance on protecting stakeholders' interests.

Belgium's central bank chief, Pierre Wunsch, warns that prioritizing environmental concerns over economic growth won't lead to wealthier societies, and failing to acknowledge this could lead to public anger.

The Pakistan Stock Exchange saw a significant increase in shares, gaining over 900 points, as the International Monetary Fund showed a willingness to engage with the new government, signaling positive investor confidence.

Rishi Sunak's promises, including growing the economy, have fallen flat as the UK enters a recession, leading to mockery from the Labour frontbench; a personal experience in an overcrowded A&E highlights the government's failure to properly address the NHS crisis; the Prince of Wales's call for a ceasefire in Gaza is met with accusations of interference in politics; the writer reflects on the excessive number of awards in the acting industry.

China's financial sector must focus on supporting the real economy and avoid speculative activities, according to state media, as regulators tighten regulations and address concerns over the fragility of the nation's financial system.

Ghana's cocoa output for the 2023/24 season is projected to fall significantly short due to factors such as adverse weather conditions, smuggling activities, illegal gold mining, and swollen shoot disease, resulting in a potential 40% shortfall from the target of 820,000 metric tons.

Uttar Pradesh, one of India's largest states, has been struggling economically and lags behind not only Pakistan but also Sub-Saharan Africa, due to a feudal system, poor infrastructure, and a lack of democratic reform.

India's decision to liberalize the space sector and allow increased foreign direct investment has been praised by the country's space ecosystem, although experts suggest the need for an Indian Space Law and liability regime; the reforms range from 49% to 100% FDI for various subsectors of the space economy and aim to infuse foreign capital into the sector, which is projected to have a $40-100 billion space economy by 2040.

One in three Americans have more credit card debt than savings, with over $1 trillion in credit card balances at the end of 2023, according to a Bankrate survey and data from the Federal Reserve Bank of New York. Financial stress is particularly prevalent among younger and lower-income households, leading many Americans to prioritize paying down debt and increasing emergency savings simultaneously.

The Federal Reserve may be at risk of triggering a recession by moving too slowly to cut interest rates after inflation eases, according to some economists. They argue that the longer the Fed waits to cut rates, the greater the risk of negative consequences for the economy. However, other economists believe that the Fed is right to be patient and that inflation remains the bigger threat.

The ringgit's poor performance is due to Malaysia's lack of competitiveness, which has been exacerbated by the 1MDB financial scandal and short-term solutions implemented after the 1998 financial crisis, according to a World Bank economist.

China is expected to continue with a gradual approach to stimulating its economy, as recent measures are unlikely to boost sentiment without further reforms and aggressive easing, according to market experts.

Venezuela is attempting to collect old debts from the Petrocaribe program, receiving a $500 million payment from Haiti to cancel its $2.3 billion debt, as the country seeks to regain international recognition and address its economic collapse and isolation.

A disturbing number of powerful banks are losing faith in the Bank of England, predicting that its tightening policies risk a deep and protracted downturn and expect something akin to an economic depression unless there is a change of policy.

Ghana's year-on-year inflation rate for January 2024 rises to 23.5%, significantly higher than its neighboring countries, leading to price hikes and economic challenges for the country.

Consumer inflation perceptions over the past 12 months decreased, while inflation expectations for the next 12 months increased slightly; expectations for income and spending growth remained stable and increased marginally, respectively; expectations for economic growth improved slightly and the expected unemployment rate decreased; expectations for home prices and mortgage interest rates remained unchanged and decreased, respectively.

High food prices in northern Canada, exacerbated by the pandemic and global factors, have led to increased food inflation, leaving residents struggling to afford basic groceries from the dominant grocer, North West Company, which has faced allegations of inflating prices and not fully passing along federal subsidies meant to keep food prices low.

The high prices of essential commodities in Nigeria, such as cement, iron, and rice, despite the country's abundance of natural resources, highlight economic imbalances and market manipulations that are pushing the majority of Nigerians into poverty and widening the gap between the privileged few and the marginalized.

The energy price cap in Great Britain will decrease by £238 to £1,690 this spring, benefiting households due to a mild winter and lower gas prices, while standing charges will be equalised for all customers.

The International Monetary Fund (IMF) is ready to engage with the new government of Pakistan to ensure macroeconomic stability and prosperity for its citizens, following allegations of election irregularities made by incarcerated party founder Imran Khan. Pakistan is also planning to seek a new loan of at least $6 billion from the IMF to help repay its debts.

China's central bank, the People's Bank of China (PBOC), is using surprise easing measures to support the struggling economy, despite being constrained by risks of currency devaluation, debt buildup, and limited policy room. These unexpected policy actions aim to gain attention and shift sentiment but have yet to have a sustained impact on markets.

France is facing a weaker economy and will implement spending cuts as a result of war, high interest rates, and slowdowns in major trade partners.

The International Monetary Fund (IMF) has expressed willingness to work with the new Pakistani government on policies to ensure macroeconomic stability, while ignoring Imran Khan's demand for an audit of the election results before approving a new loan for Islamabad.

Pakistan's battle with debt repayment has intensified as the State Bank's foreign exchange reserves declined and political uncertainty rose, requiring over $6 billion for foreign payments by the end of the fiscal year.

The Nigerian Federal Government will halt the export of cooking gas, known as Liquefied Petroleum Gas (LPG), in order to increase domestic availability and lower its price.

The Nigerian Gross Domestic Product (GDP) growth in 2023 was the slowest since 2020, falling to 2.74% from 3.10%, due to reduced growth in the agriculture and manufacturing sectors and the negative performance of the oil sector.

Chinese business leader Michael Yu Minhong has called on China's leadership to respect market rules, improve relations with enterprises, and safeguard the business environment, amid concerns that the private sector is struggling to recover compared to state-owned businesses.

Japan's Nikkei 225 surpasses its all-time closing high, driven by strong company earnings and boosted by Asian technology shares after US chip giant Nvidia reports strong earnings.

Vietnam is predicted to experience the largest surge in wealth growth in the world over the next decade, with an estimated 125% increase in wealth, positioning itself as a global manufacturing hub and attracting foreign investment.