The Logan Square Farmers Market will be held as planned after concerns about safety led to a decision to cancel the market, with the market's organizers implementing new safety measures to prevent cars from driving through the market area.

India's ban on rice exports has caused panic in the international market and led to a spike in prices in Asia, raising concerns about food security and potential scarcity.

Chinese electric vehicle maker Xpeng plans to expand into more European markets, including Germany, Britain, and France, in 2024, aiming to challenge European companies with cheaper models.

Stocks rebounded on Monday, with the Nasdaq Composite leading the way, breaking its four-day losing streak and pushing Wall Street into positive territory, while bond yields continued to rise.

Over $1 trillion in commercial real estate debt will mature in the next two years, and some borrowers may have to sell assets due to limited lending sources, with smaller property owners being at higher risk.

The U.S. economy continues to grow above-trend, consumer spending remains strong, and the labor market is tight; however, there are concerns about inflation and rising interest rates which could impact the economy and consumer balance sheets, leading to a gradual softening of the labor market.

Sustainability-linked bonds (SLBs) are performance-based debt instruments that tie their financial characteristics to the issuer's achievement of sustainability goals, particularly carbon reduction targets, with the SLB market still in its early stages but showing promising growth and potential.

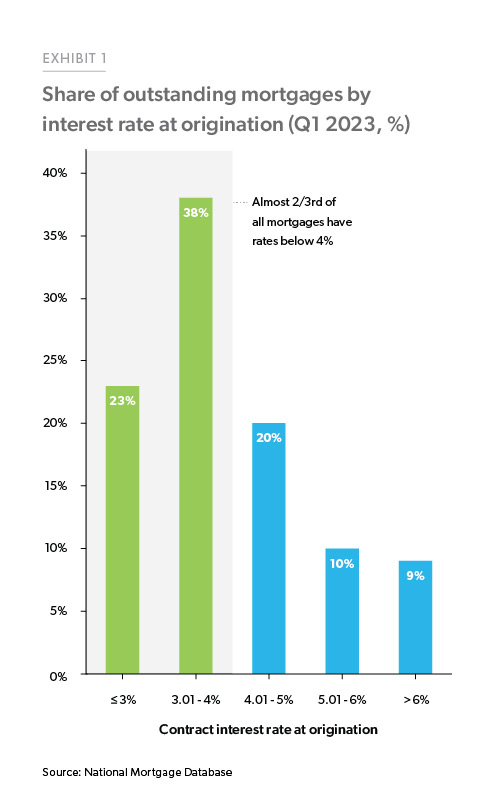

The U.S. housing market is facing dire consequences due to high mortgage rates, a housing supply shortage, and a lack of confidence in the Federal Reserve's actions, according to market expert James Iuorio.

Stocks rise as Wall Street achieves its first winning week since July after Federal Reserve Chair Jerome Powell states that the Fed will proceed cautiously with interest rates.

The resumption of student loan payments in October could worsen the affordability crisis in the U.S. housing market and make mortgages more unaffordable, especially for first-time homebuyers.

Cryptocurrency exchange Bybit has introduced an AI-powered trading assistant called TradeGPT that provides real-time market analysis and answers user questions in multiple languages, leveraging the generative abilities of ChatGPT's language model and Bybit's ToolsGPT. Other exchanges like Crypto.com and Binance have also integrated AI-powered tools for market insights, and the use of AI in various sectors continues to drive innovation.

U.S. economic growth, outpacing other countries, may pose global risks if the Federal Reserve is forced to raise interest rates higher than expected, potentially leading to financial tightening and ripple effects in emerging markets.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7KPTTSUAOFKXTKIJE5YJONZGHI.jpg)

Private market insured losses from Hurricane Idalia are projected to be between $3 billion and $5 billion, with an additional $500 million in losses expected for the National Flood Insurance Program.

China's share of the European electric car market has more than doubled in less than two years, with the UK being the largest market for Chinese electric car brands, as new battery electric technology and lower prices have boosted sales and wiped away concerns about lower-quality cars, posing an "imminent risk" to the European industry, according to industry experts.

Nvidia's upcoming earnings report, expected to show a 65% increase in revenue, could have a significant impact on global stock markets and sentiment around the AI industry.

U.S. stocks rebounded as Federal Reserve Chair Jerome Powell kept options open for more interest rate hikes, with the Nasdaq leading the gains and finishing the week up 2.2%.

:max_bytes(150000):strip_icc()/GettyImages-1576892903-44f45f5965bd4640b34cc424748499fd.jpg)

Bajaj Finance's shares dipped 0.67% to 7,268.00 Indian rupees on a positive trading day, closing below its 52-week high, while outperforming some competitors.

Semiconductor giant Arm Holdings is set to go public in an initial public offering (IPO), offering investors a chance to invest in a market-defining technology company that plays a crucial role in the computing industry, with its microprocessor technology found in various devices including smartphones, tablets, smart TVs, and cars. The IPO is expected to have a reasonable initial price, making it an attractive opportunity for investors.

Dow Jones & Company, Inc. retains copyright to the material provided and prohibits its distribution and use without permission.

Crude oil prices remain high, supported by production cuts and a decrease in inventory, while the WTI futures contract reached a 10-month peak at $86.09 and the Brent contract traded above $89 for the first time since January.

Stock futures are mixed as the market aims to maintain momentum in the holiday-shortened week, following an upbeat week for Wall Street with the Dow and the Nasdaq recording their best performances since July and the S&P 500 registering its best week since June.

World markets experienced some relief as the bond squeeze eased, with investors eagerly awaiting signals from the Federal Reserve conference in Jackson Hole and hopeful for a resurgence of the early-year AI craze. President Xi Jinping's attendance at the BRICS summit in South Africa also provided some positivity for China's economy.

Federal Reserve Chairman Jerome Powell will likely provide updates on the central bank's stance on interest rates in the US during the Jackson Hole meeting, although an announcement regarding the end of interest rate hikes is less likely due to positive economic data and the potential risk of triggering another crisis.

Canada's main stock index, the S&P/TSX composite index, rose 0.3% on Friday, boosted by strong performances from BlackBerry and the energy sector, as caution in the market lessened following Jerome Powell's speech at the Jackson Hole Economic Policy Symposium.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WNGLDLQ5CBPMDIICVC2XJFL5ZA.jpg)

The Reserve Bank of Australia is expected to keep its key cash rate unchanged at 4.10% as inflation shows signs of easing, according to a Reuters poll, but the RBA's guidance offered on Tuesday could trigger big moves in the Australian dollar.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/SYBIUAG7FVJYFEFJLBUDOWV54E.jpg)

Tech companies, such as Microsoft, Amazon, and Advanced Micro Devices (AMD), are attractive investment choices due to their long-term potential in AI, e-commerce, and chip development, respectively. These companies have a history of offering reliable gains and are well-positioned to benefit from the growth and demand in the tech industry.

China's regulators are struggling to attract global funds to invest in the country's stocks, as market-boosting efforts alone are not enough to offset concerns about the lack of stimulus to support economic growth and ongoing political tensions.

The latest jobs report shows 187,000 jobs gained in August, but the unemployment rate also rose to 3.8%.

The upcoming IPO for Arm, the chip designer, in the US is facing skepticism from investors, leading to reduced expectations for the company's valuation, which is now estimated to be in the range of $50 billion to $55 billion due to concerns over growth rates, profit margins, and political risks associated with its Chinese operations.

Your browser of choice has not been tested for use with Barchart.com, so please download one of the listed browsers if you encounter any issues.

The US economy is expected to slow in the coming months due to the Federal Reserve's efforts to combat inflation, which may lead to softer consumer spending and sideways movement in the stock market for the rest of the year, according to experts. Additionally, the resumption of student loan payments in October and the American consumer's credit card debt could further dampen consumer spending. Meanwhile, Germany's economy is facing a recession, with falling output and sticky inflation contributing to its contraction this year, making it the only advanced economy to shrink.

Despite efforts by the U.S. and other countries to reduce reliance on Chinese supply chains, Chinese companies have successfully expanded their presence in key markets such as cutting-edge materials and electric vehicles, making it difficult for countries to ensure their economic security.

Most stock markets in the Gulf ended lower as investors grew cautious due to volatile oil prices and awaited monetary policy decisions by the US Federal Reserve.

Asian stocks are expected to open lower as attention shifts to China's efforts to improve its economy and European shares provide a weak lead for investors, while crude oil futures remain near nine-month highs.

Ashtead Group's pretax profit increased in the first quarter of fiscal 2024, driven by strong rental revenue in North American markets, while the UK market softened.

Treasury yields reach new decade highs in Asia as traders become concerned about the duration of elevated interest rates, causing a dampening effect on stocks, particularly in China, even as some markets attempt to rebound.

Global stock markets and Wall Street futures are rising as traders await signals on interest rate plans from the Federal Reserve conference, with investors hoping that the Fed officials will signal an end to interest rate hikes despite concerns about inflation not being fully under control yet.

Mortgage rates have risen for the fourth consecutive week, reaching their highest levels since 2000, leading to decreased demand for home-purchase mortgages and a stagnant housing market.

Asian markets will be influenced by economic indicators, policy steps, and diplomatic signals from China, as well as reacting to the Jackson Hole speeches, purchasing managers index reports, GDP data, and inflation figures throughout the week, with investors desperate for signs of economic improvement as China's industrial profits continue to slump and authorities take measures to stimulate the capital market.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/W736DGWI65KTNLUVAY26Y427ZA.jpg)

Market makers in the crypto sector are facing increased costs and lower profitability as investors shy away from the industry following a $2 trillion market crash, leading them to diversify their activities, store digital assets away from trading venues, and use them as collateral to borrow tokens for deployment on crypto platforms.

Stocks in Asia rose as investors were encouraged by a report indicating a cooling US jobs market, potentially leading to a slowdown in the Federal Reserve's campaign to raise interest rates and slow the economy.

JPMorgan Chase remains optimistic about the stock market despite recent dips, with limited downside projected for the crypto markets, and bullish outlooks for Telephone & Data Systems and HilleVax.

Former SEC chair Jay Clayton believes that the approval of a spot bitcoin exchange-traded fund (ETF) is inevitable, stating that bitcoin is something that both retail and institutional investors want access to.

Apple shares have declined due to falling revenue in its product segments, but the company's long-term outlook remains strong, driven by its booming services business and dominant market shares, with two reasons to buy Apple stock being the upcoming iPhone launch and its potential in high-growth industries like AI and virtual/augmented reality.

India is expected to halt sugar exports for the first time in seven years due to low rainfall and reduced cane yields, which could increase global prices and fuel inflation on global food markets.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/SUESWPRN6RIA7NTARNKQCMIOXI.jpg)

China has cut the stamp duty on stock trades and plans to slow the pace of initial public offerings in an effort to boost investor confidence and stimulate the capital markets.

This article discusses the benefits of using a 5-minute bar chart for Comex gold futures as an analytical and trading tool for active intra-day gold futures traders.

Chinese stocks rally as Beijing takes steps to boost the market.