The S&P 500 reaches a record high, disregarding the higher-than-anticipated inflation data for February.

Global fuel prices are rising due to disruptions in trade routes, refinery closures, and increased demand, making it difficult to forecast fuel availability and potentially impacting the US presidential election.

South Africa's foreign minister announces that citizens fighting with Israeli forces in Gaza will be arrested upon their return, worsening tensions between the two countries; the South African government has recently accused Israel of genocide.

An Ottawa man's credit score is negatively affected by an unpaid ticket from 2005, showing the impact of old debts.

The US economy could see a surge in layoffs by the end of 2024 due to aggressive Fed rate hikes that haven't fully impacted the economy, with unemployment potentially rising to 5% by year-end and even higher in the following years, according to economic experts.

The S&P 500 reaches a record high despite a higher-than-anticipated inflation reading in February.

The median size of new homes in the US has dropped to its lowest level in over a decade, reflecting a trend towards smaller, more affordable homes, though prices have not necessarily decreased.

The Federal Reserve's preferred gauge of inflation, the Personal Consumption Expenditures price index, is close to its 2% target, but the latest data from the Consumer Price Index shows prices up 3.2% in the past 12 months, highlighting the difference between the two metrics and the factors behind the diverging readings. The weight given to housing in the indexes plays a major role, with CPI giving it more importance, while PCE considers spending on healthcare services more significantly. Additionally, the use of owners' equivalent rent (OER) to track housing inflation has limitations and does not accurately reflect changes in rent prices.

JPMorgan Chase CEO Jamie Dimon believes that the Federal Reserve should wait before cutting interest rates despite concerns over high borrowing costs, as low unemployment and rising wages provide room for higher rates to maintain the booming economy. Dimon also warns against the possibility of stagflation, which he believes would be worse than a recession.

About 60% of consumers live paycheck-to-paycheck, with debt being one of the main reasons, although the percentage has slightly decreased from 2022; however, high-income earners are becoming less reliant on a monthly paycheck, leading to increased optimism for the coming year.

Despite sweeping sanctions and the loss of many global brands, Russia's economy remains stable, with low unemployment, expected economic growth, and a robust construction sector, boosting President Putin ahead of the upcoming election.

President Biden emphasized that prices are lower than a year ago but failed to mention that prices for common grocery items remain higher than when he assumed office, as inflation continues to drive up costs for milk, eggs, butter, boneless chicken breasts, white bread, and sugar.

Maryland's unemployment rate increased slightly in January, but it still remains one of the lowest in the country, while D.C. continues to have one of the highest unemployment rates even with a slight increase.

Despite the Federal Reserve's plan to cut interest rates this year, recent data shows that inflation in the US is still rising, leading to uncertainty about the effectiveness of their inflation-fighting strategy.

The text discusses the discrepancy between hard data, which shows a strong recovery in the economy, and soft data, which reflects a significant economic pessimism among households. This difference may be due to the specific groups that the economy is benefiting.

The CEO of JP Morgan Chase, Jamie Dimon, has warned that a recession in the US is a possibility and recommends that the Federal Reserve should wait before cutting interest rates, citing distorted economic indicators following the pandemic and the need for further clarity.

February's CPI report aligns with expectations and indicates economic resilience, with the data suggesting that if the Federal Reserve were to implement rate cuts, it would likely not happen until June. Oppenheimer's John Stoltzfus emphasizes the need for patience in bringing down inflation, while Manulife's Frances Donald cautions against premature rate cuts that could undo progress made thus far, suggesting a focus on the economy's resilience instead.

Nearly two-thirds of bond market strategists polled by Reuters believe that the inverted yield curve, a key indicator of an upcoming recession, is no longer reliable due to factors such as the Federal Reserve's stimulus program and the resilience of the economy.

Chinese banks have been cautious in releasing payments to Russian traders, with only 10 percent of traders able to pay suppliers for goods from China due to lengthy due diligence checks and fear of running afoul of US rules.

Credible Operations, Inc., a personal finance marketplace, provides information on mortgage rates and tips on how to get the best rate, including comparing lenders and loan offers, getting pre-approved, and considering fixed or adjustable-rate mortgages.

Inflation in the US increased slightly in February, with the Consumer Price Index rising to 3.2 percent compared to a year earlier, and core inflation reaching 3.8 percent, indicating that returning to normal levels of inflation could be a challenging and lengthy process. The Federal Reserve will proceed cautiously with decisions on interest rates in order to manage inflation and promote economic growth.

Swedish furniture giant Ikea plans to reduce prices in the U.S. as inflationary pressures ease, following its implementation of price reductions on hundreds of products, with the aim of restoring prices to pre-pandemic levels by the end of 2025.

China needs to pursue "smarter investment" and refine industrial policies to address overcapacity in traditional manufacturing and infrastructure in order to avoid years of stagnation and remain competitive internationally, according to economist Cao Heping.

Gen Z, the youngest generation in the workforce, lacks confidence in their financial knowledge and skills, with 57% of them preferring savings accounts as their investment method compared to 46% of baby boomers who prefer stock investments.

China's economy is expected to slow down due to structural barriers and the government's reluctance to implement aggressive stimulus measures, resulting in a variety of economic challenges such as low consumer confidence and falling foreign investment. The report also highlights China's shift towards a state-directed approach to development, which prioritizes strategic industries over overall growth and may have implications for global commodity demand and lending capacity. Additionally, the report mentions China and Russia's military efforts to challenge U.S. influence, as well as North Korea's partnerships with China and Russia and its use of chemical weapons.

Ohio's unemployment rate has been below 4% for 14 consecutive months, the longest stretch on record, due to tight labor markets and a lack of workers.

Inflation in Germany has dropped to its lowest level since June 2021, at 2.5% in February, as energy and food prices ease, according to Germany's Federal Statistics Office, providing relief to consumers whose purchasing power had been reduced by higher inflation rates.

The divergence between the positive hard data indicating a strong recovery in the US economy and the negative soft data reflecting widespread economic pessimism may be due to the deteriorating quality of the soft data, as surveys are receiving fewer responses and those who do respond are likely to downplay the positive aspects of the recovery, leading to a distorted view of the economy that could impact policymaking and perpetuate income inequality.

Insurance costs, including home and car insurance, are driving up overall inflation in the US due to various factors such as rising prices of parts and replacement vehicles, climate-related issues, and higher medical care insurance expenses.

Unemployment in the UK rose unexpectedly to 3.9% in January, while wage growth slowed, indicating a weakening labor market and a broader economic slowdown; however, recent surveys show businesses gaining confidence and preparing to raise prices as employees receive above-inflation pay rises.

Despite sweeping sanctions and trade restrictions imposed on Russia by Europe, the US, and their allies, the Russian economy has remained stable, with low unemployment, strong growth forecasts, and the majority of people not experiencing significant economic changes, while inflation remains a concern due to higher prices.

Japanese retailers are capitalizing on India's growing middle class and consumer demand for high-quality goods, with brands like Uniqlo and Muji finding success in the market by offering practical and well-made products that resonate with millennials and Gen Z consumers. The long-standing trust Indians have in Japanese brands for their quality and craftsmanship is creating opportunities for further expansion and success.

Argentina's central bank has unexpectedly lowered its benchmark interest rate from 100% to 80% due to expectations of lower monthly inflation and a strengthening peso in parallel markets.

JP Morgan CEO Jamie Dimon believes there is a 50% chance of a recession in the next year or two and that the Federal Reserve should wait for more clarity before cutting interest rates, despite the world's current expectation of a soft landing.

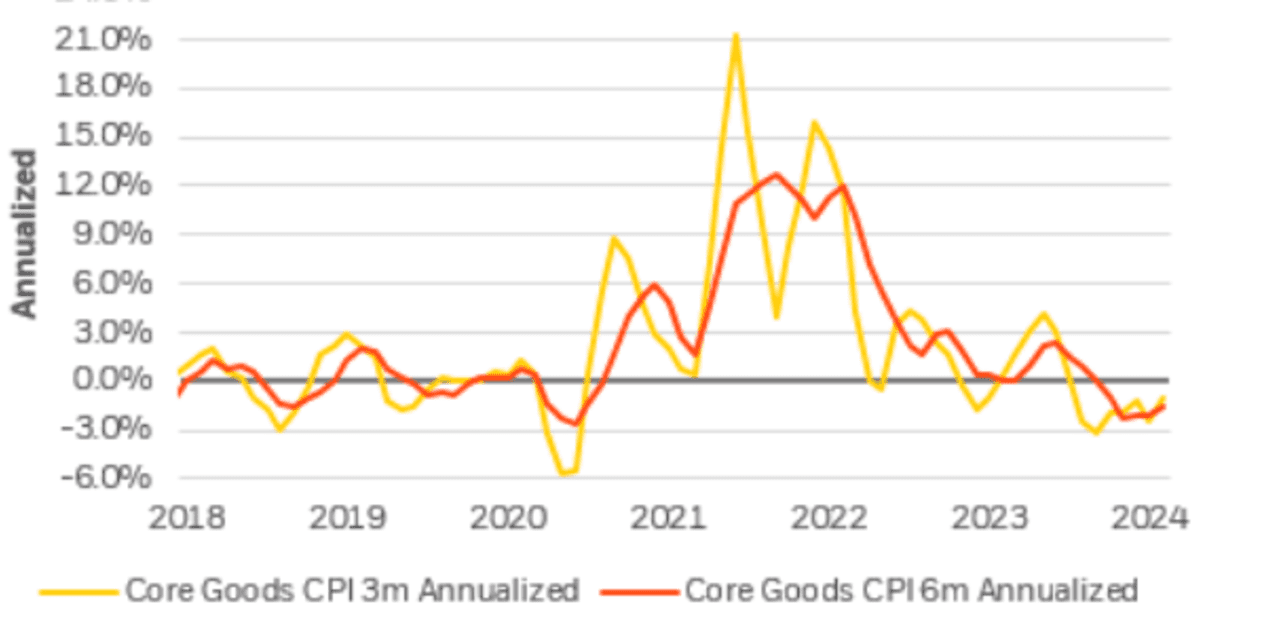

Inflation in the post-pandemic period has entered a stall, with the annual rate holding steady between 3% and 4%, despite the Federal Reserve's efforts to bring it down to their 2% target, and experts believe that above-forecast inflation is likely to persist for some time due to factors such as high shelter costs and ongoing geopolitical turmoil.

Australian households are facing multiple challenges, with inflation being the primary drag on their financial well-being, according to Reserve Bank Assistant Governor Sarah Hunter. The Reserve Bank of Australia is expected to maintain its current interest rates ahead of its upcoming board meeting.

China's economy is showing signs of improvement as consumer prices returned to positive territory for the first time in six months, indicating a strengthening domestic demand and steady economic recovery, though uncertainties and pressures persist both domestically and internationally.

Inflation in the post-pandemic period has entered a stall, with the annual rate holding between 3% and 4%, despite the Federal Reserve's effort to raise interest rates and slow down price growth, mainly due to the inability to bring down shelter costs, such as rent and homeownership. As a result, above-forecast inflation is expected to persist for some time, while workers struggle to keep up with inflation-adjusted wages. The Fed is likely to maintain high interest rates to counter the risk of prices accelerating again.

China is considering legalizing personal transactions of rural homes, which could have significant implications for its economy and future development, as it would address ongoing property market crises, bridge the urban-rural divide, and promote sustainable growth in the country. However, concerns remain regarding the potential loss of agricultural resources and the impact on the 300 million migrant workers who rely on rural areas for employment.

Stocks closed mixed as investors await key data on consumer prices, while a new report reveals that almost half of parents provide financial support to their adult children, with many sacrificing their own financial security in the process.

Credit card delinquencies are rising, but overall consumer credit health is stable, with banks becoming more selective and competitive in attracting higher-end consumers, which could impact the forthcoming 2024 presidential election.

Tipping is becoming more expected in various places, sparking a potential "tipflation" backlash, with suggested tip percentages varying depending on the service provided.

Yahoo Finance Live previews the day's top stories, including upcoming corporate earnings from Kohl's, Manchester United, and Guess, as well as the Consumer Price Index inflation print and expectations for the US federal budget deficit.

Nigerian Breweries has announced a second price increase for its products within two months due to rising input costs.

The share of American tech workers satisfied with their pay dropped from 56% to 49% in 2023, according to a survey by job site Dice, reflecting the impact of layoffs and cost cuts in the industry. While the average tech salary in the Bay Area declined by 2.3% to $142,000, tech workers in Orlando and Philadelphia saw an increase of more than $8,500 in average pay.

Share prices are surging to all-time highs, prompting questions of whether it's a bubble, but experts believe there are no signs of euphoria or irrational exuberance yet, and indicators such as cash holdings and IPO activity do not reflect a typical bubble scenario.

The Nebraska State Board of Education rejected a proposal to ban sexually explicit and pornographic books from school libraries, with some board members arguing that the ban was a tactic to target books about racism, gender, and the LGBTQ community.

The U.S. maintained its position as the world's leading oil producer for a sixth consecutive year in 2023, surpassing its own previous record with an average daily production of 12.9 million barrels of crude oil, according to a report by the Energy Information Administration (EIA).

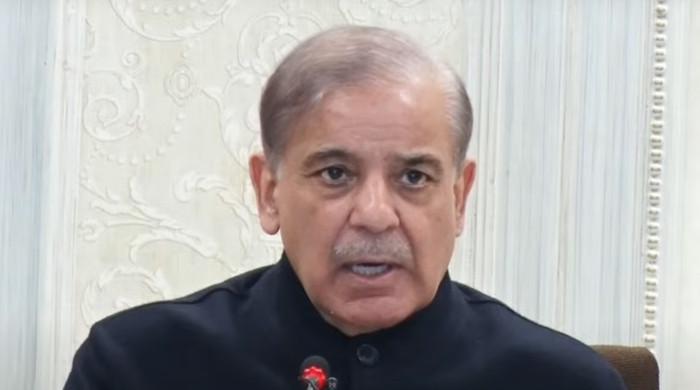

Pakistan's Prime Minister Shehbaz Sharif aims to end reliance on foreign loans and seek investments from friendly countries in order to tackle inflation and provide relief to the struggling masses.

Catherine Mann, a policymaker at the Bank of England, suggests that the UK still has a long way to go to meet the central bank's inflation target of 2%.