The U.S. labor market has proven resilient in the face of the pandemic, with narratives of a "she-cession," early retirements, a white-collar recession, and missing men falling apart as employment rates rebound among various demographic groups, highlighting the lesson that one should never bet against the U.S. worker.

The US Labor Department has revised downward its estimate of total payroll employment in March 2023, revealing a slightly cooler labor market than previously thought, which may influence the Federal Reserve's decision on interest rates at their upcoming policy meeting in September.

Investors await US job data ahead of the Federal Reserve's Jackson Hole symposium, causing the dollar to rise, while the Turkish lira rallied after a larger-than-expected central bank rate hike.

Investors will have a lot to consider this week as they analyze economic indicators such as US nonfarm payrolls, wage growth, and inflation, as well as Eurozone inflation numbers and central bank commentary, all of which could impact policy decisions and market sentiment.

Investors are preparing for a busy week on Wall Street with reports on the job market and earnings, as well as the government's report for August, while all three major market averages finished higher on Friday.

This week's highlights include new data on the U.S. labor market, earnings reports from several retailers, and the latest inflation data.

Investors will be focusing on new data on the U.S. labor market, including job openings and the nonfarm payrolls report, as well as earnings reports from retailers and the latest inflation data.

Wall Street is calm ahead of key economic reports that could provide insight into the job market, inflation, and potential interest rate changes by the Federal Reserve, while consumer confidence and job opening reports are expected to remain strong in August.

The US labor market shows signs of easing as job openings decline for the third consecutive month, worker quits decrease, and layoffs increase, indicating a more balanced state, according to the Bureau of Labor Statistics.

The number of job vacancies in the US dropped in July, indicating a cooling labor market that could alleviate inflation, while fewer Americans quit their jobs and consumer confidence in the economy decreased, potentially impacting consumer spending; these trends may lead the Federal Reserve to delay a rate hike in September.

Stocks rally as job openings decline in July, bonds rally on softening job market and odds of interest rate pause, court rules SEC needs more reasoning to block Grayscale's Bitcoin ETF, and other market movements.

Investors hold onto their risk-on hats as US job openings data drops, increasing the likelihood of a Fed pause on rates, and Asian equity markets rise in anticipation of the Federal Reserve's monetary tightening coming to an end.

The US jobs data for July suggests a cooling employment market, with a drop in labor demand and easing of hiring conditions, which could help lower inflation without a significant rise in unemployment rates.

The U.S. jobs market shows signs of cooling as Labor Day approaches, giving investors relief from concerns about a potential Federal Reserve interest rate hike. However, global market rally and uncertainty around China's market rebound indicate that risks still persist.

Despite initial expectations of rising unemployment, the US labor market has remained robust due to pandemic-related fiscal support and increased consumer spending, preventing a hard landing for the economy.

The August jobs report is highly anticipated as investors assess the health of the labor market amidst rising interest rates and inflation, with projections indicating an increase in hiring and a steady unemployment rate, but potential disruptions from ongoing strikes and bankruptcies could affect the data. The report is closely watched by the Federal Reserve for signs of labor market softening as they grapple with inflation, and while the labor market has remained tight, there are indications of a gradual slowdown. Job openings have decreased, along with resignations, pointing to a labor market that is cooling.

Investors await the release of U.S. nonfarm payrolls and a barrage of manufacturing data to close out a week of mixed economic reports, while China's private-sector survey shows factory activity expanding despite ongoing economic challenges.

U.S. futures are up on the first trading day of September, with the Nasdaq 100, S&P 500, and Dow Jones Industrial Average all showing gains, while the recent data suggests that the U.S. labor market is cooling down and the Fed may pause the rate hike cycle in September.

The US job market shows signs of slowing but remains resilient, with 187,000 jobs added in August and a rise in the unemployment rate to 3.8%, as more people actively look for work. Wage gains are easing, signaling a potential slowdown in inflation, and the Federal Reserve may decide against further interest rate hikes.

The week has been driven by macroeconomic data, but the threat of economic contraction is not currently imminent, with the US Ten-Year Note yielding around 4.11% overnight and the US Dollar Index trading around 103.5; the Bureau of Labor Statistics will release its employment-related surveys for August today, with economists expecting non-farm job creation of around 170,000 and wage growth at 4.4% year over year.

U.S. stocks rose after August jobs data showed a slowdown in the pace of job gains, calming investor concerns about the Federal Reserve raising interest rates, with the Dow Jones Industrial Average rising 0.5%, the S&P 500 up 0.4%, and the Nasdaq Composite gaining 0.3%.

The US job market is cooling down, with signs of weakening and a slowdown in momentum, which may allow the Federal Reserve to ease inflation pressure through weaker job creation and reduced demand.

The August jobs report indicates that the labor market is cooling despite a larger-than-expected gain in payrolls.

Stock markets showed signs of improvement last week, fueled by hopes of a Goldilocks economic scenario, despite downward revisions in Q2 GDP growth and a slowdown in housing prices, while robust hiring and a decline in wage growth raised concerns about a cooling job market. The strength of U.S. consumers and the moderation of the Consumer Confidence index are factors that could influence the Federal Reserve's decisions on inflation, with investors advised to rely on trustworthy data and analysis. Noteworthy upcoming earnings and dividend announcements include Zscaler, Gitlab, GameStop, C3ai, American Eagle, DocuSign, and Kroger. Key economic reports this week will focus on Factory Orders, ISM Services PMI, and Q2 Non-Farm Productivity and Unit Labor Costs.

Stock investors have been reacting positively to "bad economic news" as it may imply a slowdown in the economy and a potential halt to interest rate hikes by the Federal Reserve, however, for this trend to change, economic data would have to be much worse than it is currently.

The US job market added 187,000 jobs in July, returning to pre-pandemic levels and indicating a gradual cooling off of the labor market, with positive economic news and a steady unemployment rate of 3.5%.

Traders will have a break from the stock market on Labor Day following positive economic data that suggests a slowing economy and potentially prevents the Federal Reserve from raising interest rates, while other markets such as commodities and bonds will be closed, and stock futures are expected to rise; additionally, the crypto trade remains active.

Equities rose on Monday as market participants speculated that the Federal Reserve may be nearing the end of its interest rate hike cycle, following a positive US jobs report and signs of a softening labor market. Additionally, investors were hopeful that China would implement measures to stimulate its economy and property sector.

The coming week is expected to be lighter for investors, with the Federal Reserve's interest rate decision being the highlight, as US markets observe Labor Day and updates on the services sector and corporate earnings are anticipated.

U.S. stock investors are closely watching next week's inflation data, as it could determine the future of the current equity rally, which has been fluctuating recently due to concerns over the Federal Reserve's interest rate hikes and inflationary pressures.

Uncertainty in various sectors, including potential strikes, government shutdowns, geopolitical tensions, and the question of future Federal Reserve interest rate hikes, is causing markets to lack conviction, but this week's inflation readings could provide direction for the markets. If inflation comes in below expectations, it may signal that the Fed will not hike rates further, while stronger-than-expected inflation could lead to more rate hikes and market volatility. Additionally, increasing energy prices and the potential strike by the United Auto Workers union add to the uncertainty.

The latest data on inflation, gas prices, SNAP benefit cuts, job prospects, Wells Fargo layoffs, student loan scams, and McDonald's beverage stations are discussed in this financial news update.

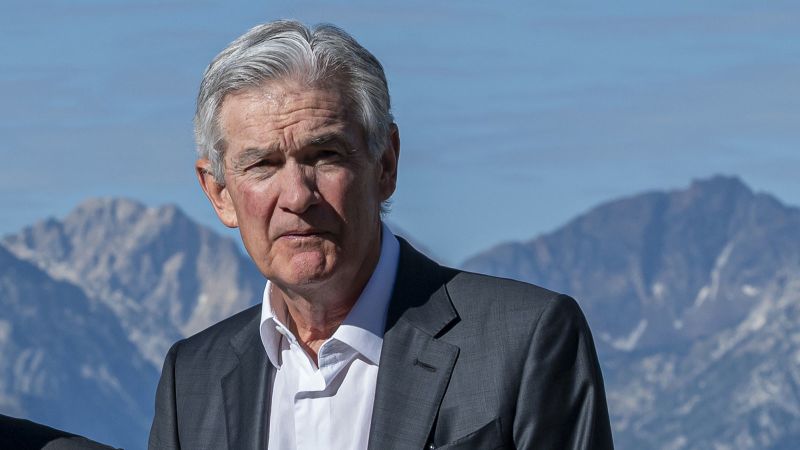

Investors are focused on Jerome Powell and the Federal Reserve's upcoming policy decision, as well as earnings reports from FedEx and the impact of the United Auto Workers strike on companies like Stellantis, GM, and Ford.

The upcoming U.S. Federal Reserve meeting is generating less attention than usual, indicating that the Fed's job of pursuing maximum employment and price stability is seen as successful, with labor market data and inflation trends supporting this view.

Summary: The markets have experienced various shocks this week, with the most significant one coming from the Federal Reserve, making labor data more crucial than Fed discussions.

The panel discusses the upcoming Fed comments, the market's expectation of no further rate hikes in September, and the impact of high interest rates on jobs, wages, and consumer spending.