German producer prices fell more than expected in July, marking their first decline in over two-and-a-half years, as easing energy prices raised hopes for a further decrease in inflation in Europe's largest economy.

Real wages have fallen in most European countries as record-high inflation has eroded the nominal wage growth, with Hungary experiencing the largest decline of 15.6 percent, while Belgium and the Netherlands saw small increases.

The euro fell to a two-month low against the dollar and a 12-month low against the pound after German and eurozone business activity slumped more than expected in August, leading to concerns about the state of the European economy and potential pauses in tightening measures by the European Central Bank, while the dollar rose to a two-month peak amid positive U.S. economic data.

Euro zone business activity declined more than expected in August, particularly in Germany, while some inflationary pressures returned, posing a challenge for the European Central Bank's efforts to control inflation without causing a recession.

The euro fell and bond and share markets bounced back as weak European data caused investors to anticipate Nvidia's results and Powell's Jackson Hole speech.

Weak European data caused the euro to decline and led to a rise in bond and share markets, while investors awaited Nvidia's results to assess the viability of the tech sector's high valuations.

Stocks fell on Thursday as investors retreated ahead of the Federal Reserve's Jackson Hole symposium, with European stocks dropping and technology stocks giving up earlier gains, while Walt Disney shares tumbled, and Treasury yields increased on strong economic data and concerns about inflation.

Treasury yields fell to their lowest levels in over a week due to concerns about job creation and consumer confidence, leading bond traders to lower the probability of a Federal Reserve interest rate hike this year.

German inflation fell slightly in August, but economists predict that the downward trend will continue in the coming months, with food prices showing above-average growth.

The euro rose against the dollar and euro zone bond yields fell after US unemployment rate increased, suggesting the Federal Reserve may be done with interest rate hikes.

Investor morale in the euro zone fell more than expected due to Germany's economic weakness, with the situation being described as "precarious" and potentially leading to a global recession.

European stocks and Asian equities declined as disappointing data from China raised concerns about the country's economic recovery, with the Stoxx 600 dropping 0.7% and the MSCI Asia Pacific Index heading for its first drop in seven days.

European shares fall to one-week lows due to weak China and euro zone data, as concerns over slowing global growth increase.

European stocks continue to decline due to weak German data and elevated oil prices, raising concerns about stagflation in the euro area.

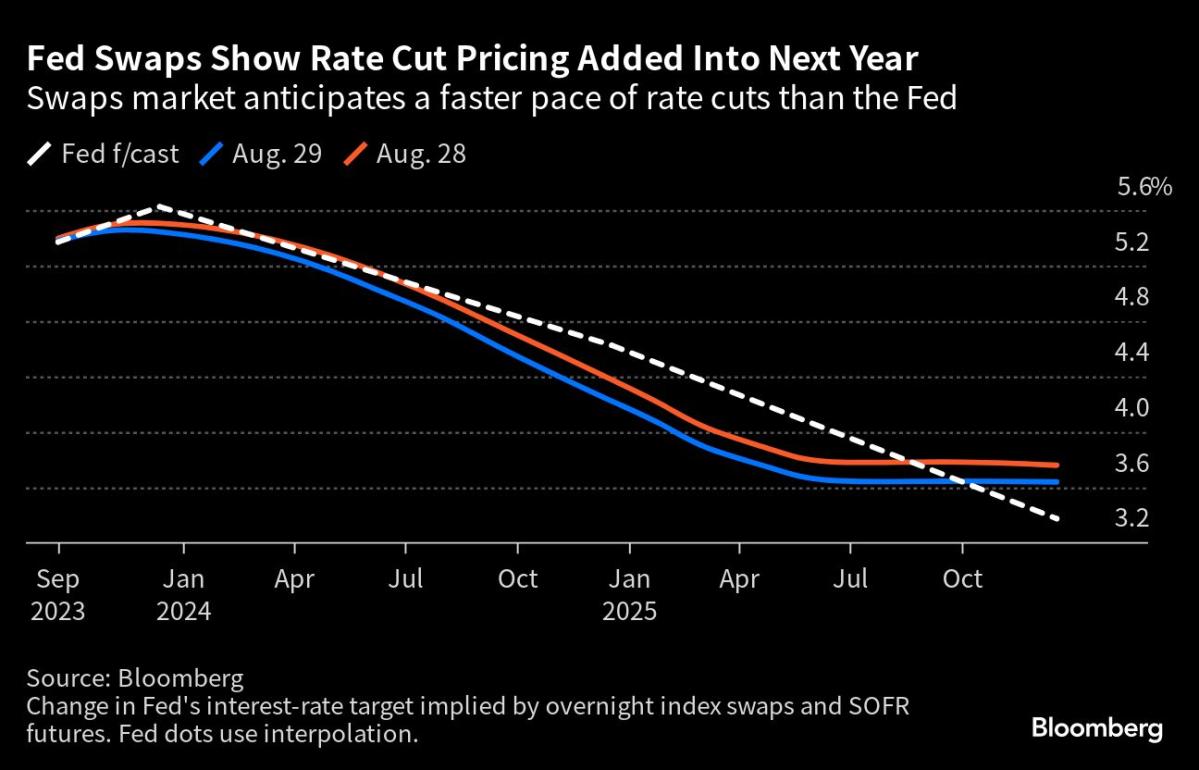

Stocks fell on Wall Street as concerns about inflation and weakening global demand weighed on investor sentiment, raising doubts about the Federal Reserve's plans to cut interest rates.

Most Latin American currencies fell as the dollar strengthened on robust U.S. economic data, with the Mexican peso leading the declines, while Chile's peso gained after the central bank cut its benchmark interest rate and lowered its economic growth forecast for 2023.

European stock markets weakened on Thursday due to signs of slowing growth in Europe and China, as well as concerns about future Federal Reserve tightening. German industrial production fell more than expected, adding to the struggles of the eurozone's largest economy. China's exports and imports also fell in August, indicating continued pressure on its manufacturing sector. Additionally, stronger-than-expected US inflation data raised concerns about sticky inflation. Oil prices fell as signs of slowing Chinese growth overshadowed a draw in US inventories.

U.S. Treasury yields dropped as concerns over potential interest rate hikes grew due to recent economic data, including lower jobless claims and sustained inflationary pressures.

The European Commission has revised down its economic forecast, citing high prices for goods and services as a significant factor, leading to reduced growth projections for the European Union and the eurozone. Germany is expected to experience a downturn, while inflation is projected to exceed the European Central Bank's target. Weak consumption, credit provisions, and natural disasters are also contributing to the loss of momentum in the economy. However, the report highlights the strength of the EU labor market with a low unemployment rate.

U.S. equities fell as the Fed began its policy meeting and the 10-year Treasury yield reached a 16-year high, with Walt Disney shares dropping after announcing increased spending on theme parks and cruises, and Cboe Global Markets shares rising following a CEO change.

UK inflation unexpectedly fell in August to 6.7%, easing pressure on the Bank of England to raise interest rates, with falling prices for hotels and air fares offsetting the rising cost of fuel.

European markets were slightly lower as concerns over higher interest rates emerged from recent central bank decisions, with the pan-European Stoxx 600 index down 0.1%, while construction and material stocks dropped 0.9% and mining stocks added 0.9%.