Union Finance Minister Nirmala Sitharaman criticized the Congress party and highlighted the low inflation rate during the last year of the Atal Bihari Vajpayee government, while also mentioning the UPA government's neglect of the Northeast region. She revealed that a 'White Paper' on the economy is being released now to maintain confidence in institutions and investors. Moreover, Sitharaman pointed out a decline in unemployment rate for graduates from 17.3% in 2017 to 13.4% in 2023.

The European Central Bank will likely start cutting interest rates soon due to the advanced stage of disinflation and progress towards the 2% inflation target, according to ECB Governing Council member Fabio Panetta.

India aims to achieve $300 billion in electronics production, including $100 billion in exports, in the coming years, with the government confident in meeting these targets due to the rapid development of the manufacturing ecosystem and increased investments in the component ecosystem, such as the PLI scheme for IT hardware and server, leading to a significant increase in exports and positioning the country to compete globally.

The NITI Aayog plans to transform cities like Mumbai, Surat, Varanasi, and Vizag in order to help India become a developed economy by 2047, as part of their goal of achieving a $30 trillion economy.

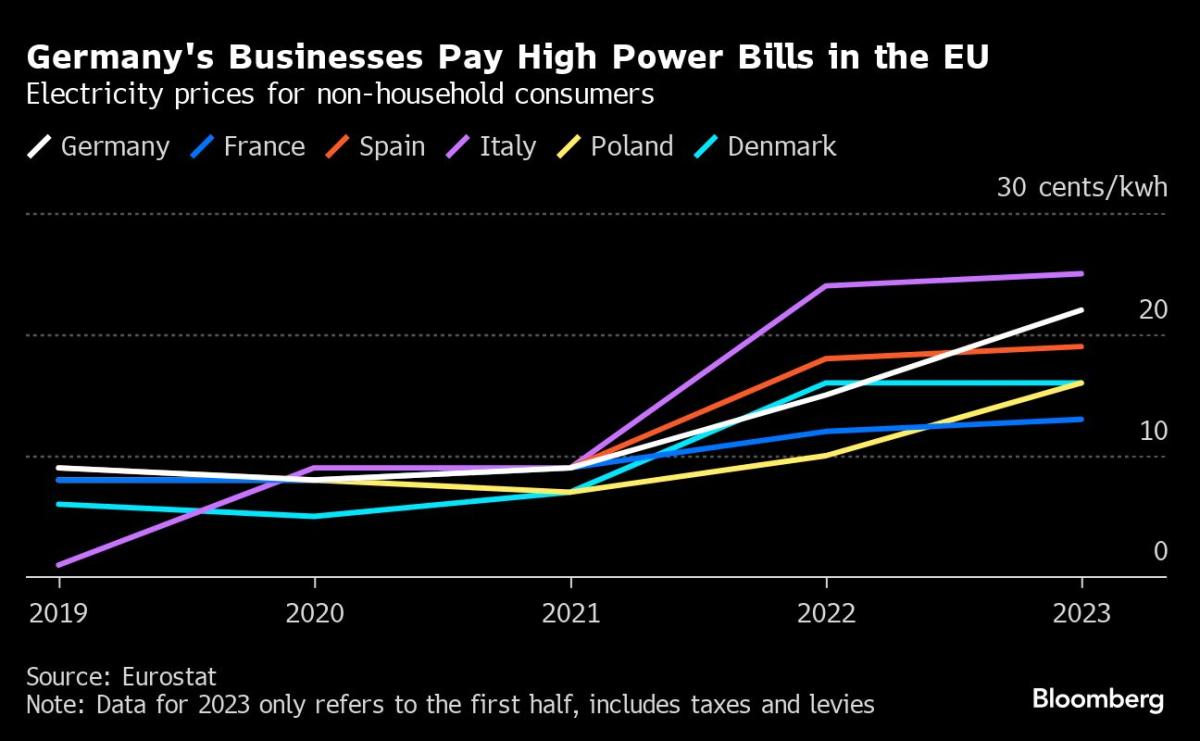

Germany's days as an industrial superpower may be coming to an end as manufacturing output declines and competitiveness erodes, with factors such as the US's shift away from Europe, China's rise as a rival, a decrease in demand for German goods, and domestic issues such as aging infrastructure and a lack of investment in public services contributing to the decline.

The NITI Aayog has prepared an economic transformation plan for Mumbai, Surat, Varanasi, and Vizag to help India become a developed economy by 2047, with a vision document being prepared for a GDP of USD 30 trillion by 2047.

Nigeria's foreign-exchange market has attracted over $1 billion in the past two weeks, indicating a return to confidence in the country's economy, following the central bank's efforts to stabilize the naira.

China's crashing stock market has led to a massive decline in foreign investors, who are unlikely to return due to the volatile nature of the market and concerns over the country's economy, leading to a focus on fast profits rather than stable growth.

Indonesian presidential candidates have been making repeated promises to raise the country's growth rate to 7%, a pledge that has been made for the past two decades but has not been fulfilled so far, with the economy growing at an average rate of around 5% last year and falling short of the target. The outgoing president has achieved certain economic milestones, including a balanced current account and improved infrastructure, but there are concerns over the country's industrial policy and trade restrictions that could hinder future growth.

The main driver of inflation in Pakistan is fiscal policy, and addressing structural deficits is crucial to reducing inflation.

The Pakistani government plans to conduct special audits of state-owned entities in major economic sectors to identify barriers to entry for the private sector and promote fair competition, following the advice of the IMF. The audits will focus on power, transport, finance, and oil and gas sectors, with the goal of creating a competitive environment and encouraging private sector investment.

Pakistan's State Bank foreign exchange reserves dropped by $173 million in a week due to debt servicing payments, adding to an already uncertain economy facing significant debt servicing requirements in March.

Pakistan's exports to nine regional countries grew by 17.71% in the first half of the current fiscal year, driven by increased shipments to China.

Prime Minister Narendra Modi declared that India's progress was once hindered by incremental thinking, but his government has changed this mindset and is focused on rapid progress, as evidenced by achievements in infrastructure development and completion of projects in a timely manner, along with significant savings through direct benefit transfer (DBT) and the JAM initiative. Modi emphasized that India has gained the trust of the world and is experiencing a virtuous cycle of economic growth, fiscal discipline, rising investments, and reduced poverty, while ensuring stability and consistency in policymaking.

Consumer prices in China dropped 0.8% in January, the fastest pace since the global financial crisis, putting pressure on the Chinese government to support the weakening economy and prevent a downward spiral caused by deflation.

The S&P 500 closed above 5,000 for the first time, reaching another historic high, driven by a strong US economy, retreating inflation, robust earnings, and expectations of interest rate cuts by the Federal Reserve.

The Federal Reserve could potentially cut interest rates in May in response to distress in the commercial real estate sector, according to economist Komal Sri-Kumar, who warns of a systemic threat and urges the Fed to act sooner rather than later to avoid a crisis similar to the 2008 financial meltdown.

Former President Donald Trump plans to escalate the trade war with China through imposing tariffs of 60 percent or more on Chinese imports if he is reelected, a move that has made the business community nervous and raises concerns about the impact on the US economy and inflation.

The Congressional Budget Office expects the federal budget deficit to temporarily decrease by $188 billion this year to $1.5 trillion, but it will likely rise again in the next nine years due to factors such as tax revenues and spending, leading to a growing gap between them. The deficit is a concern for lawmakers due to the burden of servicing the debt, an aging population, and rising healthcare costs. The publicly held debt is projected to increase to the highest level ever recorded. There are ongoing disagreements between Democrats and Republicans on the causes and solutions for the national debt, adding to the uncertainty of the economic outlook.

China's consumer prices fell by 0.8% in January, their biggest drop since 2009, due to seasonal factors and weak consumer demand, but experts believe the decline may have bottomed out and prices are expected to rise from February onwards.

Pakistan's upcoming election is crucial for establishing a new government that can stabilize the country's struggling economy, which is burdened with high poverty rates, inflation, and external debt obligations, requiring negotiations with the IMF and a focus on reducing expenses and balancing the budget deficit.

Federal Reserve Chair Jerome Powell stated that the central bank is planning to cut interest rates later this year if inflation continues to decrease, but they are cautious about finding the right timing to avoid creating inflation or triggering a recession.

A social media post about giraffe conservation by the US embassy in China has become a platform for frustrated individuals to express their grievances about the country's economy amidst increasing government crackdowns on negative commentary.

Optimism about the U.S. economy rises as business conditions at service-oriented companies reach a four-month high in January, with the Institute for Supply Management's survey showing a rise in activity and expectations of interest rate cuts.

A report by the Rhodium Group warns that China's economy could face a slowdown to 3-4% growth unless structural issues are addressed, highlighting the lack of reform by Beijing while acknowledging the relative stability of the property sector; the report also mentions export controls and weak domestic demand as concerns for China's role as a manufacturing destination, and suggests that the country's long-term growth potential will be disappointing without addressing fundamental problems.

The UK's economy is experiencing significant growth, but economists predict that it will have the highest inflation figures among the G7 countries, while other nations like France and Germany are facing a slump in their services sectors.

Pockets of Americans, particularly lower- and middle-income earners, are experiencing financial stress due to inflation, high credit card balances, and rising delinquency rates, posing a risk to their future financial well-being.

The UK has a larger problem with long-term sickness and inactivity than previously estimated, with 2.8 million people not looking for work due to health issues, according to new data from the Office for National Statistics (ONS). The ONS suggests that the labour market is bigger, sicker, and tighter than previously thought, with employment higher than expected and long-term sickness accounting for over 30% of inactivity. Analysts suggest that these new estimates may affect monetary policy decisions and indicate that progress on labor market rebalancing may have stalled.

Prime Minister Modi highlights the rapid growth of India's economy under his leadership and assures that in his third term, India will become the third largest economic power.

The U.S. Federal Reserve can afford to take time before deciding to lower the benchmark interest rate due to a resilient economy and progress towards the Fed's inflation target, according to Minneapolis Federal Reserve president Neel Kashkari.

Despite positive data on jobs and wages, a significant number of voters are still pessimistic about the economy and inflation under President Biden.

China's Ministry of Industry and Information Technology has urged 14 Chinese regions to stabilize manufacturing and support companies in exploring external markets to ensure a good start to the year amidst challenges faced by the sector in the run-up to the Lunar New Year holiday.

Americans are accumulating more credit card debt due to high inflation and steep interest rates, with credit card debt expected to reach a new record of over $1.08 trillion, driven by the ongoing inflation crisis and the rising cost of everyday necessities.

Over 400,000 additional people have dropped out of the labor market in the UK, causing the jobless crisis to be worse than previously estimated, with the majority of the increase attributed to immigration and long-term sickness as the main reasons for inactivity.

Prime Minister Narendra Modi has reiterated his promise to make India the world's third-largest economy in his third term, contrasting his development agenda with the opposition's naysaying culture.

Oil prices have dropped following comments from Jerome Powell, Chairman of the Federal Reserve, who stated that the “danger of moving too soon is that the job’s not quite done” in relation to interest rates; the value of the dollar also rose to its highest level against the pound in almost two months. The stronger dollar has made commodities priced in the dollar less attractive to buyers. Brent crude fell 0.6% to $77 a barrel, whilst US West Texas Intermediate fell by 0.7% to $72 a barrel.

The OECD warns central banks to be sure that inflation has been contained before cutting interest rates, despite the recent decrease in inflation rates, and highlights potential risks to inflation from various factors such as disruptions in shipping and conflicts in the Middle East.

UK businesses are facing the second-highest level of financial distress in Europe due to surging inflation and interest rates, with diminishing profitability being a major concern, especially in the real estate, healthcare, and retail sectors. The disruption caused by the Red Sea crisis has also impacted trade and retail profitability, posing challenges for European marketers.

The Biden administration is sending a delegation of Treasury Department officials to Beijing for economic talks to address issues such as China's nonmarket economic practices, industrial overcapacity, sovereign debt burdens, and macroeconomic outlooks for both countries.

A pair of Canadian pension funds have sold two downtown Vancouver office buildings, including tenants like Amazon, for $223 million; Canada extends its ban on foreign ownership of housing by two years; Canadian Deputy Prime Minister Chrystia Freeland said the extension is a part of making housing more affordable for Canadians; The death toll in the Gaza Strip rises following Israeli airstrikes; Minneapolis Federal Reserve president Neel Kashkari suggests that the US Federal Reserve has time to study data before deciding on interest rate cuts; Russian President Vladimir Putin plans to visit Turkey soon to discuss new Black Sea grain export ideas for Ukraine; El Salvador's President Nayib Bukele claims a sweeping re-election victory; Canada's Brookfield raises $10 billion for its second global transition fund to support the transition to a net-zero economy; Danone Canada launches an innovative plant-based yogurt made with Canadian pea protein; An Israeli food tech company gains approval to sell its lab-grown milk protein in Canada; Air Canada's first female pilot reflects on the sexist hurdles she faced; The Grammy Awards grant Taylor Swift album of the year for the fourth time; Diplomatic tensions between Ecuador and Russia over military equipment threaten banana exports; The Canadian government extends the ban on foreign buying of Canadian housing until 2027.

Younger Women Poised to Inherit Unprecedented Wealth, Though Facing Challenges in Financial Planning

A potential wealth transfer of $30 trillion from baby boomers to women by the end of the decade is underway, with women of younger generations increasingly taking control of managing their household's wealth due to factors such as longer life expectancy and a focus on education.

The pace of inflation in Canada is nearing the Bank of Canada's target after hitting a four-decade high in 2022, but economists are divided on how long it will take to bring it down to the 2% goal, with some thinking that reining in the remaining inflation driven by domestic forces and concentrated in services will be challenging without slow economic growth and rising unemployment, while others believe that inflation is closer to target than central bankers admit.

The share of renewable energy sources in EU transport increased to 9.6% in 2022, but more efforts are needed to meet the target of 29% by 2030, with Sweden leading the way at 29.2% and the lowest shares recorded in Croatia, Latvia, and Greece.

The economy of Las Vegas, heavily reliant on casinos and entertainment venues, has faced economic shocks and a loss of confidence over the past two decades, despite recent improvements.

China's immigration authorities predict that cross-border travel during the Lunar New Year holiday will rebound to pre-pandemic levels, with the number of trips increasing threefold compared to last year, despite complex winter weather conditions.

A deflationary shock and major recession may be looming in 2024, indicated by collapsing market-based rents and the potential for negative core CPI due to falling shelter inflation. The drop in rents is attributed to supply and demand issues, as well as a squeeze on consumers who are relying on credit and struggling with high expenses. This deflationary trend contradicts official data on the booming economy, and it could result in aggressive Fed interest rate cuts.

Lower- and middle-income Americans, particularly renters, are struggling with rising debt and falling behind on payments, raising concerns about their financial health in the coming year, especially as they resume paying off student loans. Credit card delinquency rates and charge-off rates are at high levels, and the average interest rate on credit cards is at the highest in decades. While some Americans have benefited from high home prices and stock market gains, others are feeling financial stress due to inflation. This divide in the economy could have implications for the upcoming election.

The UK's services sector experienced its fastest growth since May, with rising business activity and new orders leading to increased hiring and an eight-month high in the services PMI index. Cost inflation eased to a joint-lowest rate, although staff salaries continued to rise, indicating positive prospects for service sector growth in 2024. The UK's unemployment rate was lower than previously estimated, and the country registered its one millionth electric car. However, Germany's service sector shrank for the fourth month in a row, and the OECD warned central banks against cutting interest rates before beating inflation.

The next government in Pakistan will face significant economic challenges, including billions in debt and fallout from a crackdown on Imran Khan, as the country grapples with a severe economic crisis, high inflation, and rising fuel and electricity prices.

Nigeria's richest man, Aliko Dangote, dropped significantly in the billionaires ranking after losing N7 trillion in just 24 hours due to the devaluation of the naira by the Nigerian government.