China is facing a severe economic downturn, with record youth unemployment, a slumping housing market, stagnant spending, and deflation, which has led to a sense of despair and reluctance to spend among consumers and business owners, potentially fueling a dangerous cycle.

China's economy, which has been a model of growth for the past 40 years, is facing deep distress and its long era of rapid economic expansion may be coming to an end, marked by slow growth, unfavorable demographics, and a growing divide with the US and its allies, according to the Wall Street Journal.

China's economic slump is worsening due to the prolonged property crisis, with missed payments on investment products by a major trust company and a fall in home prices adding to concerns.

China's historical dominance in the crypto industry persists despite periodic crackdowns, with many crypto companies still earning a significant portion of their revenue from the country and maintaining unofficial channels of liquidity; China's economic uncertainty, including concerns about future crackdowns and a collapsing real estate market, can impact global crypto markets.

China's stuttering economy poses a major threat to global commodities demand, as economic activity and credit flows deteriorate, and structural challenges and weaknesses in various sectors, including base metals, iron & steel, crude oil, coal & gas, and pork, affect the market.

China's economic slowdown, marked by falling consumer prices, a deepening real estate crisis, and a slump in exports, has alarmed international leaders and investors, causing Hong Kong's Hang Seng Index to fall into a bear market and prompting major investment banks to downgrade their growth forecasts for China below 5%.

The risks of China's economic slowdown have not been factored into the markets yet, according to Insigneo Chief Investment Officer Ahmed Riesgo, who believes that the crisis of confidence in China's economy will soon become a major global risk.

China's economy is facing challenges with slowing growth, rising debt, tumbling stock markets, and a property sector crisis, and some analysts believe that heavy-handed government intervention and a lack of confidence are underlying causes that cannot be easily fixed. However, others argue that China's problems are solvable and that it remains a superpower despite its considerable problems.

China's economic challenges, including deflationary pressures and a slowdown in various sectors such as real estate, are likely to have a global impact and may continue to depress inflation in both China and other markets, with discounting expected to increase in the coming quarters.

China's unexpected economic slowdown, driven by excessive investment in the property sector and local government spending, is leading experts to question whether a collapse is imminent, although they believe a sudden collapse is unlikely due to China's controlled financial system; however, the slowdown will have implications for global growth and emerging markets, particularly if the U.S. enters a recession next year.

China's economic slowdown is worrisome for global markets as it is one of the largest buyers of commodities.

There are growing concerns that China's economic growth is slowing, and there are doubts about whether the Chinese government will provide significant stimulus to support its trading partners, including Australia, which heavily relies on China as its top trading partner. China's economic slowdown is attributed to various factors such as trade tensions, demographic changes, a property market slump, and the lack of cash support during COVID-19 restrictions. While some experts remain optimistic that the Chinese government will implement stimulus measures, market sentiment is becoming strained, and patience is wearing thin. The impact on Australia's economy and stock market could be severe, particularly affecting mining companies, banks, construction, tourism, education, and listed fund managers.

China's stock market is on the verge of a meltdown as major property developers collapse, while Wall Street is booming due to renewed interest in tech stocks, posing a potential threat to the UK as it gets caught in the crossfire.

Asian markets will be influenced by economic indicators, policy steps, and diplomatic signals from China, as well as reacting to the Jackson Hole speeches, purchasing managers index reports, GDP data, and inflation figures throughout the week, with investors desperate for signs of economic improvement as China's industrial profits continue to slump and authorities take measures to stimulate the capital market.

Many ordinary Chinese are experiencing a widespread economic slowdown characterized by pessimism and resignation, despite Beijing's attempts to downplay concerns and project a positive narrative.

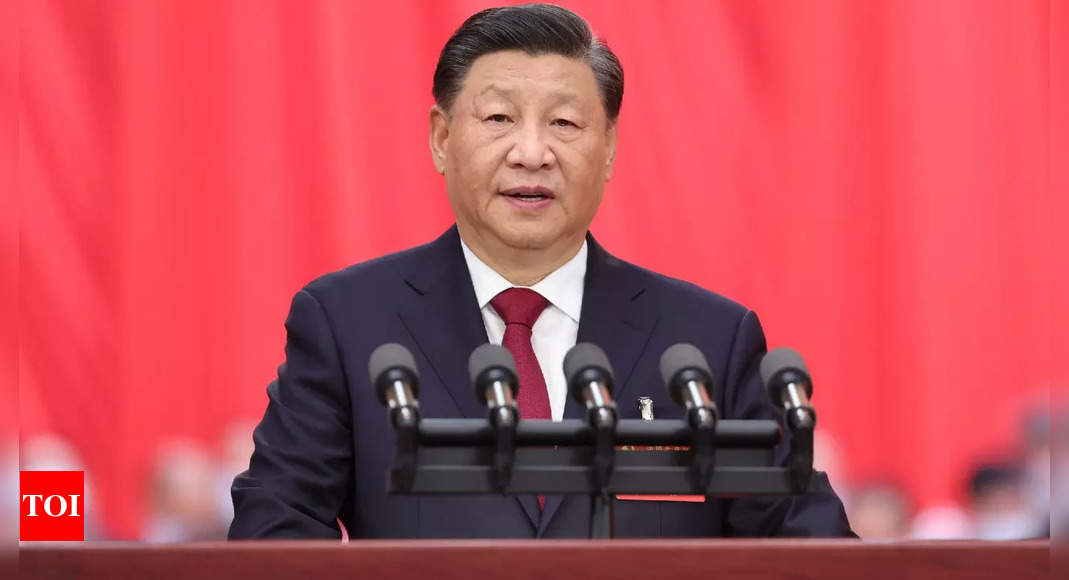

China's economy is experiencing a structural slowdown and becoming increasingly opaque, making it difficult for outsiders to understand the true state of the country's economic affairs, as President Xi Jinping prioritizes ideology over economic growth and transparency.

China's economy is struggling due to an imbalance between investments and consumption, resulting in increased debt and limited household spending, and without a shift towards consumption and increased policy measures, the economic slowdown may have profound consequences for China and the world.

UBS reports higher than expected profits, job creation in the US slows, and markets rally on weaker economic data and hope for a pause in interest rate hikes. China's factory activity shrinks but at a slower pace, while retail sales increase. There are opportunities for investors in other Asian markets.

The global economy is expected to slow down due to persistently high inflation, higher interest rates, China's slowing growth, and financial system stresses, according to Moody's Investors Service, although there may be pockets of resilience in markets like India and Indonesia.

The slowdown in China's property market continues despite government measures to revive the economy, with analysts warning that the sentiment among many Chinese is too weak for these moves to be effective.

China's economic slowdown, driven by a debt-ridden and overbuilt property sector, is not expected to have a significant impact on the global economy or US exports, although a prolonged downturn could have broader consequences. While companies like elevator maker Otis will feel the effects, China's reduced growth is unlikely to be contagious beyond its borders.

Disappointing economic data in Asia-Pacific markets, overinvestment in China, and Chinese electric vehicle companies expanding in Europe are among the key factors impacting global markets, while the price of bitcoin remains volatile with conflicting predictions about its future.

The prospect of a prolonged economic slump in China poses a serious threat to global growth, potentially changing fundamental aspects of the global economy, affecting debt markets and supply chains, and impacting emerging markets and the United States.

Fears about the health of the global economy have intensified as service sector activity in China, the eurozone, and the UK shows signs of weakness, leading to a drop in share prices in Asia and a decline in the pound against the US dollar.

China's economy is showing signs of slowing down, including a decrease in GDP growth rate, declining exports, deflationary consumer price index, high youth unemployment, a weakening yuan, and a decrease in new loans, which could have global implications.

China's stock market rebound may be temporary as corporate earnings continue to decline and companies revise down their outlooks, causing concern for foreign funds and prompting Bank of America to urge caution.

Asia stocks fall as weak economic data in China and Europe raise concerns over global growth, while the dollar strengthens as investors assess the outlook for U.S. interest rates.

China's economic growth has slowed but has not collapsed, and while there are concerns about financial risks and a potential property crisis, there are also bright spots such as the growth of the new energy and technology sectors that could boost the economy.

China's property shares are declining and tech shares are underperforming, leading to a slide in the Asian market, while the European market waits for monetary policy decisions from the ECB and the Bank of England.

China's government is downplaying its economic crisis by promoting positive narratives, while social media campaigns and state-run newspapers attack Western media outlets for biased reporting; however, reports suggest that the property sector downturn is causing significant ramifications, and growth projections for China have been downgraded by major banks.

A retreat of funds from Chinese stocks and bonds is diminishing China's global market influence and accelerating its decoupling from the rest of the world, due to economic concerns, tensions with the West, and a property market crisis.

Pessimism among U.S. businesses operating in China is on the rise, with a record low percentage of firms optimistic about their five-year outlook, according to a survey by the American Chamber of Commerce in Shanghai, driven by concerns over geopolitics and a slowing economy.

China's economic model is in decline and will have a significant impact on global markets, according to veteran investor David Roche, who predicts long-term struggles for manufacturing-based economies and warns of potential social unrest and geopolitical problems.

Investor negativity towards Chinese stocks is starting to shift as money managers halt or slow down cuts to their exposure, despite a bearish tilt in the market, signaling a potential change in sentiment and reliance on fundamental factors rather than hope for recovery.

The outlook of U.S. companies on China's markets in the next five years has hit a record low due to factors such as political tensions, tariffs, slow Covid recovery, and issues in the real estate market; however, complete decoupling between the two economies is unlikely.

U.S. companies are losing confidence in China and some are limiting their investments due to tensions between the two countries and China's economic slowdown.

US business confidence in China is being drained by geopolitical tensions and an economic slowdown, with only 52% of American firms optimistic about their five-year China business outlook, according to a study by the American Chamber of Commerce in Shanghai.