Underlying US inflation likely rose in January by the most in a year, as tracked by the Federal Reserve’s preferred metric, highlighting the challenges in managing price pressures.

Pakistan's external and domestic debt has reached over $270 billion, with the majority of the population trapped in a "debt trap" caused by the ruling elite, and stabilizing the economy depends on managing this debt, prioritizing social sectors, and addressing economic inequalities.

The average monthly per capita consumption expenditure in Indian households has increased by 33.5% in urban areas and 40.42% in rural areas since 2011-12, according to the latest All India Household Consumption Expenditure Survey.

Argentinian President Javier Milei has been called out for ordering funding cuts to the country's main petroleum-producing provinces, prompting threats of cutting off oil supplies.

Volunteers at a moshav near the Gaza Strip are urgently picking pineapples as Thai migrants who usually cultivate the land have been unable to return due to the war, exacerbating the worker shortage in Israel's struggling economy.

Defaulting on loans and the emergence of a default culture in Bangladesh is attributed to Ziaur Rahman's policy of channeling state financial institutions to benefit the capitalist class, according to Rehman Sobhan, chairman of the Centre for Policy Dialogue.

The rural-urban difference in average monthly per capita expenditure has narrowed to 71.2% in 2022-23 from 83.9% in 2011-12, indicating that rural consumption spending has increased more than urban consumption spending during this period.

According to the International Labour Organization, just over 5% of the global workforce is currently unemployed, with an anticipated two million additional individuals expected to seek employment within the next year. The global economy is also facing its slowest growth period in three decades, with income inequality posing obstacles to economic recovery and social justice. Furthermore, some tech giants, such as Meta Platforms and Salesforce, are transitioning from layoffs to robust hiring, indicating the demand for tech professionals. PepsiCo's Pathways to Readiness and Empowerment Program aims to provide career opportunities for youth, while AI is set to revolutionize the global economy, potentially exacerbating income and wealth inequality.

Thousands of people in the UK who were mis-sold timeshares in the past may never receive compensation due to delays and complex cases, leaving them out of pocket by up to £50,000 each.

The aim of microeconomic reforms in Nigeria is to rectify economic imbalances that disproportionately favor a small group of elites and ensure government revenue is directed into the government's treasury.

The US job market exceeded expectations in January 2024, with 353,000 jobs added and a strong labor market, while the overall outlook for the US economy remains positive, although uncertainties persist; Johnson & Johnson is partnering with Jacksonville Job Corps to address a manufacturing shortage, investing $200,000 in a training center; and Abbott Laboratories is set for a $179 million expansion plan to create 123 new jobs at its Liquid Nutrition Manufacturing Plant in Tipp City.

Investors are advised to pick up high-yielding closed-end funds focusing on real estate investment trusts (REITs) as a contrarian play against inflation worries, as the 3.1% inflation rate in January is not as bad as it seems and the rise in rents is a positive indication for the economy.

UK bosses are seeking higher pay packages and raising concerns about the decline of the British stock market due to fears that high-paying American job offers will tempt executives away; however, critics argue that increasing pay to US levels won't solve the UK's structural and cultural challenges.

The highest-earning workers, young workers, and female workers in the US are working fewer hours than before the pandemic, according to payroll provider ADP, with the average workweek in 2023 being the lowest in five years; while this may be concerning, it is worth noting that a significant portion of these workers are seeing their incomes rise, suggesting that less work isn't necessarily a negative outcome.

The top stories from across Nigeria this week include controversial primary elections in Edo State, a dip in the Gross Domestic Product, a tragic incident involving a lion and a zookeeper, discussions on cement prices, and government intervention in the cooking gas sector.

Adam Ruzicka's contract with the Arizona Coyotes is terminated after he posted a video with cocaine on social media; Ameren Corporation and Northern Oil and Gas release their Q4 2023 earnings call transcripts; an RNC member is trying to prevent the party from paying Donald Trump's legal bills; the federal government of Canada reports a deficit of $23.6 billion for the April-to-December period; the Wisconsin Ethics Commission recommends felony charges against a Trump-aligned fundraising committee; Donald Trump claims that "Black people like him" because he has been indicted; Rudy Giuliani files for bankruptcy due to a defamation verdict against him; and a Fox News anchor cuts off Clay Travis for insulting Nikki Haley.

Employment numbers in Arizona are projected to increase by 1.5% by 2025, with the construction, health care, education, and trade sectors expected to experience the most growth, although the projections are moderated due to financing costs and anticipated federal fund rate increases in 2022 and 2023, according to a report from the Arizona Office of Economic Opportunity.

South Carolina's economy has rebounded well from the pandemic, with strong job growth and a diverse range of industries driving economic expansion, although the state faces challenges such as worker shortages, aging demographics, and high interest rates.

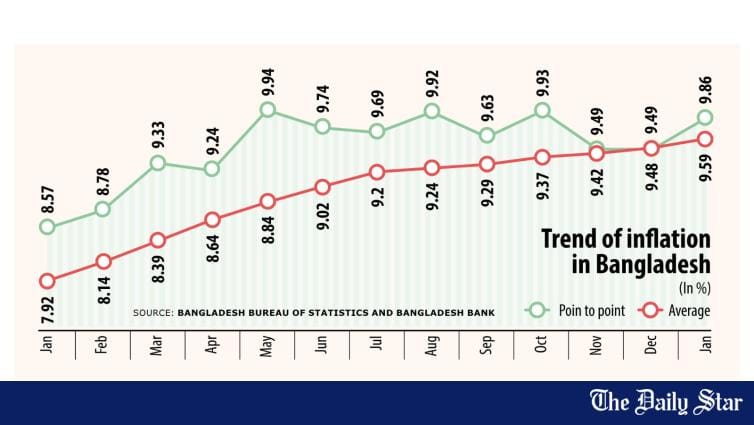

Bangladesh's annual average inflation rose to 9.59% in January, surpassing the central bank's target of 7.5% and suggesting that monetary tightening measures may not be effective in curbing inflation due to supply-side issues.

Millennial couples are having fewer children, opting to spend their money on luxuries instead, and this trend could have a detrimental effect on economic growth in the long run, as a shrinking population leads to a decline in workforce and GDP, lower productivity, and increased strain on social security payments.

China's economy during the Spring Festival holiday surpassed pre-pandemic levels, with increased domestic tourist arrivals and spending, leading to global confidence in China's economic strength and potential for long-term positive development.

Cocoa prices hit record highs as the Ghana Cocoa Board cuts its production estimate due to smuggling and unfavorable weather, while drying out cocoa fields and insufficient rain in West Africa further contribute to concerns about global cocoa supplies.

The article discusses how various events such as winter, recession, stock market crash, and vibrant real estate market that were anticipated did not occur, leading to potential over-preparation.

The Nigerian Naira continues to struggle due to scarcity of foreign currency inflows, leading to a worsening exchange rate crisis despite efforts to stabilize it.

The estimated national debt of $34.27 trillion poses a long-term challenge to the job market, as a default on the debt could result in significant job losses, impact government programs, raise interest rates, and undermine economic growth and investor confidence. Addressing the debt requires comprehensive policy measures and economic reforms, with potential solutions including opening borders to immigrants, raising the retirement age, reducing government spending, raising taxes, negotiating lower interest rates, and aiming for sustainable debt levels.

Americans are staying in their homes longer, with the average homeowner now spending almost 12 years in their home, up from 6-½ years two decades ago, driven by factors such as lower mortgage rates, higher home prices, and incentives to stay put, especially among baby boomers.

The Bono Regional Minister of Ghana has urged development partners to add value to cashew fruits and nuts to create jobs and reduce poverty, as a lack of processing plants results in a waste of 889,000 metric tons of cashew fruits annually in the region. Additionally, the region's poultry sector faces challenges due to a lack of laboratory facilities, high costs, and competition with imported products.

The Lipstick Effect, a theory that suggests people splurge on small indulgences during economic downturns, appears to be happening during the current financial squeeze in the UK, with consumers gravitating towards affordable luxuries like cosmetics, chocolate, and underwear. However, experts warn that relying solely on retail therapy to cope with financial strain may not be sustainable in the long term and suggest practicing responsible spending habits and seeking healthier coping mechanisms.

The Federal Reserve remains cautious about rate cuts due to inflation concerns and commercial real estate vulnerabilities, while Nvidia's exceptional earnings and expanding AI division have propelled its stock value and the broader stock market to unprecedented levels, benefiting stocks and ETFs related to Nvidia. The US has imposed sanctions on more than 500 Russian entities in response to the conflict in Ukraine, and Elon Musk expressed skepticism about the viability of electric vehicle manufacturers Lucid and Rivian.

A young couple in Louisiana is unable to buy a home due to their overwhelming consumer debt of $210,000, hindering their ability to secure a mortgage and potentially putting them at risk of financial disaster. They have multiple auto loans, student debt, and credit card balances, and their low income and shallow savings further complicate their situation.

The Central Bank of Nigeria has directed the Nigerian Customs Service and other parties involved to use the same foreign exchange rate for the importation of goods and services, in order to reduce uncertainties and price increases driven by daily exchange rate fluctuations.

China's economic growth may be slowing, but its potential for high-quality development, consumer-driven economy, and investment opportunities in future-oriented sectors make it an attractive investment hub for global investors.

China's struggling economy and surplus of goods may lead to a temporary period of falling prices in the UK, but this deflationary period could have negative consequences, including job losses and failing businesses.

UK politician Liz Truss accuses the "deep state" of sabotaging her attempts to boost the British economy, arguing that "wokenomics" and collectivism within institutions such as the civil service, central banks, major corporations, and financial markets have stifled economic growth and incentives.

India can leverage its position in the global electronics market and take strategic measures to strengthen its ESDM sector and become a competitive manufacturing powerhouse, according to a report by PwC India. The report emphasizes the importance of policy reforms and recommends addressing non-tariff barriers, promoting skill development, and creating a conducive environment for growth and innovation in the sector.

Chinese cargo ship, Explorer No 1, has arrived in Europe with 7,000 made-in-China electric vehicles (EVs), sparking concerns among European carmakers who cannot compete with the lower prices, and is likely to lead to an influx of cut-price Chinese goods, potentially causing a trade war with China. Additionally, the Chinese economy's surplus in manufacturing and falling prices are exporting deflation to the rest of the world, putting downward pressure on inflation rates. This presents an opportunity for the UK to reduce interest rates, pump up the money supply, and cut taxes to inject life back into the economy and combat the dangers of deflation.

Former Australian Prime Minister Tony Abbott praises India, calling it the world's emerging democratic superpower and highlighting its business-friendly environment.

Gen Z and millennial workers are rushing to file their taxes in hopes of receiving a refund to subsidize their earnings, pay down debt, and cover bills, as rising living costs and inflation put financial strain on them, according to a survey commissioned by Credit Karma.

Pakistani authorities have secured $6.3 billion in foreign loans in the first seven months of the fiscal year, but faced limited borrowing options due to poor credit ratings and global financial market conditions.

Global debt has reached a record high of $313 trillion, with several nations, including India, China, and Argentina, showing increasing signs of being unable to repay their debts.

Investors may be getting carried away with the current economic boom, as they are counting on both a strong economy and falling interest rates, which may not be compatible, and there are other risks such as relying on a small group of big winners in the market and the uncertainty of the US economy's direction.

China's 1 trillion yuan exports of electric vehicles, lithium batteries, and solar cells face concerns of overcapacity as Western countries increase legal action and tariffs due to fears of market distortion, potentially setting back China's economy unless it diversifies and boosts domestic demand.

The current frontrunner for the Republican nomination, former President Donald Trump, could implement aggressive tariffs and cause market reactions if he were to win the 2024 presidential election, according to a report authored by strategists from Citi.

Mortgage rates have risen, with the 30-year fixed-rate mortgage reaching 6.9%, as the Federal Reserve delays plans to cut interest rates until they are more confident in achieving their inflation target, and home prices continue to increase.

Ending the moratorium on imposing taxes on cross-border digital e-commerce transactions in India may hinder the country's plans to become a global chip leader and exacerbate the global chip shortage, according to a letter from the World Semiconductor Council; studies suggest that offering tax incentives is more advantageous for India's semiconductor industry.

India is projected to become the world's third-largest economy by 2027, surpassing Japan and Germany, due to its current growth trajectory and structural reforms, according to analysts at Jefferies.

Employing workers in the UK has become a challenging task due to burdensome regulations, unreliable workers, and a bloated benefits system, causing many employers to question the wisdom of hiring anyone at all.

The number of home foreclosures in the US is increasing due to soaring interest rates and rising costs, with some states being hit harder than others, such as Delaware and Nevada. Escalating interest rates and inflation, as well as the expiration of state and federal foreclosure bans, are contributing factors to the rise in foreclosures. The housing affordability crisis in the country is worsening, driven by surging house prices, lack of inventory, and elevated mortgage rates. Lenders repossessed more properties in January, with Michigan experiencing the highest increase in completed foreclosures, primarily driven by Detroit.

Argentina's markets are showing support for libertarian leader Javier Milei, who has focused on austerity measures and has gained the favor of investors, leading to bond gains and a decrease in Argentina's risk index.

A new study shows that billionaires in the U.S. have become 34% richer since 2020, growing their wealth three times the inflation rate. California cities dominate the list of places where the rich are getting richer, with Los Altos being the top city with an average household income above $400,000. However, having an income of $200,000 or more may not be enough in some areas due to high taxes and the cost of living.