The US national debt is projected to reach $54.4 trillion by 2034, causing concerns of an impending economic collapse.

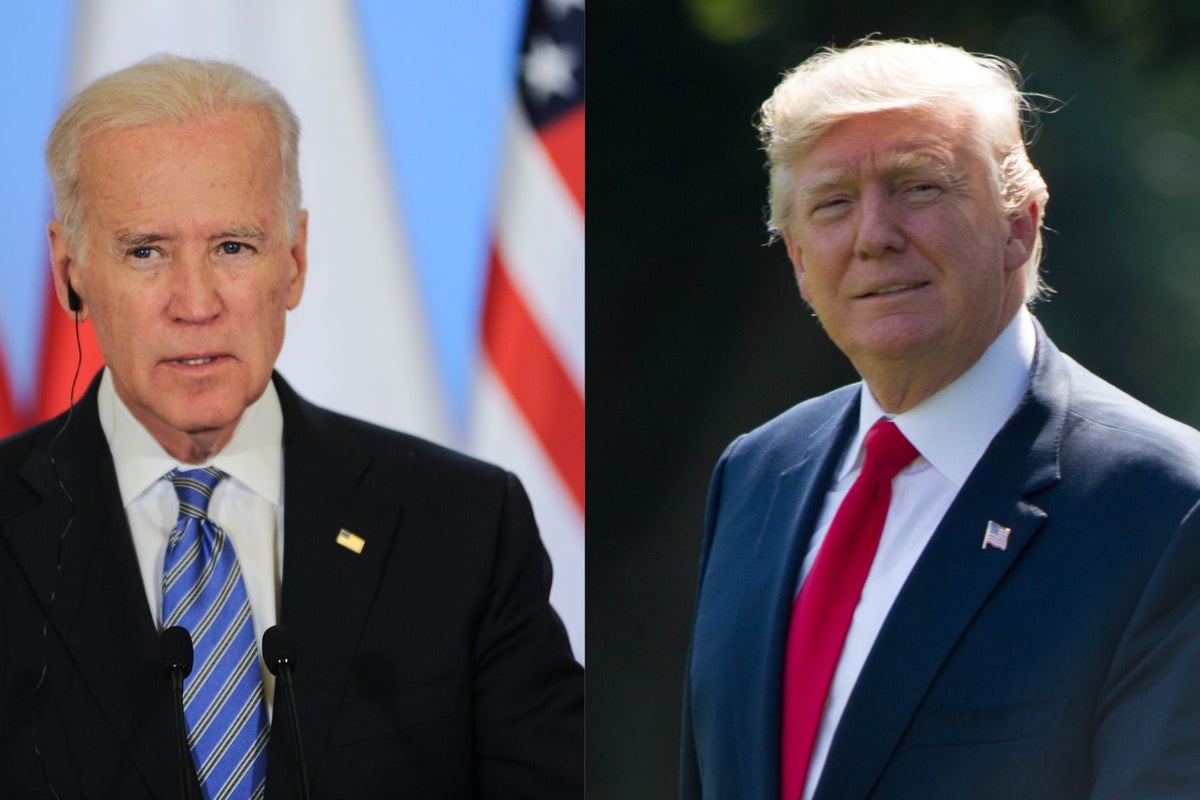

A poll conducted by the Financial Times and the University of Michigan Ross School of Business reveals that 42% of Americans prefer former President Donald Trump's economic leadership over President Joe Biden, putting pressure on Biden's ability to sway public opinion on economic matters.

Australia's tax system is in need of reform as workers bear a disproportionate burden while wealth and assets are lightly taxed, creating inequities and impacting low-income earners, according to experts and accountants. The country's heavy reliance on income tax and the lack of taxation on goods and services such as aged care services pose further challenges as the population ages and the number of workers declines. Calls for tax reform have been made to address these issues and create a fairer and more sustainable system that supports essential services and social safety nets.

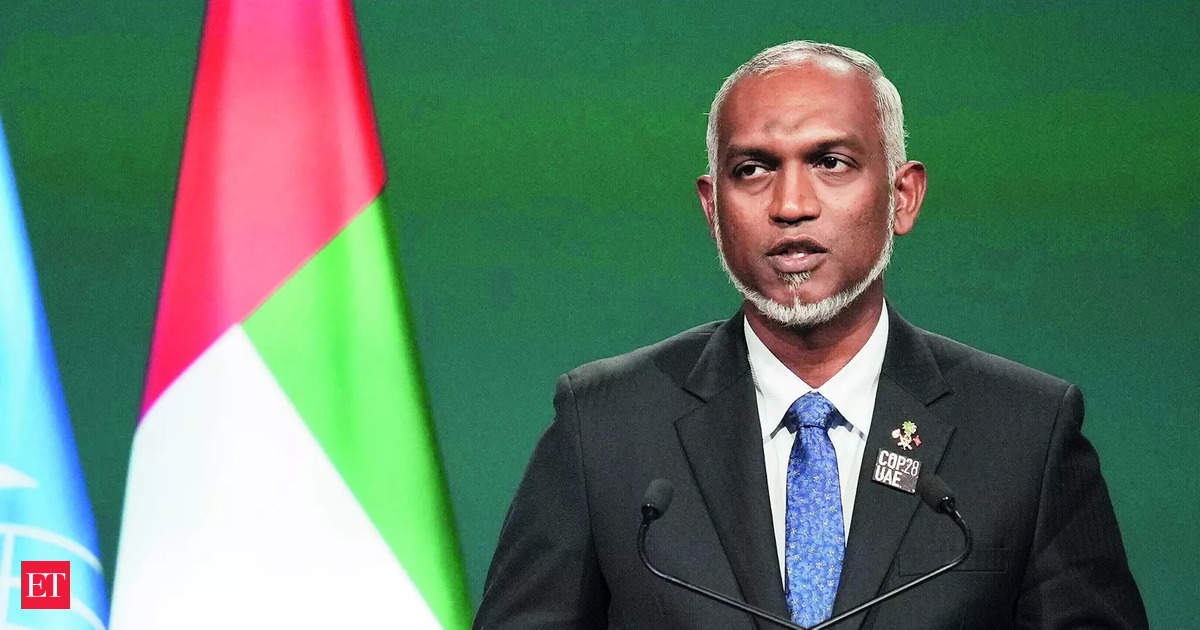

The Maldives' economy may suffer if its reliance on Chinese loans increases and India's assistance decreases, endangering its already high-risk debt distress.

India and Indonesia, once part of the "Fragile Five," are now favored by investors due to successful reforms and fiscal restraint, reflected in improved credit-default swaps and significant inflows into bonds. Elections in both countries are unlikely to spook investors, with positive near- and long-term fundamentals and favorable economic outlooks.

U.S. President Joe Biden is calling on snack companies to stop "shrinkflation," where product sizes are reduced but prices remain the same, labeling it as a "rip-off" and urging businesses to do the right thing for consumers.

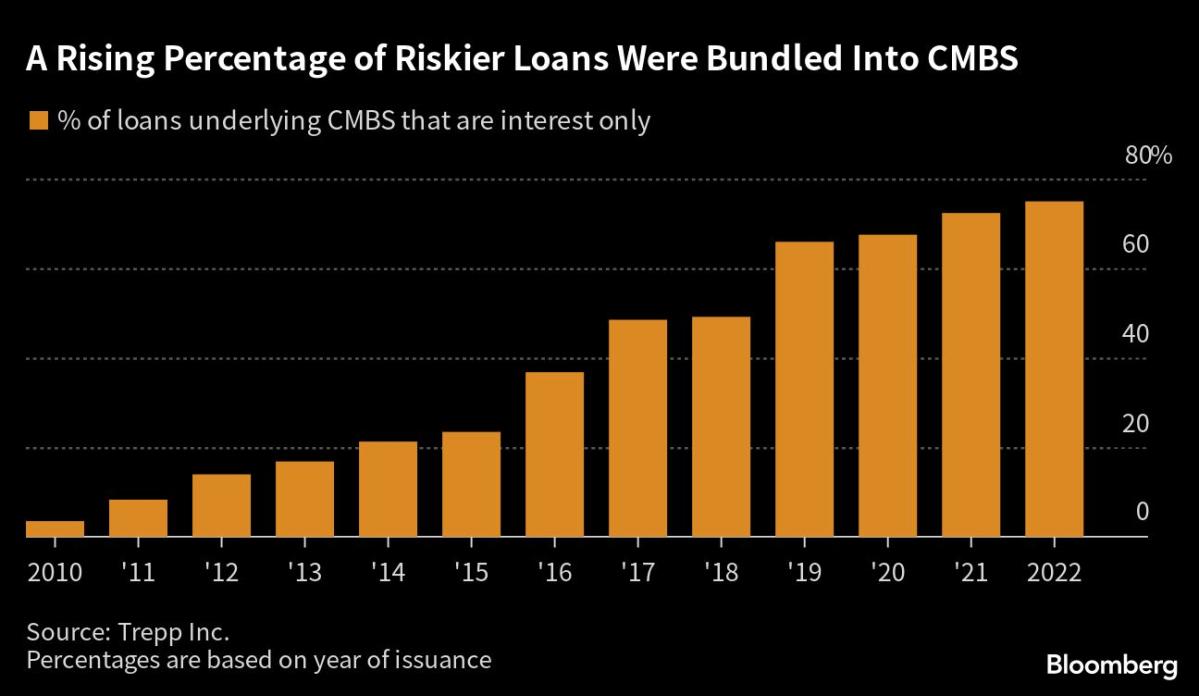

Smaller banks face a higher risk of default as they hold a disproportionate amount of commercial real estate loans, causing concerns of another banking crisis due to decreased demand and high interest rates.

Consumer confidence in the U.S. is improving as the "vibecession" comes to an end, with measures such as the Conference Board's consumer confidence index and the University of Michigan's consumer sentiment measure showing positive trends, largely driven by improving evaluations of the job market and declining inflation. The improvement in outlook is across party lines, although the partisan gap has widened.

The euro has survived and surpassed expectations despite its imperfections, providing stability and growth for the countries that use it, and celebrating its 25th anniversary.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/JZBAIB63LFGHHB2ZKXGLB4FCUQ.jpg)

Moody's downgrade of Israel's credit rating is described as a "political manifesto" by the country's finance minister, who rejects the decision's economic claims.

Federal Reserve Chairman Jerome Powell warns that the US government's unsustainable fiscal path, characterized by accumulating debt at a faster pace than economic growth, could suppress economic growth and lead to long-term trends of falling inflation and interest rates rather than a major crisis of inflation or rising interest rates.

The world's biggest economies are experiencing a "decoupling" as the US displays resilience, European growth weakens, and China faces challenges, leading to shifts in global stocks and trade.

Despite slowed inflation, consumers are still facing higher price levels, increasing the need for borrowing, and leading to higher loan delinquency rates; recent tips include comparing auto insurance policies, avoiding overdraft fees, and paying down credit-card balances.

The outlook for India and Indonesia has significantly improved, with successful reforms and fiscal restraint making them investor favorites, as reflected in improving credit-default swaps and significant capital inflows.

The UK is expected to be in a recession in the second half of 2023, with GDP contraction in the fourth quarter, leading to criticism of the government's economic performance; however, economists suggest that the recession may be short-lived and 2024 could bring better times, while the Bank of England is concerned about rising wages and inflation.

Campaign Director Martin Quinn urges Prime Minister Rishi Sunak to implement a UK Payment Choice Act to ensure cash acceptance and access, as banks continue to close branches and ATMs, emphasizing the importance of cash for freedom, anonymity, local economy, and data privacy.

According to the Federal Reserve Bank of New York's recession probability tool, there is a 61.47% likelihood of a recession occurring by or before January 2025, suggesting that a recession is very likely in 2024.

The Federal Reserve Bank of New York's recession probability tool, which measures the yield curve, suggests there is a 61.47% chance of a recession occurring by or before January 2025, which is one of the highest probabilities since the early 1980s. However, history has shown that recessions and stock market downturns are short-lived, and patient investors should not be overly concerned.

Saudi Arabia's Minister of Communications and Information Technology, Abdullah Al-Swaha, met with Nvidia CEO Jensen Huang to support and strengthen the region's digital economy, particularly in Saudi Arabia. The two discussed the potential role of generative artificial intelligence in digital innovation and investment opportunities. Saudi Arabia has been making efforts to drive the digital economy through global collaborations and partnerships.

Many Americans, particularly young people, do not feel positive about the US economy despite positive economic indicators, leading to concerns about an affordability crisis and potential impact on President Biden's reelection chances; Gen Z is turning to TikTok for financial advice and embracing the concept of "loud budgeting."

The United States is facing a growing public debt crisis that could have significant economic and national security implications, with experts expressing concerns about reduced public spending, loss of investor faith, worsening housing and jobs markets, and social unrest if the debt becomes unsustainable; however, opinions differ on the severity of the threat and whether the debt is being accumulated responsibly.

India is facing a data shortage as important indicators like the Census and Consumer Survey have not been released for years, according to Surjit Bhalla, former executive director of the IMF and former member of the Prime Minister's Economic Advisory Council. He also discusses the state of the economy, subsidies, unemployment, privatization, and investment flows.

Labour faces a challenge in winning over older voters who are resistant to change and prioritize economic caution, but polling shows that public support for government spending on infrastructure is at a 20-year high, and a shift in attitudes may be underway, although the perception that Labour is not good with money remains a hurdle. Labour's revised spending plans focus on funding through a tax on oil and gas companies and attracting private investment, following a model seen in other countries experiencing age-related wealth inequalities. The party aims to engage younger voters to overcome the electoral advantage of older voters.

Many people in the Philippines are turning to weekend bazaars to buy directly from farmers' collectives and learn about sustainable practices as a response to the "corporate capture" of agriculture.

The Pakistani rupee is expected to remain stable in the coming weeks, despite political uncertainty following a split election result, as healthy dollar supplies from exporters offset the potential negative effects.

The UK may have entered a recession at the end of last year, which could have negative implications for Rishi Sunak's Conservative Party and raise questions about his leadership, as the country is already facing challenging by-elections and a potential delay in the general election; however, these concerns could be mitigated if the economy improves, inflation slows, and real wages continue to rise, supported by interest rate cuts and tax reductions.

Deputy President Rigathi Gachagua plans to meet with Kenya Tea Development Agency to address the issue of declining earnings for tea farmers due to the appreciation of the US Dollar, emphasizing that farmers' income should align with the exchange rate. He also called out the Judiciary for delaying the implementation of government-led tea sector reforms.

The price of cement in Nigeria has doubled in three years to reach a record high of N7,000 per bag, due to inflation and increased demand caused by the COVID-19 crisis, negatively impacting construction and block production. The Cement Producers Association warns that the government's plan to introduce concrete roads will further raise the price to N9,000 per bag.

The results of the recent general elections in Pakistan have raised concerns about achieving political and economic stability, with the new government facing challenges in maintaining the economic stability achieved by the caretaker government and potentially seeking a new IMF accord to stabilize the economy for at least three years.

China's wealthy individuals, such as Ms Xue, who have invested heavily in property and wealth-management products, are suffering significant financial losses as property values and investment returns continue to decline, resulting in a negative wealth effect that is reshaping China's markets and impeding the country's plans for future growth.

Pakistani businessmen and wealthy individuals have been investing in Dubai's real estate and establishing export-import trading houses in the city, leading to concerns about income and job losses in Pakistan due to the shift in businesses.

Beijing and Shanghai students have historically enjoyed a smooth path in life due to political and networking advantages, but final-year undergraduate Cui Xiaoming faces uncertainty as his subscription is at risk of termination if he doesn't update his payment details.

Nigerian families are struggling with the rising prices of goods and services, particularly food, as inflation rises to a 27-year high and staple items such as rice almost triple in price. This has led to protests and widespread hardship across the country.

India's Chief Economic Adviser, V. Anantha Nageswaran, emphasized the importance of a healthy population in India's journey towards becoming a developed country by 2047, warning against India becoming sicker before it becomes richer and raising concerns about child obesity and diabetes; he also highlighted the need for realistic assessments of challenges and cautioned against the pitfalls of excess optimism and bad investment decisions.

Despite the financial strain caused by increasing cost of living, Australians are spending more money on lotto tickets and scratchies than ever before, with over $7 billion wagered in the 2020-21 financial year, as hope for a better life continues to drive people to enter lotteries.

Investors are concerned that smaller banks may face significant losses in the commercial real estate market, which has already experienced a downturn in the US and globally.

Nevada has the most competitive job market in the US, with a 3.7 percent increase in employment in the year to December 2023, while Mississippi experienced a decrease in the number of jobs.

President Biden's climate initiatives outlined in the Inflation Reduction Act are projected to cost over $400 billion more than anticipated, according to the latest estimates from the Congressional Budget Office, with total costs reaching approximately $800 billion or even over $1 trillion, due to factors such as increased clean vehicle tax credits and revenues from excise taxes on gasoline.

Labour, led by Sir Keir Starmer, has unveiled a series of policies that are costly and burdensome for businesses, including increased regulation, trade union powers, and additional workers' rights, which could hinder economic growth and competitiveness.

Household debt in the US reached a record high of $17.5 trillion in the fourth quarter of 2023, driven by increased credit card debt and mortgages, as rising prices and high interest rates force Americans to rely on debt to cover everyday expenses.

Michael Yamson, the Managing Partner of Ishmael Yamson & Associates, expresses concerns over the government's plan to reintroduce the Import Restriction Bill, highlighting the lack of "trade diplomacy" and potential negative impacts on domestic production, inflation, and trade relations with key partners such as China and the WTO.

The pandemic exacerbated wealth inequality as the net worth of white individuals grew significantly more than that of Black and Hispanic individuals, with stock market gains being a major factor, according to a report from the New York Federal Reserve Bank. Racial disparities in wealth were driven by differences in financial asset holdings, with a larger proportion of white households having money in stocks and mutual funds compared to Black and Hispanic households. Closing the wealth gap is challenging because of these disparities and the concentration of Black wealth in pensions rather than stocks and mutual funds. Black-owned businesses were also disproportionately affected by the pandemic and faced greater challenges. While there have been improvements in employment, wages, and Black business ownership, further policy measures may be necessary to address the significant wealth gap in the US.

The pandemic has deepened wealth inequality, with white individuals experiencing greater growth in net worth compared to Black and Hispanic individuals, largely due to higher levels of investment in stocks and mutual funds by white households.

Russia is building an alternative to the SWIFT payment system that will settle cross-border transactions in local currencies, potentially sidelining the US dollar, and plans to pitch the new system to over 159 countries.

January 2024 saw a deficit in the US private sector of $52 billion, negatively impacting asset markets and predicting a lower stock market performance in February, while a decrease in federal spending and increased taxation could further affect the private sector balances and short-term market trends.

During the Great Depression, Mexico, Brazil, and Australia were among the 20 richest countries, experiencing varying degrees of economic growth and resilience.

Business leaders seeking growth in an uncertain world should avoid extreme pessimism or optimism and instead focus on the international market as a source of growth, including opportunities in China and Asia as a whole, according to President Tharman Shanmugaratnam at the Singapore Chinese Chamber of Commerce and Industry's Chinese New Year celebrations. He highlighted both the challenges and strengths of China's economy, emphasizing its deep manufacturing ecosystem, advanced infrastructure, and talent pool as advantages for potential growth.

EU member states and MEPs have reached a preliminary deal to relax fiscal rules, giving governments more time to reduce debt and providing incentives for public investments in climate, industrial policy, and security.

The rate of inflation is expected to slow down in January, with economists predicting a mild increase in consumer prices and a decrease in the inflation rate from the previous year. The Federal Reserve is closely monitoring the core rate of inflation and housing costs before considering any interest rate cuts.

The number of cattle in the US has hit a decades-low level, raising concerns among ranchers about the future of the beef industry and blaming Biden's policies for not investing in cattle farmers and causing a decrease in beef production.