Investors with excess liquidity are taking on more credit risk in order to secure high yields before the Federal Reserve reduces interest rates, leading to a surge of cash flowing into junk bonds and the highest weekly inflow into high-grade funds since September 2020.

Saudi Arabia's real estate market is expected to experience a boost as wealthy Muslim individuals plan to invest $2 billion in properties in Makkah and Madinah, according to a survey by Knight Frank. The holy cities are highly sought after among high-net-worth individuals, and the introduction of new premium residency visa options linked to real estate ownership aims to attract international investment. However, the full impact of these changes may be gradual due to the high property values and visa renewal fees.

India's import and consumption of urea, a key crop nutrient, has declined due to higher domestic production of nano urea and the adoption of eco-friendly alternatives by farmers.

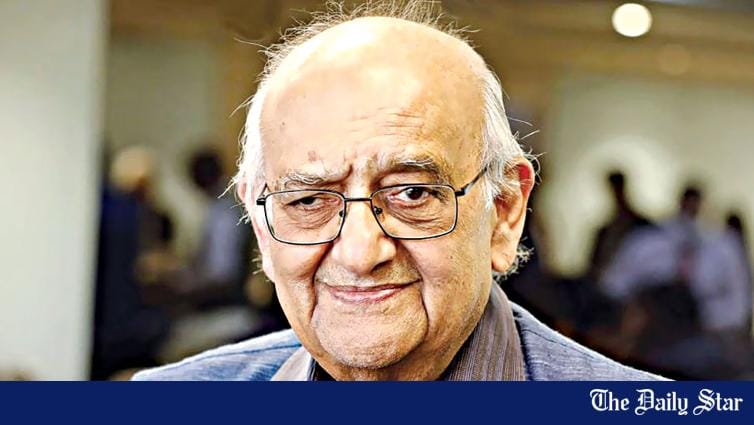

Eminent economist Prof Rehman Sobhan predicts that Bangladesh will become a more unequal society in the next 10 years, despite improvements in the economy, due to the concentration of economic and political power.

The US economy's reliance on off-balance-sheet accounting and inflated stock market valuations, along with its looming insurance and banking crisis, could pose significant risks, contrary to the admiration it receives for its quick growth, according to an analysis.

Despite agreements to reduce cement prices to between N7,000 and N8,000 per bag, Nigerians are still unhappy as retailers in Lagos and Ogun States continue to sell at higher prices, affecting homebuilding and real estate businesses, while some northern states have experienced a reduction in prices.

A recent survey shows that most Americans struggle to afford a $1,000 emergency, and where you live can have a significant impact on your budget; living in cities such as New York City and San Francisco requires a high post-tax salary to live comfortably, while more affordable options are found in cities like Houston and El Paso, Texas.

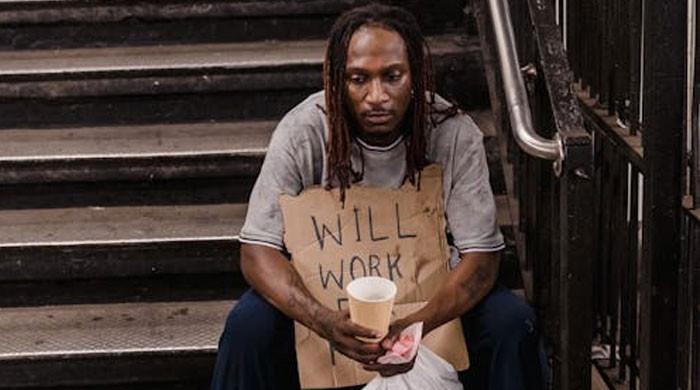

The text argues that governments have been using monetary interventions to remedy economic crises, but the consequences of these actions have had a profound impact on people's attitudes towards work, resulting in a growing number of individuals choosing unemployment and claiming disability benefits, making it necessary for governments to reduce taxation and dismantle the benefit system to address the unsustainable situation.

China has announced a series of economic reforms aimed at achieving around 5% growth this year, despite challenges such as unreliable financial data, rising youth unemployment, and a slowdown in the property market. The government plans to boost employment, prevent risks, and transform the growth model through structural adjustments and improvements in quality and performance. However, analysts are skeptical about China's ability to achieve these goals and overtake the US economy in the near future.

The U.S. Bureau of Labor Statistics is expected to release data showing that inflation rates will remain high, leading investors to anticipate interest rate cuts and driving the stock market rally.

Cement prices have dropped in some states in Nigeria, particularly in the North, following government intervention to reduce construction material costs, with brands such as Dangote, Lafarge, and BUA selling at lower prices in Abuja, Nasarawa, and Niger states.

An unexpected rise in the US unemployment rate has raised concerns of a surprise recession according to economist David Rosenberg, who believes that once the rate rises significantly from its lows, a recession that no one sees coming is likely to occur.

China needs to increase the income and social standing of skilled workers in order to address the shortage of highly-skilled talent and promote technological innovation and industrial development.

China plans to tackle unemployment and boost its industrial value chain by providing more support for private firms, training people for the hi-tech sector, and increasing loans and tax breaks for businesses looking to recruit, according to Human Resources and Social Security Minister Wang Xiaoping.

Peter Schiff disagrees with Maxine Waters' claim that housing is the main driver of inflation, arguing that deficit spending and money printing are the true causes, although he acknowledges government housing policy plays a role; the debate comes as inflation increases and the housing market faces significant challenges.

Millennials and Gen Zers in the US are facing a credit card crisis as their debt levels continue to rise, with the average credit card balance for millennials increasing by 62% since 2022 and Gen Zers experiencing a 50% growth, according to data from Intuit Credit Karma, potentially hindering their ability to access other loans and build wealth in the future. Furthermore, credit scores are falling for these younger age groups, with over one in three millennials and Gen Z Americans having a subprime credit score, and concerns are growing that these trends could continue if interest rates remain high and inflation persists.

The US unemployment rate has risen to 3.9%, its highest in two years, despite the addition of 275,000 jobs, indicating mixed signals on the economy's performance, but little cause for concern, according to analysts.

Germany is facing a labor shortage, prompting some companies to test a four-day work week as a strategy to attract workers, improve productivity, and address work-life balance; however, previous trials have shown mixed results, and the German experiment aims to provide a clearer understanding of the benefits and drawbacks of a shorter work week.

China's human resources minister stated that the country still faces employment challenges and job pressure has not eased, as it prepares for a record number of college graduates in 2024. However, the job market has seen a positive start this year, particularly in artificial intelligence and big data, and the government will strengthen policies to support youth employment and small private firms. China aims to create over 12 million new urban jobs this year and maintain an urban unemployment rate of around 5.5%.

The text discusses several issues impacting the US economy, including the financial troubles in California, the ongoing war between Russia and Ukraine, the costly climate agenda, the failure of ESG investing, and the current investment backdrop in the energy sector. These issues have the potential to have a dire effect on the US economy if they are not addressed.

China's consumer price index (CPI) increased by 0.7 percent year on year in February, reversing the decline in January, while the core CPI, excluding food and energy prices, rose by 1.2 percent, the highest increase since February 2022, according to data released by the National Bureau of Statistics (NBS). Additionally, the country's producer price index (PPI) saw a 2.7 percent reduction on an annual basis.

Gary Stevenson, a former high-paid trader for Citibank, reflects on his disillusionment with the world of high finance, discussing his success, the inequality it perpetuates, and his battle with depression, all outlined in his new book "The Trading Game: A Confession."

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/DKLU33MY3BA7ZPQ7OJ43EESFII.jpg)

China's Guizhou province, known for its heavy debt and extravagant infrastructure projects, is facing a reckoning as the government attempts to reduce its burden and resolve financial controversies, although investment in sectors such as agriculture and services have helped drive economic development.

The Bank of Japan is reportedly considering ending its yield curve control program and instead indicating in advance the amount of government bonds it plans to purchase, as part of its efforts to normalize monetary policy.

Despite evidence of a robust labor market and improvements in people's feelings about the economy, polls indicate that many Americans still do not perceive the economy as strong or beneficial to themselves and their families.

Parliament has approved a $300 million loan agreement between the government of Ghana and the International Development Association to support the financing of the 2024 budget, despite opposition from the minority arguing that it will worsen the country's already precarious debt situation.

The prices of vegetables and fruits have surged in the days leading up to Ramazan, causing inflation and a lack of effective price monitoring, exacerbating the financial burden on consumers.

The remittances sent by overseas Pakistanis increased year-on-year in February, but overall inflows for the first eight months of the fiscal year fell by 1.2 percent, with Saudi Arabia being the highest source of remittances. The rupee appreciated against the US dollar, but the currency market was uncertain about the reasons behind it, and the country's sovereign dollar bonds rallied to a two-year high following positive comments from the IMF.

The latest jobs report shows that while the unemployment rate ticked up to 3.9%, the labor market is not as tight as it once was, which is why the Federal Reserve is expected to implement three rate cuts this year.

China's vow to improve acceptance of cash and overseas bank cards is a positive step to attract visitors and investments, but concerns regarding the economy and security still need to be addressed.

Vietnam's pursuit of inclusion in emerging market indexes is hindered by the requirement for upfront funding by equity investors, posing a challenge to its goal of achieving inclusion by 2025.

Despite a resilient labor market and positive economic indicators, many Americans feel that the economy is not strong and do not believe it is benefiting them or their families due to factors such as rising prices, particularly in housing and food, student loan debt, and a polarized partisan environment.

Canadian farm net cash income is predicted to reach a new record in 2023, with a 13% increase in the difference between cash receipts and operating expenses, providing optimism for agricultural investment; however, headwinds such as higher carbon tax and energy prices are expected in 2024.

A new report from WalletHub reveals that credit card debt in the US has reached a record high of $1.3 trillion, with the average American household owing $10,848; however, adjusted for inflation, it is still below the peak during the Great Recession in 2008, although WalletHub predicts that it may soon surpass that level.

The average credit score in the US fell from 718 to 717 last year, marking the first decrease since 2013, as Americans accumulated more debt during the pandemic.

San Francisco's unemployment rate has reached its highest level since October 2021, with a loss of 15,700 jobs in January, primarily in the professional, scientific, and technical services sector, as well as the tourism and retail industries. Tech companies such as Google, Salesforce, eBay, Cisco, and Grammarly have all recently implemented layoffs in the city.

The UK ranks second as the most miserable country in the world, with mental wellbeing being classified as 'distressed or struggling', according to the Mental Health Quotient assessment, due to factors such as high house prices and the cost of living crisis.

Former Treasury Secretary Lawrence Summers believes that the Federal Reserve's estimate of a neutral interest rate is too low and that there is a growing possibility that policymakers will not lower rates this year. Summers argues that the neutral rate is higher than the 2.5% the Fed claims, urging caution in shifting towards rate cuts.

Despite President Biden's claims of an economic rebound, Americans are still experiencing rising inflation, with everyday goods like groceries and housing becoming increasingly expensive.

Minister of Finance and Coordinating Minister for the Economy, Olawale Edun, assures Nigerians that the economy will continue to soar higher under President Bola Tinubu, prioritizing what is best for the country and the well-being of its citizens.

The housing market in the US is facing a shortage of millions of housing units, and Federal Reserve Chair Jerome Powell believes that it will take more than just monetary policy to fix the problem. The shortage is caused by a variety of factors, including low mortgage rates that make it difficult for homeowners to refinance and move, restrictive zoning laws, and high construction costs. Despite expectations of rate cuts, the housing market's deep-set supply problems will not be solved in the short term.

During his State of the Union address, President Joe Biden raised concerns about shrinkflation, where companies reduce the size of products while keeping the prices the same, and highlighted instances such as fewer chips in a bag as an example. Shrinkflation mainly affects household paper products and snacks, but overall, it impacts a small portion of products. The White House has launched a "strike force" on pricing to address these issues.

Tony Elumelu, chairman of Transcorp, has called on the Nigerian government to restructure the electricity industry, sell transmission lines, and attract investors to develop the nation's gas reserves to improve the country's energy supply and boost its economy.

Fox News offers live TV shows and video content, including Fox Business Channel, Fox News Channel, and Fox News Radio.

The Dow Jones ended lower after investors analyzed the February jobs report and other news.

President Joe Biden is raising awareness about "shrinkflation," where companies subtly reduce product sizes to raise prices, in an effort to shift blame for high prices onto big business and show his support for everyday people.

The UK has been ranked as the second most miserable country in the world for mental wellbeing, with levels still not recovered from pre-pandemic levels and 35% of respondents reporting struggling with their wellbeing, according to a new report by US-based think tank Sapien Labs. Factors contributing to the low mental wellbeing include the impact of Covid-19, the cost-of-living crisis, economic recessions, rising rent and house prices, lack of trust in political leaders, and high consumption of extra-processed foods. Young adults and poorer families have been particularly affected.

President Biden's State of the Union address included proposals for tax credits to aid first-time homebuyers, but experts believe that these proposals are unlikely to become law due to the political landscape and the country's existing housing shortage.

Former Trump economic adviser Stephen Moore declares that the United States has the strongest economy in the world, following President Biden's State of the Union address and a strong February jobs report.

The article provides a list of the 20 countries that spend the most on research and development (R&D) based on their absolute R&D spending, with Finland, Norway, and Poland ranking among the highest spenders.