Argentina's monthly inflation rate is projected to decline to 15.3% in February, reflecting a significant decrease from previous months due to President Milei's austerity measures and efforts to reduce grocery prices, although the country still faces substantial inflation challenges.

The U.S. added 275,000 positions in the jobs report for February, but wage growth slowed and unemployment rose.

U.S. employers added 275,000 jobs in February, surpassing economists' expectations, but rising wages and strong job growth may delay the Federal Reserve's plans for rate cuts.

The Special Adviser to the President on Energy stated that the Federal Government reserves the right to pay fuel subsidy intermittently to alleviate hardship in the country, but did not confirm whether the subsidy has fully returned.

The U.S. added 275,000 jobs in February, but wage growth slowed and unemployment rose.

Israel plans to bring in 70,000 workers from abroad, including 10,000 from India, to address a labour shortage in its construction sector, while India is grappling with a jobs crisis at home despite economic growth, highlighting the need for faster and labour-intensive economic growth and a manufacturing strategy akin to China's to create non-farm jobs.

The February jobs report shows that the US added 275,000 jobs, surpassing expectations, while the unemployment rate rose to 3.9%.

President Joe Biden has proposed tax credits and other initiatives to improve housing affordability and increase the number of homes available, in response to the ongoing housing affordability crisis in the US, although critics argue that the plan does not sufficiently address the lack of available homes as a key factor behind the crisis.

Canada's labor market added 40,700 jobs in February, surpassing economists' expectations, but the unemployment rate rose to 5.8% due to population growth outpacing employment growth.

Federal Reserve Bank of New York President John Williams suggests that the "neutral" state of interest rates has not increased significantly after the coronavirus pandemic, implying that interest rates still have a limited effect on the economy.

Credit investors are showing optimism and taking on more risk, despite uncertainty in the markets and warnings from industry leaders, signaling a return to the "easy money era" as cash flows in and the US Federal Reserve provides a soft economic landing.

Nigerian business tycoon Tony Elumelu supports the recent decisions made by the Central Bank of Nigeria (CBN) and expresses optimism about the country's economy, stating that Nigeria is on the right track. Elumelu believes that the recent policies, including the increase in the Monetary Policy Rate and Cash Reserve Ratio, will produce desired outcomes in the medium to long term. He also emphasizes the importance of staying focused and consistent in order to achieve success.

US job growth in February is expected to be more moderate compared to January, leading economists to question whether January's strong numbers were a trend or an anomaly, with uncertainty surrounding the direction of the labor market; the Federal Reserve is closely monitoring employment data as it considers when and how much to cut interest rates.

Despite government officials claiming that inflation is decreasing, Americans are still facing high prices at the grocery store, with grocery bills being the top concern for voters due to a surge in prices for items like eggs and milk over the past three years.

The disconnect between American consumer sentiment and the economy can be explained by the way inflation is measured, specifically in regard to interest rates, which the traditional measure fails to capture.

Corporate bankruptcies in Russia have surged in the first two months of 2024, indicating financial difficulties on the ground despite official GDP growth and a resilient wartime economy. The rise in bankruptcies is attributed to high interest rates and macroeconomic instabilities, with companies struggling to refinance and navigate through international trade issues and tightening Western trade restrictions. The upcoming presidential election could further pressure private companies if proposed changes to the tax system result in additional taxes for businesses.

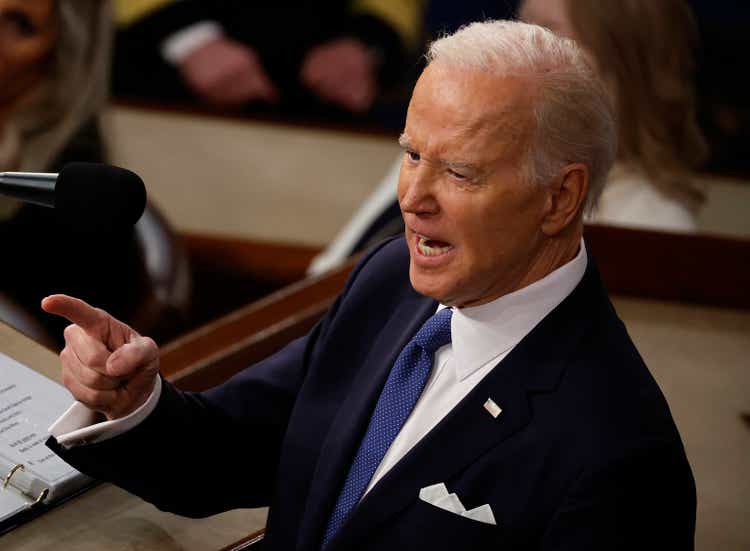

President Joe Biden delivered his third State of the Union address, highlighting his economic achievements, proposing tax policies for a second term, and announcing new measures including tax credits for first-time homebuyers and capping the cost of insulin.

China plans to increase its spending on science and technology by 10% in 2024, allocating 371 billion yuan ($52 billion) to support research and development, signaling the government's commitment to prioritize innovation despite economic challenges and international competition.

China's predicted overtaking of the US in GDP is now uncertain, South Korea laments its lost edge to China in key tech, and a Hong Kong marketing executive involved in a scandal is sentenced to community service.

Georgia's unemployment rate dipped to 3.1% in January 2024, the lowest it has been in over a year, with the number of people in the labor force growing slightly, signaling economic growth in the state.

President Joe Biden used his State of the Union address to highlight his economic achievements, including the creation of 15 million new jobs and a decline in unemployment rates, as he faces a tight race against former President Donald Trump in the upcoming election.

President Joe Biden highlighted positive economic developments, such as falling inflation and low unemployment, in his State of the Union address, but he omitted some important context regarding the country's economy. While inflation has decreased under Biden, it is partially attributed to the Federal Reserve's efforts and may be influenced by factors like pandemic-related spending. Additionally, while job growth and low unemployment are noteworthy, there are still job deficits from pre-pandemic levels, and the employment-to-population ratio has not fully recovered.

Pakistan's trade deficit with the Middle East reduced by 41.31% to $5.674 billion in the first seven months of the current fiscal year, primarily due to lower imports of petroleum products, while exports to the region increased by 36.18%.

China's oil demand has entered a low-growth phase as decarbonization leads to a decrease in fossil fuel consumption, but overall demand for crude will continue to grow due to the expanding petrochemical sector, according to China National Petroleum Corp's Economics & Technology Research Institute.

The surge in remote work during the pandemic has led to a polarization in where bosses and frontline workers live, with expensive cities becoming more management-heavy and more affordable cities specializing in individual contributor and frontline work. Factors such as home values and the prevalence of cross-metro work contribute to this shift, which has implications for housing costs, the return-to-office debate, and the competitiveness of firms in different locations. Ultimately, only high-paid managers may be able to afford to live in expensive cities as this trend continues.

The U.S. job market is experiencing a slowdown with fewer workers leaving their jobs and a significant drop in hiring, leading some economists to refer to it as "The Great Stay," while other worrying trends, such as decreased hours worked and increased layoffs, pose challenges to the labor market's strength.

Investors seeking diversification should consider looking beyond US equities and allocating funds to countries like Japan and India that are shifting away from China and implementing shareholder-friendly actions such as buybacks, according to WisdomTree Global CIO Jeremy Schwartz and Crossmark Global Investments CEO and CIO Bob Doll, who also highlight gold's recent surge and the potential opportunities in the unloved category of mining stocks.

A recent opinion poll found that a majority of Britons do not trust the Tories or Labour to handle the economy, with many also expressing doubt in their ability to lower taxes after the next General Election. However, Labour is currently leading in support, suggesting a potential landslide victory for the party.

Gen Z-ers are experiencing financial hardship to the point where they cannot afford food, with 44% of respondents admitting to skipping meals in order to pay their bills, which is significantly higher than other age groups, according to a survey by Assurance IQ, highlighting the challenges faced by Gen Z due to their lack of accumulated wealth and high levels of debt.

California's labor market is facing growing concerns as the state experiences an increase in jobless claims and unemployment rates, standing out as one of the only two states with an increasing unemployment rate over the past year, signaling a weakening labor market compared to the rest of the country. The surge in layoffs is impacting various sectors, including technology, retail, and healthcare, indicating a broader shift in the state's employment landscape, although analysts believe it does not signal a recession.

U.S. Senator John Fetterman brings realism to the inflation debate by questioning the significance of an "$18 dollar cookie" amidst overall declining food prices and highlights the challenges faced by lower-income households due to rising prices of basics like housing, food, and gas.

Egypt has secured an expanded loan deal with the IMF, now totaling $8 billion, to support economic stability and reform, alongside additional funding for environmental sustainability; the collaboration reflects Egypt's commitment to fiscal management and sustainable growth.

Mortgage rates slightly eased, leading to an increase in mortgage applications and signaling strong buyer interest in the housing market. However, buyers hoping for further rate drops may have to wait longer.

Consumer credit in the US grew by $19.49B in January, surpassing expectations, with total outstanding consumer borrowing reaching $5.04T.

Mortgage rates drop to the 6% range, giving hope to homebuyers as inflation data weakens, leading to an increase in mortgage applications and a rise in home listings, providing more affordable options for buyers.

In January, wage growth in Minnesota outpaced inflation as employers offer incentives to retain workers in a tight labor market, resulting in a 5% increase in average hourly wages while inflation rose 3.1%.

The February jobs report is highly anticipated by investors who are looking for clues about the health of the labor market amid higher interest rates and inflation concerns; economists project an increase of 200,000 jobs and an unchanged unemployment rate of 3.7%.

Consumer credit scores in the US have experienced a slight drop for the first time in a decade, indicating potential financial stress among some Americans caused by high interest rates, inflation, missed payments, and rising debt levels, although experts say it is not cause for alarm.

Federal Reserve Chairman Jerome Powell expressed optimism about the U.S. economy, highlighting strong growth, low inflation, and positive economic indicators during his testimony on Capitol Hill.

Summerfest, an annual music festival in Milwaukee, experienced a decline in overall economic impact compared to a decade ago due to operating two fewer days a year, but saw an increase in economic impact per day; the festival generated $160.3 million for the city and supported 3,400 jobs in 2023, according to a study conducted by Tourism Economics.

Mortgage rates have slightly decreased, prompting a rise in mortgage applications for homebuyers, although rates still remain a significant obstacle in an already unaffordable housing market.

Small businesses in the US continue to recover from the pandemic, but face challenges due to higher interest rates and difficulty finding workers, according to a report by the 12 regional Federal Reserve banks.

Billionaire CEO Barry Sternlicht suggests that Federal Reserve chairman Jerome Powell should tell Congress to stop spending money excessively in order to combat inflation, as the Fed's interest rate hikes alone are ineffective.

Many Americans lack basic financial knowledge, leading to money challenges, but it is not necessarily because they never learned anything; this video explores the state of financial education in the US.

Nigeria is exploring the possibility of joining the BRICS alliance in 2024, which would further strengthen its economic ties with Russia and contribute to the bloc's second expansion effort.

Nearly half of the Americans surveyed are struggling to afford their heating bills, leading some to resort to having sex or getting drunk to stay warm, according to a report from NewHomesMate.

Mortgage rates have slightly fallen this week, leading to an increase in purchase applications in a housing market that has been stagnant due to high home prices and elevated rates.

The average long-term U.S. mortgage rate decreased, offering potential homebuyers some relief during the spring buying season.

Federal Reserve Bank of Cleveland President Loretta Mester believes that the central bank will be able to lower interest rates this year, but she does not see an immediate urgency to do so and wants sufficient evidence that inflation is on a sustainable and timely path back to 2%.

The number of Americans filing new claims for unemployment benefits remained unchanged last week, indicating a gradual easing of the labor market and potentially delaying interest rate cuts by the Federal Reserve.