Prominent money managers who bet on government bonds in anticipation of a recession in the US are now facing subpar returns as Treasury yields reach a 15-year high, although some remain firm in their strategy and continue to buy dips in bond prices.

Global stock markets and Wall Street futures are rising as traders await signals on interest rate plans from the Federal Reserve conference, with investors hoping that the Fed officials will signal an end to interest rate hikes despite concerns about inflation not being fully under control yet.

The Chinese bond market is experiencing a significant shift due to concerns over China's economic growth prospects, including a bursting property bubble and lack of government stimulus, leading to potential capital flight and pressure on the yuan, which could result in increased selling of US Treasuries by Chinese banks and a rethink of global growth expectations.

Stock investors are optimistic and focused on the potential positives, while bond investors are more concerned about potential negatives; however, when the stock and bond markets differ, the bond market is typically more accurate in predicting the state of the economy according to Interactive Brokers Chief Strategist Steve Sosnick.

Bank of America believes that the stock market will continue to rise as investors' bullish sentiment contradicts their conservative portfolio positioning, suggesting there is still upside potential until hedge funds increase their exposure to cyclical and high-beta stocks and economic conditions deteriorate considerably.

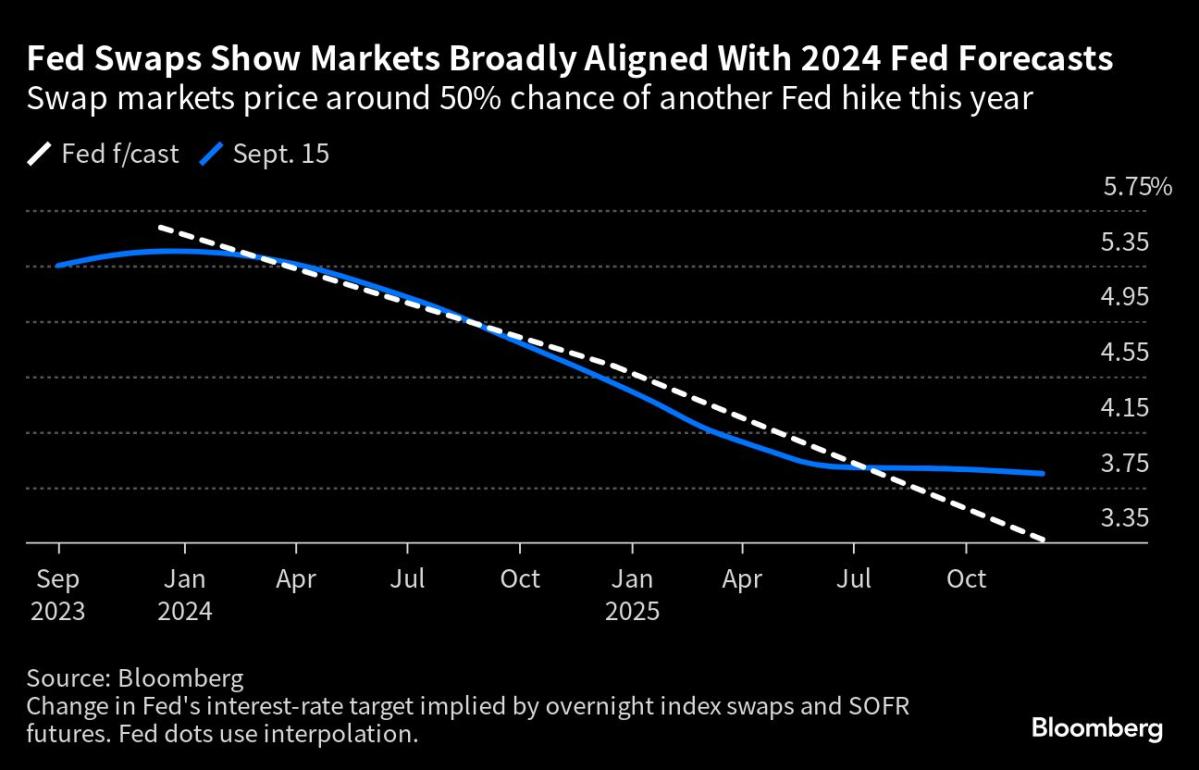

The Fed and bond market may be headed for a clash as they have differing views on whether interest rates are sufficiently restrictive to cool the economy and bring inflation back to target.

Equity markets are higher as investors consider macro data, with Wall Street experiencing a rally fueled by optimism about interest rates and job openings.

Stocks on Wall Street rose as the head of the Federal Reserve indicated a cautious approach to interest rates, resulting in the first winning week for the market since July.

Treasury yields are on the move and investors should pay attention to where they might be headed next.

Euro zone bonds and stocks rally as traders maintain their bets on the European Central Bank cutting interest rates next year amid concerns over economic growth.

Investors are becoming increasingly cautious about the US stock market and the economy as 2023 draws to a close, leading to a more defensive investment approach by Wall Street banks and experts warning of potential pain ahead.

Bitcoin and other cryptocurrencies experienced a rise in value as traders made bullish bets in anticipation of the Federal Reserve's interest rate decision, though this surge may be premature.

Investors will closely scrutinize the Federal Reserve's updated economic forecasts, particularly its interest rate outlook, to determine the market's next big story.

The Federal Reserve is expected to keep interest rates steady and signal that it is done raising rates for this economic cycle, as the bond market indicates that inflation trends are moving in the right direction.

The Federal Reserve's continued message of higher interest rates is expected to impact Treasury yields and the U.S. dollar, with the 10-year Treasury yield predicted to experience a slight increase and the U.S. dollar expected to edge higher.

Investors are more focused on the release of new forecasts from the Federal Reserve, which will reveal their views on the prospect of an economic "soft landing" and the rate environment that will accompany it.

The Federal Reserve's plans for prolonged elevated interest rates may continue to put pressure on stocks and bonds, although some investors doubt that the central bank will follow through with its projections.

Bond investors are faced with the decision of how much risk to take with Treasury yields at their highest levels in more than a decade and the Federal Reserve signaling a pause in rate hikes.

Financial markets are betting on more rate cuts next year than what Federal Reserve policymakers believe is likely, which may complicate the Fed's efforts to control inflation.

Bitcoin and other cryptocurrencies are experiencing a slight increase, but the surging bond yields are causing pressure on digital assets as investors consider the impact of interest rates and Federal Reserve policies.

Higher interest rates are causing a downturn in the stock market, but technological advancements in recent decades may provide some hope for investors.

A majority of Wall Street investors are concerned about the stock market's gains in 2023 and believe that it could retreat further as the risk for a recession increases.

Households and hedge funds are increasingly investing in the Treasury market as yields on bonds rise, attracting investors amid rate hikes by the Federal Reserve.

Investors are pushing yields in the Treasury market towards or above 5%, driven by the speed at which they are rising rather than the actual level, which could have negative implications for banks and existing holders of Treasurys.

Investors are expected to shift from traditional bond investments to Bitcoin as a hedge against US dollar debasement, according to Bloomberg Intelligence crypto market analyst Jamie Coutts.

Investors attempt a risk-on rally as Treasury yields and oil prices stabilize, but concerns over higher interest rates continue to impact sentiment in European and global markets.

Investors should be cautious as signs of a potential market downturn continue to emerge, with narrowing market breadth, worsening market sentiment, surging Treasury yields, climbing oil prices, and a hefty revision of consumer spending revealing a decrease in spending that could impact economic growth.

As interest rates continue to rise, the author warns of the potential consequences for various sectors of the economy, including housing, automotive, and regional banks, and suggests that investors should reconsider their investment strategies in light of higher interest rates.

Despite the relatively calm appearance of the stock market, there are many underlying issues that could pose risks, including the debt ceiling crisis, potential default on U.S. debt, tensions with Russia and China, ongoing effects of the pandemic, and uncertainty about the future direction of the economy. Therefore, while investors should remain in the market, it is advised to hedge bets and diversify holdings.

Betting on a bond-market rebound may be a wise decision as continued falling prices and rising yields could potentially lead to a financial catastrophe, according to a strategist at J.P. Morgan Asset Management.

Billionaire investor Bill Ackman predicts that the Federal Reserve is likely done raising interest rates as the economy slows down, but warns of continuing spillover effects and expects bond yields to rise further.

Investors are likely to continue facing difficulties in the stock market as three headwinds, including high valuations and restrictive interest rates, persist, according to JPMorgan. The bank's cautious outlook is based on the surge in bond yields and the overhang of geopolitical risks, which resemble the conditions before the 2008 financial crisis. Additionally, the recent reading of sentiment indicators suggests that investors have entered a state of panic due to high interest rates.

The recent surge in bond yields is causing a significant shift in markets, but there is still optimism among investors.

Surging U.S. real yields are strengthening the dollar's rebound and making it more profitable to bet on the currency, while also increasing the cost for bearish investors to bet against it.

The chaos in the bond market is largely attributed to the Federal Reserve, as panic over higher interest rates has led to a selloff in long-dated Treasurys, although some market experts believe this panic is disconnected from market fundamentals and that interest rates are unlikely to remain high for long.

The recent rise in interest rates and bond market rebellion against America's debt politics is causing concern, impacting the real economy with higher mortgage rates and a slump in stocks, leading to voters expressing discontent with the Biden economy.

The author discusses their perspective on the market, stating that they believe a reversal is in sight and that the low interest rate environment has influenced their investment strategy, favoring both long-duration assets and value names. They also mention potential opportunities in bonds and emerging markets, as well as their short-selling philosophy.

The Federal Reserve is facing a tough decision on interest rates as some officials believe further rate increases are necessary to combat inflation, while others argue that the current rate tightening will continue to ease rising prices; however, the recent sell-off in government bonds could have a cooling effect on the economy, which may influence the Fed's decision.

Wall Street's hopes for a Goldilocks scenario in the stock market and economy have been dashed as interest rates soar and the Fed's "higher for longer" mantra raises concerns about a looming recession and its impact on consumers and businesses.

Investors' nerves were settled by dovish remarks from Federal Reserve officials, suggesting that rising yields on long-term U.S. Treasury bonds could have a similar market effect as formal monetary policy moves, potentially reducing the need for further rate hikes.

Stocks on Wall Street edged higher amid hopes that the Federal Reserve is done with interest rate hikes, but investors remain cautious as the Middle East conflict escalates.

Investors are closely monitoring the bond market and September CPI data to determine the Fed's stance on interest rates, with Seema Shah of Principal Asset Management highlighting the circular nature of market reactions to yield spikes and their subsequent declines. She suggests that while there are concerns about upward momentum, the equity market will find comfort in a continued drop in yields and could remain range-bound for the rest of the year. Diversification is recommended as the market narrative remains unclear, and investors may consider waiting until early 2024 for greater clarity on the economy and the Fed's actions.

Investors are betting that the Federal Reserve may not raise interest rates again due to recent market moves that are expected to cool economic growth.

Investors in U.S. Treasuries are feeling on edge due to news of increased consumer prices and weak demand, suggesting that volatility in the fixed-income markets continues, while lower bond yields reflect a desire for safe assets amidst uncertainty caused by the war in Israel, with concerns of further tightening from the Federal Reserve and mixed economic data from China adding to the market's unease.

Federal Reserve officials are expected to pause on raising interest rates at their next meeting due to recent increases in bond yields, but they are not ruling out future rate increases as economic data continues to show a strong economy and potential inflation risks. The Fed is cautious about signaling an end to further tightening and is focused on balancing the risk of overshooting inflation targets with the need to avoid a recession. The recent surge in bond yields may provide some restraint on the economy, but policymakers are closely monitoring financial conditions and inflation expectations.