Main financial assets discussed: Emerging market stocks, Indian stocks, iShares MSCI India ETF (INDA), iShares MSCI India Small-Cap ETF (SMIN), WisdomTree India Earnings Fund ETF (EPI)

Top 3 key points:

1. Emerging markets have outperformed all other global sectors, including the United States, since the late 1980s.

2. Emerging markets are currently undervalued compared to the U.S. market, making them an attractive investment opportunity.

3. India is a particularly promising emerging market due to its balanced economy, improving standards of living, and strong demographic advantages.

Recommended actions: **Buy** India Small Caps (SMIN) ETF.

### Summary

India's retail inflation in July rose to 7.44%, higher than market expectations, and is expected to remain elevated in Q3. The global currency market is experiencing significant turbulence, with the USD appreciating despite economic weaknesses. Heightened inflation and volatility in the currency market pose risks to the Indian market.

### Facts

- India's retail inflation in July was 7.44%, exceeding market expectations.

- Elevated inflation is expected to continue in Q3.

- The global currency market is experiencing turmoil, with the USD appreciating despite economic frailty.

- FII outflows have increased, but India's equity market is performing better than other emerging markets.

- The RBI has revised its inflation forecast upward and expects inflation to decrease to 5.7% in Q3.

- High interest rates and inflation are expected to impact corporate earnings growth and valuation.

- India's one-year forward P/E valuation has decreased from 20x to 18.5x.

- Bond yields have increased, leading to a divestment of equities and acquisition of bonds.

- The domestic market is supported by restrained FII divestment, robust purchasing by DIIs and retail participants, and outperformance compared to other emerging markets.

- Selling in global equities has increased due to concerns of deflation and defaults in China's realty and finance sectors.

- The author expects the selling from FIIs to continue in the short-term due to elevated global bond yields, US credit downgrade, and slowdown in emerging markets, but India will continue to outperform.

- In the last month, the MSCI World index was down 4.2% compared to MSCI India's 1.85% decrease.

Summary: The turmoil in emerging markets, including declines in bonds and stocks, unpredictable political situations in Argentina and Ecuador, and global economic factors, is causing investors to reassess the risks associated with investing in these markets.

Asian stocks, particularly Chinese markets, may find some relief after Wall Street's resilience in the face of rising bond yields, though economic data from China remains underwhelming and foreign investors continue to sell Chinese stocks.

Asian markets are expected to follow the global trend of weakness in stocks, a buoyant dollar, elevated bond yields, and souring investor sentiment, with no major catalysts to change the current market condition.

Emerging markets are facing challenges due to the Federal Reserve's efforts to combat inflation and China's economic slowdown.

The strong U.S. economic growth and potential rate hikes by the Federal Reserve could pose global risks, potentially leading to a significant tightening of global financial conditions and affecting emerging markets and the rest of the world.

The markets are facing numerous headwinds, including an imbalanced U.S. economy, stubborn inflation, a looming recession in Europe and China, a bulging deficit, reduced market liquidity, rising geopolitical risk, and high price earnings ratios, making above-average cash reserves a sensible choice for investors.

Emerging markets were shaken by investor concerns over the US economy and the strengthening dollar, causing an equity rally led by China's stimulus plans to be short-lived.

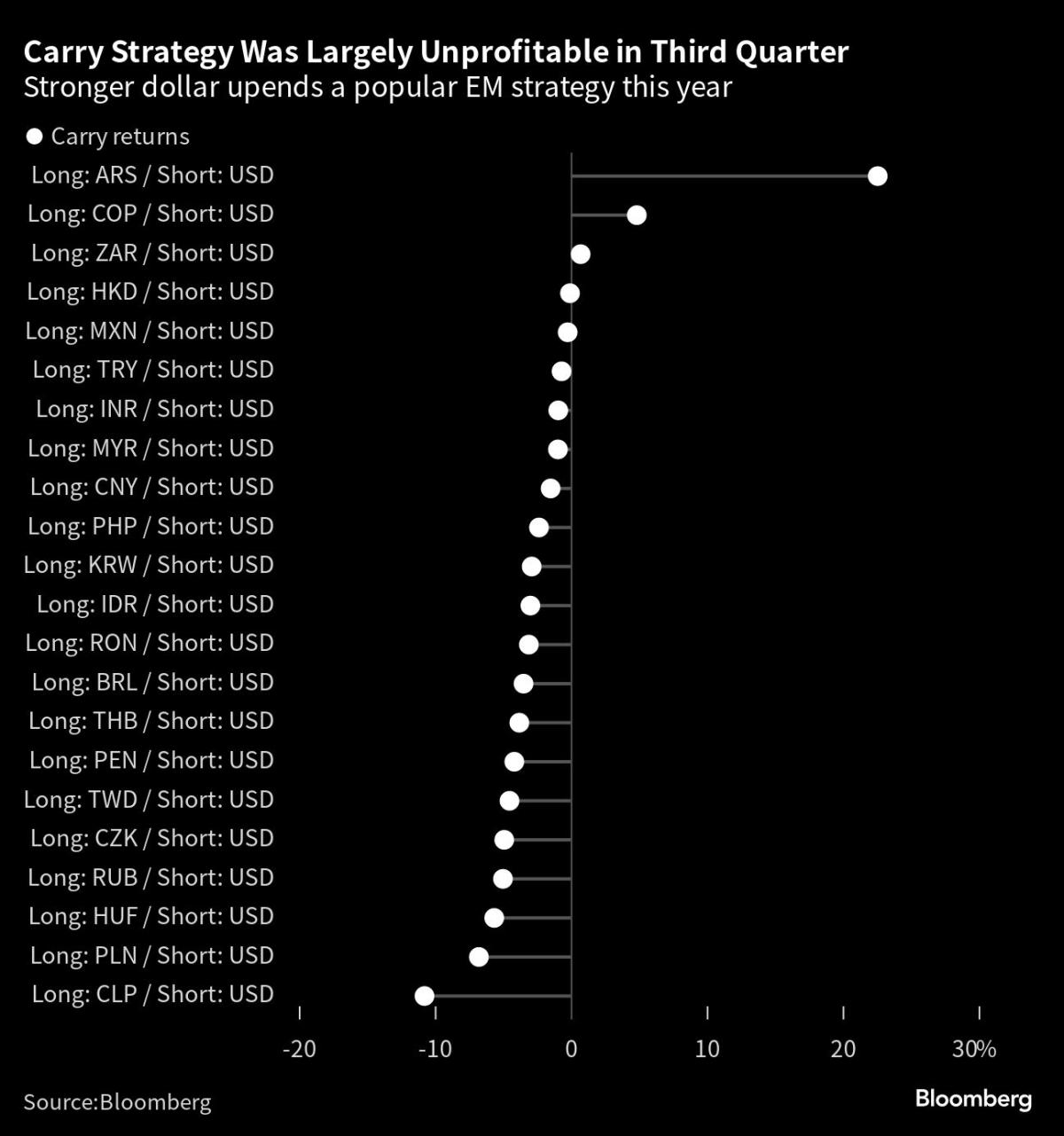

Global interest rate hikes, challenges in China, a stronger dollar, and political instability in Africa have impacted emerging market assets, causing stock and currency declines and property market concerns in China, while Turkey's markets have seen a boost in response to interest rate hikes, and African debt markets have experienced a significant pullback.

Asian stocks may face a volatile session as investors monitor U.S. economic data, a second China manufacturing PMI reading, and the U.S. employment report, with any indication of central bank leaders approaching the end of tightening likely to generate risk appetite.

Emerging markets must rebuild fiscal buffers, diversify trade, and prepare for the costs of climate change, according to the IMF's deputy managing director, Gita Gopinath, who highlighted the challenges of rising geopolitical fragmentation and financial conditions, as well as the need for countries to strengthen their monetary policy frameworks and protect against climate-related financial risks.

Emerging-market central banks are resisting expectations of interest rate cuts, which is lowering the outlook for developing-nation bonds, as central banks in Asia and Latin America turn hawkish in response to the "higher-for-longer" stance taken by the Federal Reserve, currency pressures, and the threat of inflation.

The prospect of a prolonged economic slump in China poses a serious threat to global growth, potentially changing fundamental aspects of the global economy, affecting debt markets and supply chains, and impacting emerging markets and the United States.

Emerging market currencies are expected to struggle to recover from their losses this year due to high U.S. Treasury yields, safe-haven demand, and a slowing Chinese economy, keeping the dollar strong, according to a Reuters poll of FX analysts.

US stocks are experiencing their worst performance in September since 1928, but there are signs that the market could avoid a steep downturn this year, with indicators suggesting more stability and positive gains for the rest of the year, according to Mark Hackett, chief of research at US investment firm Nationwide. However, challenges such as elevated oil prices and inflation could put strain on the stock market and the US economy.

Investors may want to gain exposure to emerging markets in 2023 due to their high growth potential, the potential for diversification and offsetting of FX impacts, China's policy shifts supporting growth, the ability to compound returns through dividends, and the potential reversal of the MSCI index.

Emerging markets, particularly China, are facing challenges such as weak economic activity, real estate debt issues, regulatory environment, and market concentration, while the U.S. market is performing well; however, emerging markets outside of China, like India, are showing promise due to supply chain diversification, infrastructure investment opportunities, and a pro-business government. Other attractive markets include Taiwan, South Korea, Vietnam, the Philippines, and Indonesia.

The latest PMI data shows a contraction in developed markets, while emerging markets continue to grow, albeit at a slower pace, indicating overall solid performance in the third quarter of 2023. However, new export orders for emerging market manufacturing contracts at a slower rate, and India remains a bright spot amid the global headwinds.

Asia-Pacific markets are expected to continue declining as investors wait for China's loan prime rates and the U.S. Federal Reserve's rate decision, while oil prices rise due to supply concerns and all 11 sectors in the S&P 500 trade down.

Chinese stocks defy regional declines as tech stocks rise, while the 10-year Treasury yield slightly decreases from a 16-year high; US futures tick higher following a 1.6% slide in the S&P 500; bond yields rise in Australia and New Zealand after positive US labor market data; and India's sovereign debt is set to be included in JPMorgan's benchmark emerging-markets index.

Asian markets begin the last week of the quarter battered by the surge in U.S. bond yields, with investors hoping for a rebound and closely watching the U.S. bond market.

Global markets face pressure as U.S. bond yields surge and the dollar strengthens; Hollywood screenwriters reach a tentative deal to end strike; global shares decline, dollar rises ahead of crucial U.S. inflation data; Vietnam aims to challenge China's rare earths dominance; Canadian economy headed for a rough patch; Trudeau expects Canadian interest rates to decrease by mid-2024.

The recent decline in the US equity market is validating concerns about its lopsided nature, with a small number of top-performing stocks leading the market lower and the remaining companies struggling to make gains, potentially exacerbating losses in a rising Treasury yield environment.

Asian markets may be bolstered by Wall Street's performance, but concerns regarding the surging dollar, rising U.S. Treasury yields, and troubles in the Chinese property sector may dampen investor enthusiasm.

The global markets, including U.S. and Asian markets, are caught in a cycle of rising bond yields, a strong dollar, higher oil prices, and decreasing risk appetite, leading to fragile equity markets and deepening growth fears.

Asian investors enter the final trading day of a challenging quarter with improved sentiment following a rebound in global risk assets, while economic indicators from Japan and ongoing concerns over the Evergrande situation and China's manufacturing data loom in the background.

Asia-Pacific markets mostly fell due to an increase in Treasury yields and oil prices, leading to a decline in investor sentiment on Wall Street, with Hong Kong's Hang Seng index sliding 1.41% after shares of Evergrande were suspended.

World markets ended a difficult third quarter on a slightly positive note, with the worst of the selling in bonds and stocks easing and U.S. crude oil prices falling from their yearly highs, while hopes for a possible year-end summit between President Xi Jinping and U.S. President Joe Biden also boosted sentiment.

The stock market's seasonal weakness in August and September may set up a rally in the final quarter of 2023, historically the best quarter for U.S. stocks, according to market strategists, despite the recent worst month and worst performing quarter for the S&P 500 and Nasdaq Composite.

Chinese markets and emerging markets have not met expectations for a rally and outperformance over developed markets, causing a decline in stocks and back-to-back currency losses, but there is uncertainty about what the rest of the year holds as investors assess the situation.

The fourth quarter of 2023 may be challenging for stocks due to higher rates and a stronger dollar, which could lead to tighter financial conditions and increased volatility in the equity market.

Summary: The U.S. stock market had a bad quarter, with all indexes falling, while the World Bank lowered its growth forecast for developing economies in East Asia and the Pacific, and China's demand for commodities continues to grow despite the downgrade. Additionally, a last-minute spending bill was passed to avoid a government shutdown, and this week's focus will be on the labor market.

The U.S. stock market had a relatively flat performance in the third quarter, with stocks falling 3.2% from where they started, while energy stocks had a strong rally and real estate stocks crumbled; the bond market experienced losses, and unless there is a sudden change in the outlook, it is on track for its third straight year of losses; value stocks outperformed growth stocks, and dividend strategies held up better than the broader market; the Fed maintained its higher-for-longer stance on interest rates, contributing to volatility in the bond market; and major cryptocurrencies, such as Bitcoin and Ethereum, ended the quarter down approximately 12%.

Multiple factors, including a drop in US markets, high US Treasury yields, rising crude oil prices, increased Chinese Treasury sales, and a slowdown in Chinese real estate, suggest challenging times ahead for the markets.

Emerging markets face uncertainties from factors such as the Federal Reserve's rate hikes, China's economic slowdown, and potential debt defaults in countries like Argentina, Pakistan, and Kenya.

Emerging economies, including Pakistan and Egypt, are facing financial challenges and potential default risks as they gather for the World Bank and IMF meetings, amidst uncertainties in US fiscal policies and China's slowing economy, compounded by the impacts of extreme weather and climate change.

The US stock market experienced losses in the third quarter, driven by rising US Treasury yields, leading to a surge in the US dollar and a hostile environment for gold and silver; the fourth quarter may see a continuation of this trend if US yields continue to rise.

The rapid increase in Treasury yields has heightened concerns about potential defaults in emerging markets, with several countries at risk of missing payments or being forced to restructure their heavy debt loads.

Asian markets are expected to start positively due to a slump in U.S. bond yields and comments from Federal Reserve officials signaling the end of interest rate hikes, despite concerns in China's property sector and other economic indicators.

The U.S. economy's strength poses a risk to the rest of the world, leading to higher interest rates and a stronger dollar, while global trade growth declines and inflation persists, creating challenges for emerging markets and vulnerable countries facing rising debt costs.

The bond markets are going through a volatile period, with collapsing bond prices and rising yields, as investors dump US treasuries due to factors such as fears of conflict in the Middle East and concerns about President Joe Biden's high-spending approach, leading to higher interest rates and impacting mortgages and debt.

The Asian financial markets are experiencing turmoil as the region's currencies decline and foreign capital outflows increase due to the divergence in global monetary policies and the rise in US Treasury bond yields, although Asian economies are in a stronger position now than they were a decade ago.

Global stocks fall and US Treasury yields retreat as investors analyze mixed US economic and corporate signals, with weaker-than-expected US inflation and disposable income data pushing down Treasury yields and sparking concerns of further interest rate hikes by the Fed.