Main Topic: Federal Reserve officials express concern about inflation and suggest more rate hikes may be necessary.

Key Points:

1. Inflation remains above the Committee's goal, and most participants see significant upside risks to inflation.

2. The recent rate hike brought the federal funds rate to its highest level in over 22 years.

3. There is uncertainty about the future direction of policy, with some members suggesting further rate hikes and others cautious about the impact on the economy.

The majority of economists polled by Reuters predict that the U.S. Federal Reserve will not raise interest rates again, and they expect the central bank to wait until at least the end of March before cutting them, as the probability of a recession within a year falls to its lowest level since September 2022.

Experts are divided on whether the US Federal Reserve should raise its interest rate target to 3% to combat inflation and cushion against recessions, with some arguing that raising inflation targets would be futile.

Boston Federal Reserve President Susan Collins stated that the central bank may require additional interest rate hikes and will likely maintain elevated rates for an extended period, even if no further increases occur in the near future.

Federal Reserve Chair Jerome Powell warns that additional interest rate increases could be necessary in the fight against inflation, stating that although progress has been made, inflation remains too high and the Fed will hold policy at a restrictive level until it is confident that inflation is moving sustainably down towards their goal.

Hiking interest rates can discourage innovation and curtail long-term economic growth potential, according to a study presented at the Federal Reserve's annual conference. A percentage point increase in interest rates could lead to a 5% reduction in economic output, suggesting the need for increased government funding for innovation to offset rate increases. Higher interest rates make borrowing more expensive, reducing consumer and business demand and hindering the development of new offerings and efficiency-increasing innovations. Additionally, research and development spending, venture capital investment, and patents all decline with rising interest rates. However, the study does not advocate for refraining from raising rates if needed to control inflation.

Federal Reserve Chairman Jerome Powell signaled at a conference of central bankers that more rate hikes could be on the way as the economy continues to run hot, despite a series of policy tightening measures, in an effort to combat persistent inflation.

The Bank of England may have to increase interest rates if the US Federal Reserve decides to raise rates to cut inflation, in order to prevent the pound from weakening and inflation from rising further.

The former president of the Boston Fed suggests that the Federal Reserve can stop raising interest rates if the labor market and economic growth continue to slow at the current pace.

Atlanta Federal Reserve Bank President Raphael Bostic argues against further U.S. interest rate hikes, stating that current monetary policy is already tight enough to bring inflation back down to 2% over a reasonable period and cautioning against the risk of tightening too much.

Rising energy costs are predicted to contribute to an increase in inflation rate, but it is unlikely to prompt the Federal Reserve to raise interest rates, though there may be another rate hike in the future.

The European Central Bank is facing a dilemma on whether to raise its key interest rate to combat inflation or hold off due to economic deterioration, with investors split on the likelihood of a rate hike.

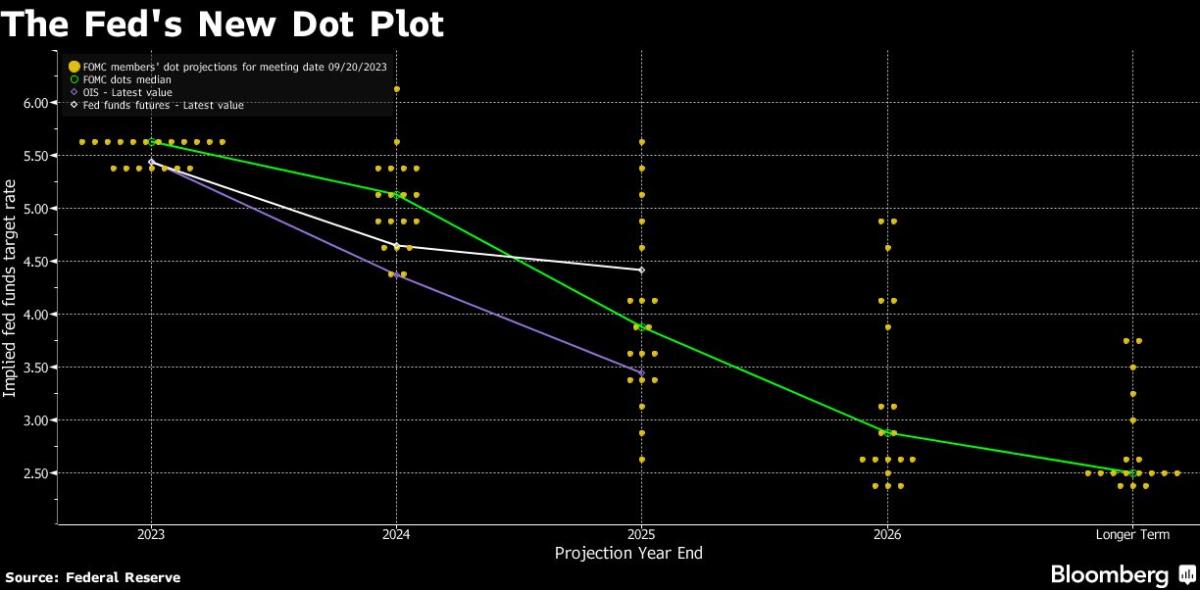

The Federal Reserve is expected to maintain one more rate hike on the table in their updated forecasts, despite their growing faith in the prospect of an economic soft-landing.

Goldman Sachs predicts that the Federal Reserve will not raise interest rates at its upcoming annual meeting due to favorable inflation news and projected economic growth, but they expect a further hike later in the year.

The Federal Reserve is expected to signal that another rate hike may be necessary due to strong economic growth and inflation metrics, creating a difference of opinion between the equity and bond markets.

The Federal Reserve is leaving its key interest rate unchanged as it moderates its fight against inflation, but plans to raise rates once more this year, as policymakers remain concerned about inflation not falling fast enough.

The U.S. Federal Reserve kept interest rates steady but left room for potential rate hikes, as they see progress in fighting inflation and aim to bring it down to the target level of 2 percent; however, officials projected a higher growth rate of 2.1 percent for this year and suggested that core inflation will hit 3.7 percent this year before falling in 2024 and reaching the target range by 2026.

The Federal Reserve has indicated that interest rates will remain "higher for longer," potentially for at least three more years, in order to sustain economic growth and combat inflation.

Central banks, including the US Federal Reserve, European Central Bank, and Bank of England, have pledged to maintain higher interest rates for an extended period to combat inflation and achieve global economic stability, despite concerns about the strength of the Chinese economy and geopolitical tensions.

Central banks around the world may have reached the peak of interest rate hikes in their effort to control inflation, as data suggests that major economies have turned a corner on price rises and core inflation is declining in the US, UK, and EU. However, central banks remain cautious and warn that rates may need to remain high for a longer duration, and that oil price rallies could lead to another spike in inflation. Overall, economists believe that the global monetary policy tightening cycle is nearing its end, with many central banks expected to cut interest rates in the coming year.

Despite expectations of higher interest rates causing a spike in unemployment and a recession, the Federal Reserve's rate hikes have managed to slow inflation without dire consequences, thanks to factors such as replenished supplies, changes in the job market, and continued consumer and business spending.

Minneapolis Federal Reserve Bank President Neel Kashkari believes that the Fed should raise borrowing rates further and keep them high for an extended period to bring inflation back down to the target of 2% due to the unexpected strength of the US economy.

Federal Reserve Governor Michelle Bowman expects additional interest rate hikes to combat inflation as rising energy prices pose a threat to progress.

Cleveland Fed President Loretta Mester believes another interest rate hike is likely, and rates could remain higher for an extended period depending on the strength of the US economy, with the focus shifting to how long rates will be held at current levels.

Federal Reserve officials indicate that monetary policy will remain restrictive for a while to bring inflation back to 2%, but there is ongoing debate over whether to increase rates further this year.

The chaos in Washington and uncertainty surrounding a possible government shutdown could make it less likely for the Federal Reserve to raise interest rates again this year, as the economy and inflation appear to be cooling off.

The Federal Reserve may not raise interest rates again this year due to an already uncertain political climate in Washington, as well as a cooling economy, slowing inflation, and potential negative impacts from high interest rates and a government shutdown.

The Federal Reserve is facing a tough decision on interest rates as some officials believe further rate increases are necessary to combat inflation, while others argue that the current rate tightening will continue to ease rising prices; however, the recent sell-off in government bonds could have a cooling effect on the economy, which may influence the Fed's decision.

The US Federal Reserve should proceed carefully when deciding whether or not to hike interest rates further to bring down inflation, according to two senior officials, as they aim for a "soft landing" to tackle inflation without harming the US economy.

The Federal Reserve officials suggested that they may not raise interest rates at the next meeting due to the surge in long-term interest rates, which has made borrowing more expensive and could help cool inflation without further action.

Top Federal Reserve officials are considering that tighter financial conditions resulting from an increase in US Treasury yields may replace the need for further interest rate hikes.

Austrian central bank Governor Robert Holzmann stated that the European Central Bank may need to implement one or two more interest rate increases if there are additional shocks to the economy, but the hiking cycle could end if things go well, as uncertainty remains surrounding the duration needed to achieve inflation targets.

Wall Street and policymakers at the Federal Reserve are optimistic that the rise in long-term Treasury yields could put an end to historic interest rate hikes meant to curb inflation, with financial markets now seeing a nearly 90% chance that the US central bank will keep rates unchanged at its next policy meeting on October 31 through November 1.

The recent inflation rate above the Federal Reserve's target could lead to another interest rate hike, making now a good time to get a home equity loan before rates potentially increase.

Federal Reserve Chair Jerome Powell indicated that the strength of the U.S. economy and tight labor markets could warrant further interest rate increases, countering market expectations that rate hikes had come to an end. Powell also acknowledged that inflation is still too high and further rate increases could be necessary.

Federal Reserve Chair Jerome H. Powell stated that the central bank may need to raise interest rates further if economic data continues to show strong growth or if the labor market stops cooling.