Japan's economy grew at an annualized rate of 0.4% in the fourth quarter of 2018, avoiding a technical recession, due to stronger-than-expected company spending on plants and equipment.

Younger generations, particularly Gen Z and Millennials, are resorting to "buy now pay later" spending habits due to the high costs of essential goods caused by the Biden Administration's economy, leading to concerns about their ability to afford children and raising questions about dark money politics.

Rising concerns about China's economic troubles and the lack of effective policy response are causing worry among global investors that this could have a ripple effect on other major economies.

The Central Bank of Nigeria does not have the liquidity to support the naira, and may need to resort to foreign borrowing to fulfill its foreign exchange obligations, according to the Economist Intelligence Unit.

Hong Kong property tycoon, David Chiu Tat-cheong, criticizes the notion that "Hong Kong is over" and argues that every market has its cycles, while also predicting a potential surge of 30% in housing transactions in the coming year and urging the government to attract overseas talent to maintain the city's international character.

Labour plans to set targets for funding female-led businesses through the state-owned British Business Bank and to launch a review of financial exclusion of women, as part of its financial inclusion agenda.

Oil prices held a loss as investors await US inflation data and reports from OPEC and the IEA to gauge the demand outlook, with concerns lingering around rising supply and economic uncertainties.

Food inflation at supermarkets since the COVID-19 pandemic has led to a 24.7% increase in the cost of groceries, outpacing overall inflation; President Biden has announced a "strike force" to address high prices and companies accused of "ripping people off."

Economists and President Joe Biden have drawn attention to the trend of "shrinkflation," which involves consumers paying the same price for a product but receiving less of it, leading to calls for legislation to classify downsizing as an unfair or deceptive practice. Many shoppers are unhappy with this strategy and feel it is deceptive and dishonest.

The trade deal between India and Australia and the UAE is seen as a sign of openness by Swiss businesses, indicating confidence in India's growth prospects, according to Swiss state secretary for economic affairs, Helene Budliger Artieda. The investment commitment of $100 billion over 15 years reflects Switzerland's belief in India's economic development and offers opportunities for diverse sectors.

China is strengthening Communist Party control over its central bank, the People's Bank of China (PBOC), to prioritize serving the economy, fighting risk, and countering potential Western sanctions, as the country aims to become a "financial superpower" and reduce reliance on Western financial infrastructure.

Shrinkflation, the practice of reducing the size of products while maintaining or increasing prices, has been quantified in Australia's cereal market, with seven popular cereals found to have decreased in size while costing more, according to research from Deakin University's Institute for Health Transformation. The study also revealed that the price of all cereals that remained on shelves in 2024 had increased by around 40 percent since 2019. Critics argue that this trend takes advantage of struggling families and exacerbates the cost-of-living crisis.

The Malaysian ringgit has reached its lowest level since the Asian financial crisis, prompting officials to consider intervention to address the decline.

Democrat businessman Gary Cohn agrees with consumers' anger over inflation caused by President Biden's American Rescue Plan, stating that it has resulted in a loss of purchasing power and hindered investment opportunities.

The U.S. job market is experiencing uneven growth, with gains concentrated in certain sectors like government, healthcare, and hospitality, while other industries are slowing down or losing jobs. This has led to a disconnect between the strong overall economy and the more pessimistic experiences of workers in specific industries, causing concerns about the future of the labor market.

The British government is offering cheap power deals to battery metal refiners and electric car gigafactories in an effort to reduce the UK's reliance on China and increase domestic production of key minerals needed for renewable energy and electric vehicles. The goal is to make the UK more competitive internationally and prevent carbon leakage. The move comes as concerns grow that China could potentially disrupt global supplies during a geopolitical crisis.

Rising prices and inflation in Tonga and other Pacific Island countries are forcing residents to cut back on certain foods and find alternatives to store-bought food, as high inflation poses a significant threat to their livelihoods and the cost of living crisis persists in the region.

Former British Prime Minister Gordon Brown is calling for Britain to be put on an economic "war footing" and the creation of a National Economic Council to achieve annual growth of 3%, warning that the country's governance needs to change in order to break out of a cycle of low growth, low productivity, and low wages that has persisted for 15 years.

Argentinian President Javier Milei is implementing sweeping economic reforms, including slashing bureaucratic agencies, devaluing the currency, imposing tax hikes, and balancing the budget deficit, in an effort to save the country's struggling economy and restore market and investor confidence.

Nigeria's external reserves rose by 2.83% in February 2024 due to increased forex inflows, while the Nigerian currency, the naira, depreciated further and is predicted to fall as low as N2,000 per dollar in 2024.

Saudi Arabia's Tadawul All Share Index rose by 0.32 percent, while the parallel market Nomu slipped by 0.49 percent; Saudi Steel Pipe Co. was the best performer of the day, and Saudi Tadawul Group Holding Co. announced a decrease in net profit for 2023.

The Israeli Ministry of Health has proposed a draft import reform bill aimed at reducing the cost of living by simplifying imports of food from the European Union and adopting EU food safety regulations. The bill expands the adoption of EU regulations in various areas of food safety and is expected to be completed by April 2024.

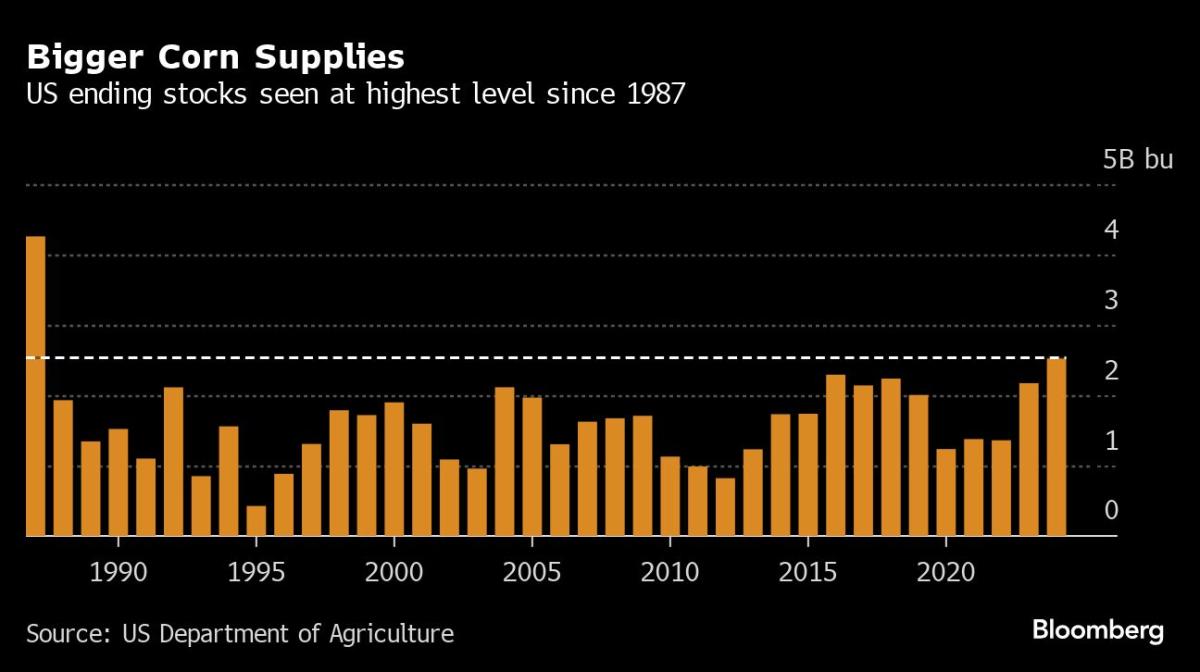

Oppenheimer, the biographical film about the inventor of the atomic bomb, is the clear favorite for Best Picture at the Academy Awards, while the US Federal Reserve is waiting for more evidence of inflation before lowering interest rates, and American farmers are set for a major supply expansion.

Despite initial concerns, Russia's economy appears to be rebounding as inflation slows down and prices stabilize, providing a positive backdrop for Vladimir Putin's upcoming re-election.

India and the European Free Trade Association (EFTA) have signed a $100 billion trade agreement to promote investment and exports, with EFTA countries gaining access to India's market and India attracting foreign investment from EFTA.

US farmers plan to fight back against losing their status as the world's top exporter of crops by maximizing production in order to regain ground in the export market.

The Federal Reserve is likely to hold interest rates steady in March while closely monitoring inflation data and signaling a potential cut in June if conditions support it.

The town of Joshimath in Uttarakhand, India, is experiencing a significant decline in business and tourism due to land subsidence, with reduced sales and a decrease in tourist footfall impacting the local economy and livelihoods.

Investors are concerned that the monthly consumer price index (CPI) report, set to be released on Tuesday, could show stubbornly high inflation and potentially undo the gains made by the S&P 500 Index, which has been on a strong run since 1964, due to improving earnings outlooks and a resilient US economy.

The Federal Reserve is facing pressure from liberals who want a higher inflation target and the addition of a labor market target, posing challenges for Fed Chair Jerome Powell.

Shrinkflation, the practice of reducing the size or quantity of products while maintaining their prices, has become prevalent during the pandemic, affecting items such as food, cleaning supplies, and candy, leading President Biden and lawmakers to address this issue and introduce a bill to combat the deceptive practice.

The Federal Reserve may keep interest rates higher for longer if the rising costs of services, such as healthcare and insurance, continue to contribute to inflation, despite improvements in other areas.

Saudi Arabia's real estate market is expected to experience growth as high-net-worth Muslim individuals plan to invest $2 billion in properties in Makkah and Madinah, with a strong demand for branded residential units in the two holy cities. The introduction of new premium residency visa options linked to real estate ownership aims to attract international investments, aligning with the country's Vision 2030 blueprint. However, the full impact of these changes may be gradual due to the property value requirements and visa renewal fees.

The February consumer price index is projected to show another monthly increase in prices, keeping annual inflation elevated and the Federal Reserve cautious about cutting interest rates, while retail sales are expected to rebound after a weak January showing, and consumers' perceptions about the economy and inflation are likely to stay steady or decline amid rising gasoline prices and a volatile stock market.

The London-based Economist Intelligence Unit (EIU) has forecasted five risks Nigeria might face in 2024, including further economic and social uncertainty, a devaluation of the naira to N2,000 per dollar, the possibility of unrest due to rapid market reforms, the spread of Boko Haram activities, and a reduction in domestic demand leading to a slowdown in economic growth.

India and the European Free Trade Association (EFTA) have signed an economic pact worth over $100 billion, with India lifting most import tariffs on industrial products from the EFTA in exchange for investment over 15 years.

Turkish farmers are facing adverse economic conditions and dissatisfaction with state subsidies, as rising costs and insufficient support from the state put them into deepening debt.

The Philippines has netted $14.2 billion in foreign direct investment (FDI) projects since July 2022, signaling progress toward economic recovery from the COVID-19 pandemic, according to House Speaker Ferdinand Martin Romualdez. The FDI projects are in various industries such as manufacturing, information technology, renewable energy, infrastructure, and agriculture. Some of the projects are already in different stages of construction, while others have completed registration with the Department of Trade and Industry. President Ferdinand "Bongbong" Marcos Jr.'s overseas trips are said to be yielding positive results in attracting foreign investments.

The British pound is outperforming most global currencies this year due to positive indicators of the UK's economy, leading to the expectation of higher interest rates for a longer period of time than other major economies.

Market queens from Kumasi in the Ashanti Region express concern over the high cost of doing business due to the depreciation of the Ghana cedi, discussing their issues with former First Lady Lordina Mahama and seeking her support.

The International Monetary Fund (IMF) has overlooked Pakistan's managed exchange rate, providing an opportunity for policymakers to stabilize the economy despite the poor performance and low foreign exchange reserves, although Pakistan still requires support to avoid default.

Pakistan's trade deficit with regional countries increased slightly by 0.5%, reaching $4.539 billion in the first seven months of the current fiscal year, primarily due to higher imports from China and India. Export to China saw a significant increase, while exports to other regional countries remained negative.

Fitch has upgraded Turkey's rating to "B+" from "B" due to tighter monetary policy measures taken to combat inflation, reflecting increased confidence in the effectiveness of these policies.

The US economy's performance has exceeded expectations, surprising high-profile investors and billionaires who had previously predicted a recession, with strong job reports and lower inflation, although some economists still warn of a potential downturn.

The President of the African Development Bank, Akinwumi Adesina, believes that the Nigerian economy cannot cope with the current exchange rate of over N1,500/dollar and calls for the expansion of foreign exchange inflows and a focus on long-term structural changes to enhance export-oriented manufacturing. He also emphasizes the importance of stable power supply, the need for an adaptive approach to policies, and the inclusion of women in the economy. Additionally, Adesina addresses the foreign exchange crisis and suggests expanding access to forex, providing concessional financing, and tackling inflation and structural challenges to boost food production and agricultural prosperity. Adesina's unique haircut and dress sense are rooted in his sense of duty, nationalism, and identity as a Nigerian.

The proposed 3 percent hotel tax in Hong Kong has sparked concerns from the hospitality sector, but tourists seem unfazed as they believe it will have minimal impact on their overall spending.

The article discusses how the Ambani family, with the support of the Indian government and the Adani group, has obtained special privileges, such as international airport status and amendments to wildlife conservation laws, for their private events and ventures, highlighting the concern over the growing influence of powerful industrialists in India.

Mainland China's efforts to attract Taiwanese investors are only effective for firms with existing relationships, despite offerings such as tax breaks and land discounts, due to concerns about cross-strait tensions and the challenges of investing in China's slowing economy.

The job market in the American economy continues to outperform expectations, with 275,000 jobs created in February, surpassing the projected consensus of 200,000 jobs and marking the 38th consecutive month of job growth. While some focus on minor weaknesses, the overall performance remains strong and reminiscent of Joe DiMaggio's impressive hitting streak in baseball.

America's national debt is increasing at an alarming rate of $1 trillion every 100 days, reaching a total outstanding public debt of $34.46 trillion, which could pose a threat to the stability of the next US administration and potentially lead to a crisis by 2025, warns Wharton professor Joao Gomes.