Traders in the U.S. equity options market are feeling cautious ahead of the release of inflation data, which could have an impact on the Federal Reserve's monetary policy, leading to larger swings in the stock market.

The number of dollar millionaires in India is rapidly growing, with an annual increase of 8.5% between 2012 and 2022, and wealth managers expect this trend to continue as the economy rebounds; these new rich individuals are geographically diverse, younger, and more interested in capital markets and risk-taking than the previous wealthy elite, but they still face risks from political instability and tax changes, and many are looking to move abroad.

The unemployment rate increased in several states, including Connecticut, Rhode Island, and Washington, as borrowing costs rose and companies adjusted their hiring, while the national unemployment rate rose to 3.9 percent due to an increase in workers entering the labor force.

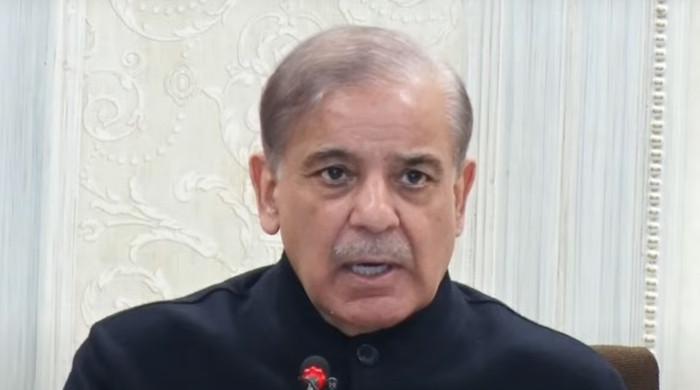

Prime Minister Shehbaz Sharif addresses the economic challenges facing Pakistan, including inflation and mounting circular debt, and expresses his determination to rid the country of foreign debts, stating that they will "get rid of IMF InshaAllah."

Canadian economists are expressing concerns about the country's declining productivity and its impact on the standard of living, pointing to factors such as rising government payrolls and government control in various sectors as contributing factors.

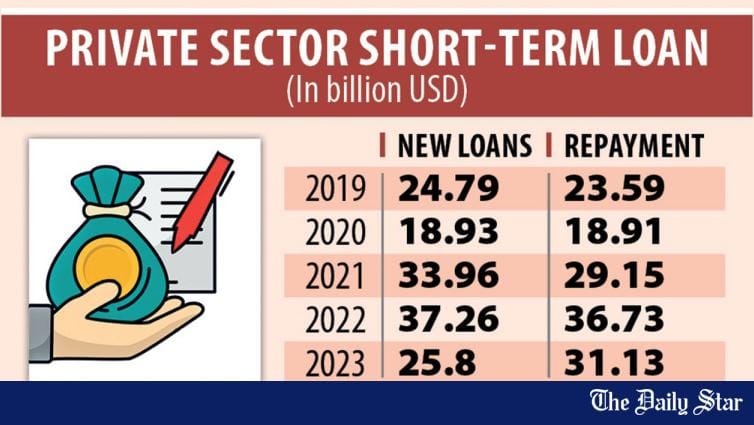

The private sector in Bangladesh is experiencing a reversal of trends, with short-term foreign debt repayment surpassing new loans due to rising interest rates in the global market and concerns over the country's banking system and macroeconomic situation.

U.S. dominance of global natural gas markets, driven by increased exports, has actually resulted in higher gas prices for American consumers, doubling the price they were paying when the U.S. kept most of its natural gas for domestic use.

New laws aimed at improving the rights of gig economy workers in the EU, including those working for companies like Uber, have been approved by member states, potentially granting workers rights such as holidays, sick pay, and the minimum wage.

Investors are eagerly awaiting the February Consumer Price Index (CPI) data, with a 3.1% expectation, and Rockland Trust Chief Investment Officer Dave Smith believes that if the results align with this expectation, it would be good for the economy and that the S&P 500 is currently trading at a fair valuation with risks already factored in.

The unemployment rates in Europe continued to decline in November 2023, with the euro area at 6.4% and the EU at 5.9%, but youth unemployment and regional disparities remain concerns, while countries like Portugal, Greece, Italy, and Spain have seen improvements in their unemployment rates.

Shehbaz Sharif, Pakistan's new Prime Minister, has appointed former JPMorgan banker, Muhammad Aurangzeb, as finance minister to address the country's struggling economy and secure loans from the International Monetary Fund (IMF).

The Golden 1 Center in Sacramento has had a significant positive impact on the downtown economy, generating billions of dollars in investment, supporting thousands of jobs, and contributing millions of dollars in tax revenue, according to a report commissioned by the Greater Sacramento Economic Council.

The Canadian embassy in Haiti remains open as officials gather in Jamaica to discuss plans to restore order to the country; Canada's UN Ambassador states that the security situation on the ground will determine how long the embassy remains open.

According to economist Stephanie Pomboy, the US economy will not avoid a hard-landing recession, with consumers already experiencing a downturn, and a potential "double-dip" profit recession for companies on the horizon due to higher borrowing costs and weakening profits.

The number of full-time jobs in the US has decreased significantly since June 2023, while part-time employment and multiple job-holding have increased, as Americans face economic pressures such as high inflation, according to data from the Bureau of Labor Statistics.

Chinese exports have surged by 7.1% in the first two months of 2024, with notable growth in trade between China and Russia, surpassing economists' predictions, and indicating an uptick in demand after the lifting of China's strict zero-Covid restrictions.

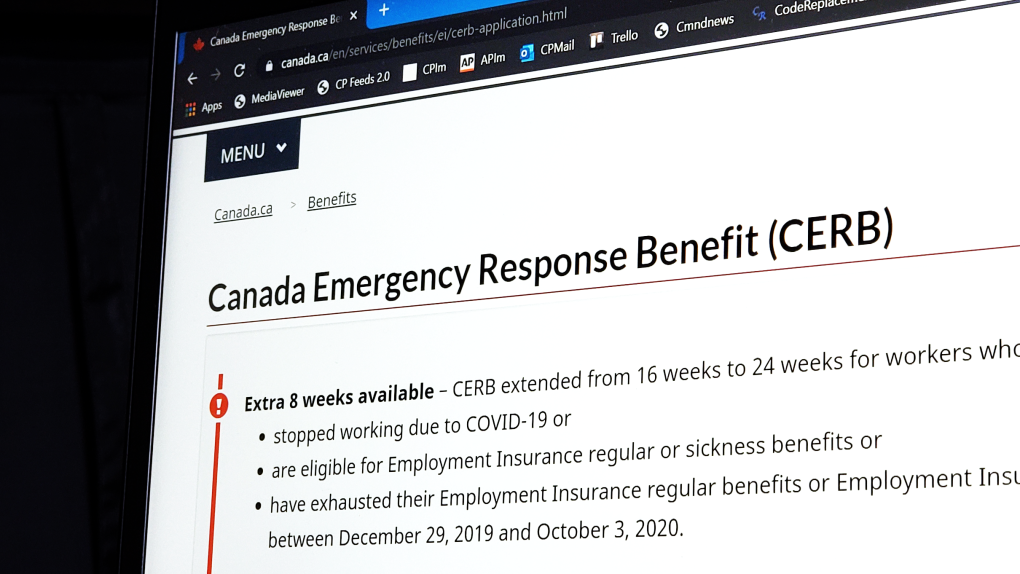

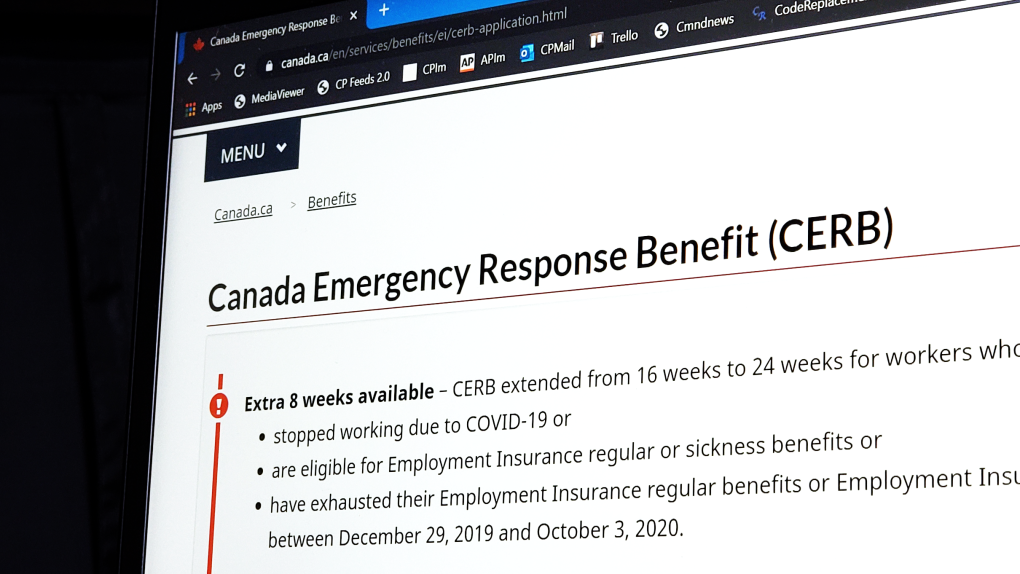

Some Canadians who received emergency pandemic benefits are now finding out they were not eligible and must pay back thousands of dollars to the government, leaving them struggling to manage their finances and calling for alternative payment arrangements.

Some Canadians who received emergency pandemic benefits are now being asked to repay thousands of dollars due to ineligibility, causing financial hardships for many.

The majority of economists in a recent Reuters poll predict that the U.S. Federal Reserve will cut its key interest rate in June as it waits for more data on inflation before confirming whether it is on track to reach its target.

Argentina is launching a record debt swap to roll over most of its peso-denominated debt due in 2024, providing temporary relief to President Javier Milei's government and stabilizing the currency.

The concept of post-scarcity, which envisions a society where everyone's basic needs are unconditionally met, is being reconsidered and redefined in the present day, with differing interpretations focusing on technology or political shifts as the means to achieve it. The key to post-scarcity lies in unconditionally meeting everyone's basic needs and reducing the workweek, allowing individuals to live a dignified life and pursue their aspirations free from the burden of scarcity. However, the question remains as to what extent work will still be necessary in a post-scarcity society.

California's economy has been struggling with high unemployment rates, with the state's unemployment rate remaining stubbornly high, surpassing the national average.

The global energy crisis caused by Russia's invasion of Ukraine has highlighted the resilience of the energy market, the role of new trading methods, and the impact of American shale production on global energy dynamics.

The UK's energy regulator, Ofgem, has expressed concerns that the rising cost of net zero policies may disproportionately impact lower income households, and is calling for steps to protect them from future energy bill increases. Ofgem is particularly worried about the debt burden faced by poorer households and the potential knock-on effect on the retail energy sector. The regulator is seeking input from stakeholders on how to provide better support to consumers and ensure affordability in the transition to cleaner energy.

The prices of vinyl records will be included in UK inflation statistics for the first time in nearly three decades, reflecting their resurgence in popularity among British consumers, influenced in part by Taylor Swift.

Brazil's monthly inflation rate is expected to reach a one-year high in February, but it is predicted to decrease in the following months due to an abundance of farm products and softer economic conditions.

China's largest bottled water producer, Nongfu Spring, is facing backlash from online nationalists who criticize the company's packaging and its owner's competition with another brand, raising concerns about the impact on the already fragile private sector in China.

Americans are drowning in credit card debt, reaching a record high of $1.13 trillion, due to failed government policy of excessive spending, borrowing, and inflation caused by the devaluation of the dollar, resulting in a cost-of-living crisis and decreased real earnings.

Despite low unemployment, strong job creation, and a growing economy, surveys show that Americans are dissatisfied with the state of the economy under President Biden, with inflation and high interest rates playing a significant role in their discontent.

:no_upscale()/cloudfront-us-east-1.images.arcpublishing.com/dmn/6KT2ORA5RLUGEBAJLXH4DKE5WA.jpg)

Small business owners and consumers blame corporate greed for soaring prices and struggling economy, while President Biden criticizes companies for raising prices while offering less.

Despite positive economic indicators such as low unemployment, increased wages, and a strong stock market, American economic pessimism persists under President Joe Biden, potentially impacting his chances of reelection in 2024. Voters still view the economy negatively, and Biden must convince the public that it is better than it seems and better than it was under Donald Trump.

India's economy is projected to transition to an upper middle-income country by FY36 and reach $15 trillion by FY47, but achieving its goal of becoming a $30 trillion developed economy by 2047 will require sustained annual growth of 9.7%.

The Federal Reserve is not expected to change interest rates at its next meeting, but there is uncertainty about whether officials will maintain their outlook for rate cuts as the economy continues to outperform expectations.

Doom spending, characterized by excessive spending on luxury items or experiences to cope with financial anxieties, is a growing trend among younger generations, particularly Gen Z and millennials, with economic factors such as unaffordable housing contributing to the phenomenon, along with the influence of social media and online marketing. To curb doom spending, individuals can track their spending, limit social media consumption, focus on alternative activities for stress relief, and seek financial guidance to achieve long-term financial goals.

The Director of Research at the Institute of Economic Affairs (IEA), Dr John Kwakye, questions why the government is approving loans despite the country's struggling economy and high levels of debt.

The number of Chinese workers in Africa has sharply declined due to a reduction in funding for infrastructure projects and the impact of the coronavirus pandemic, with the official figure dropping by 64% from 2015 to 2021; however, the real total may be slightly higher as informal migrants were not included in the count, according to an International Monetary Fund (IMF) working paper.

China's consumer inflation rose by 0.7% in February, the first positive increase in six months, largely supported by the spending boom during the Lunar New Year holiday, but analysts believe it is too early to conclude that deflation in China is over as domestic demand is still weak.

Ace satirist Kwaku Sintim-Misa, also known as KSM, states that former President John Mahama's plan for a 24-hour economy in Ghana can only be successful if the economy is stabilized and in a good state.

India has signed a trade agreement with Iceland, Liechtenstein, Norway, and Switzerland, which includes a commitment of $100 billion in investments and the creation of one million jobs in India over the next 15 years.

Various economies, including neighboring countries and Gulf nations, have expressed interest in trading with India using the Indian Rupee, a shift that can reduce transaction costs and promote direct transactions between local currencies, according to Commerce and Industry Minister Piyush Goyal.

Concerns are rising about inflation and interest rates as economists warn that achieving inflation goals may lead to an increase in price increases, driven by factors such as tax cuts, shipping costs, and global supply chain constraints. Financial markets are experiencing volatility as investors take profits and question assumptions about lower interest rates.

The UK Treasury has benefited from the country's transition to a cash-free society, with the removal of cash resulting in a boost of £12 billion in Value Added Tax (VAT) as smaller organizations and businesses find it harder to avoid paying taxes. The shift away from cash was accelerated by the COVID-19 pandemic, leading to increased card usage and reduced tax evasion. However, concerns have been raised about the impact on individuals who prefer using cash for budgeting and the need to ensure access to cash is preserved for vulnerable groups.

Singapore's first-quarter growth forecast has been upgraded to a projected 2.9% expansion, with economists attributing some of the gains to Taylor Swift's concerts in the country, which are estimated to contribute up to S$400 million (US$225 million) to the economy.

China's leaders acknowledge the challenges facing their economy, including an ailing housing market and weak domestic demand, but have provided few details on their plan to address these issues, while simultaneously increasing the government's powers and tightening secrecy around policymaking.

China's consumer inflation rate turned positive for the first time in six months, boosted by a spending boom during the Lunar New Year holiday, but analysts believe deflation in China is not yet over due to weak domestic demand.

Japan's gross domestic product (GDP) grew 0.4% in Q4 2021, narrowly avoiding recession, leading to expectations of an end to negative interest rates by the Bank of Japan.

U.S. Commerce Secretary Gina Raimondo is leading a trade mission to the Philippines and Thailand to promote economic ties and investment in the Indo-Pacific region, emphasizing the United States as an economic partner of choice without forcing countries to choose between China and the U.S.

Consumer goods manufacturers are reducing product quantities and increasing prices in response to shrinking consumer purchasing power and rising costs of living, leading to smaller packs and higher prices for essential goods.

The Bank of Japan is likely to end its negative interest rate policy in the near future, signaling the conclusion of a global experiment with unconventional monetary policies.

Pakistan will engage with the International Monetary Fund (IMF) to seek assistance in boosting its economy and addressing its debt burden, with talks focusing on the release of a final tranche of a $3 billion loan package and a new three-year arrangement worth $6 billion. The country's debt-to-GDP ratio is over 70%, with domestic debt accounting for 60% of the total debt and China holding a significant portion of Pakistan's debt.