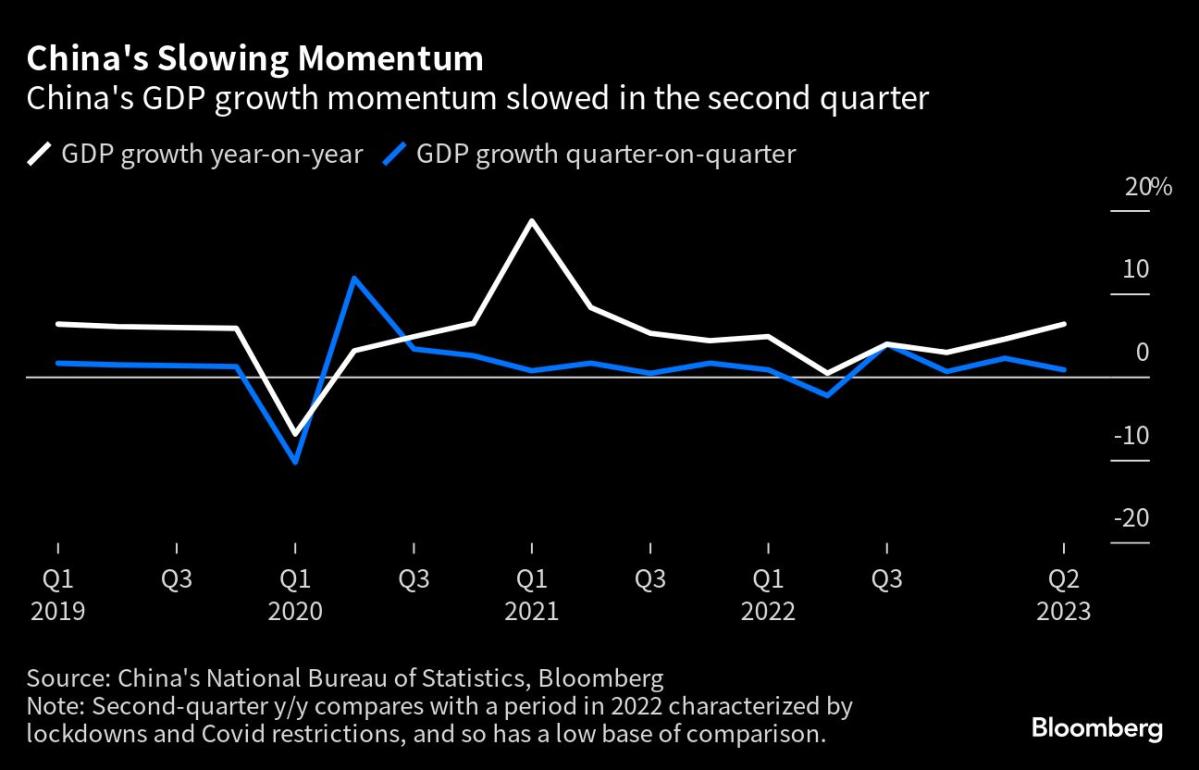

China's economy is facing challenges with slowing growth, rising debt, tumbling stock markets, and a property sector crisis, and some analysts believe that heavy-handed government intervention and a lack of confidence are underlying causes that cannot be easily fixed. However, others argue that China's problems are solvable and that it remains a superpower despite its considerable problems.

China's economic challenges, including deflationary pressures and a slowdown in various sectors such as real estate, are likely to have a global impact and may continue to depress inflation in both China and other markets, with discounting expected to increase in the coming quarters.

Global investors are urging China to increase spending in order to revive its struggling economy and address the deepening property crisis, as modest interest rate cuts and vague promises of support have failed to restore confidence in the market. Investors are demanding more government stimulus before considering a return, and the lack of a policy response from Beijing has raised concerns among fund managers. The wishlist of investors includes increased government spending, particularly for local governments and banks, as well as measures to address the property sector crisis and improve communication regarding private business interests.

China faces challenges in rebalancing its economy towards increased consumer spending due to the economic growth model that relies heavily on investment in property, infrastructure, and industry, as well as the reluctance of households to spend and the limited social safety net; implementing demand-side measures would require difficult decisions and potential short-term pain for businesses and the government sector.

China's economic slowdown, coupled with a property market bust and local government debt crisis, is posing challenges to President Xi Jinping's goals of achieving economic growth and curbing inequality, potentially affecting the Communist Party's legitimacy and Xi's grip on power.

China has introduced new mortgage policies to boost its property market and stimulate economic growth by allowing more people to be classified as first-time homebuyers and receive lower mortgage rates.

China's hybrid economic model, which combines state planning with market forces, is facing challenges as the country struggles with weak economic indicators, including high youth unemployment and falling prices, and the property market experiences financial distress due to government interventions and market dynamics; policymakers must implement short-term measures to boost market confidence, such as managing property-sector defaults and easing housing investment restrictions, while also undertaking long-term structural reforms to address moral hazards, promote fiscal responsibility, and protect private businesses and foreign investors.

China needs to fully utilize policy space to bolster economic growth and market expectations by making significant adjustments in fiscal and monetary policies, according to a senior economist and political adviser. The economist emphasizes the importance of sending strong signals to the market and considers options such as interest rate cuts, increased deficit-to-GDP ratio, and infrastructural improvements to address economic challenges caused by global demand stagnation and tightened US monetary measures.

China's economy is struggling due to an imbalance between investments and consumption, resulting in increased debt and limited household spending, and without a shift towards consumption and increased policy measures, the economic slowdown may have profound consequences for China and the world.

Guangzhou, the first major Chinese city to do so, has announced an easing of mortgage curbs in an effort to revive the property sector and stimulate the economy, a move that is expected to be followed by other top-tier cities.

Consumer spending in China rebounded in August, with all categories, including apparel, automotive, food, furniture, appliances, and luxury, experiencing increased sales compared to July, according to a survey by the China Beige Book. Retail sales in July rose by 2.5% year-on-year, raising concerns about China's economic growth, but the August survey showed a surge in spending, particularly in the services sector, which saw continued strength in travel and hospitality. Additionally, corporate borrowing increased as the cost of capital declined, indicating a boost in business activity. However, China's property sector continued to worsen, with house prices barely growing and home sales declining.

China's economy is facing significant challenges, including a property crisis, youth unemployment, and a flawed economic model, but the government's limited response suggests they are playing the long game and prioritizing ideology over effective governance.

China's economy is showing signs of improvement, with officials in two big cities taking steps to stabilize the property markets and attract more home buyers.

Chinese consumer spending has rebounded in certain sectors, but concerns persist over the property market and GDP growth falling below 5%, according to Shehzad Qazi, managing director of China Beige Book.

China is planning to relax home-purchase restrictions and implement new measures to address the debt crisis in its property sector, which accounts for a quarter of its economy, in an effort to boost consumer demand.

China's factory activity unexpectedly expanded in August, with improvements in supply, domestic demand, and employment, suggesting government efforts to revive growth may be effective.

China has announced new guidelines to boost car sales, with a focus on new energy vehicles, aiming to sell around 27 million new vehicles this year and increase sales of electric cars to approximately 9 million units, as the country looks to revive its post-Covid economy.

China's recent stimulus measures to boost its economy, including reducing down payments for homebuyers and lower rates on mortgages, are impressing the markets and may dictate the direction of the commodity market.

China's failure to restructure its economy according to President Xi Jinping's bold reform plans has raised concerns about the country's future, with the possibility of a financial or economic crisis looming and a slow drift towards stagnation being the most likely outcome. The three potential paths for China include a swift, painful crisis; a gradual winding down of excesses at the expense of growth; or a switch to a consumer-led model with structural reforms that bring short-term pain but lead to a faster and stronger emergence.

China's economy is facing a "new new normal" due to a declining population and weak confidence in its post-Covid recovery, prompting calls for systemic reforms to revive growth. The country's aging and shrinking population poses challenges to productivity, consumption, and long-term growth potential, leading major investment banks to cut growth forecasts. Policy adviser Cai Fang suggests relaxing population controls and focusing on expanding consumption as strategies to boost economic growth.

Chinese stocks surged as the government implemented additional measures to support the property sector, signaling a determination to boost the economy by addressing issues in the struggling housing market.

China's relief measures to support the property sector have spurred a home-buying spree in Beijing and Shanghai, with transaction volumes in both cities increasing significantly, indicating robust housing demand; however, concerns persist that this demand may not be sustained due to other restrictions and a faltering growth outlook.

China's economic slowdown is posing a significant challenge to President Xi Jinping's agenda, forcing him to make difficult choices and potentially relinquish some control over the economy. The slump in housing sales and the crackdown on private capital are among the factors contributing to the economic setbacks, prompting calls for change and a reevaluation of economic policies under Xi's highly centralized leadership. However, Xi seems reluctant to make major changes to his strategy, opting for a hands-off approach and avoiding a big rescue plan for distressed developers and local governments. The central government's control over taxes and the need to revamp the fiscal system further complicate the situation. Restoring government finances while reassuring private investors is a daunting task that requires strong leadership and potentially contentious policy changes. The upcoming Communist Party meetings will shed light on how Xi plans to restore confidence in his economic agenda, but some economists and former officials warn that time may be running out for China to embrace necessary reforms.

China is considering further easing measures in the property market and increasing fiscal support for infrastructure investment to boost economic growth in the fourth quarter, as sluggish demand remains a challenge.

China's economic growth has slowed but has not collapsed, and while there are concerns about financial risks and a potential property crisis, there are also bright spots such as the growth of the new energy and technology sectors that could boost the economy.

China's measures to support the property sector are lowering monthly mortgage payments for homeowners but also reducing interest earnings on bank deposits, highlighting the challenge of promoting consumer spending in a weak economic climate.

China's consumer prices returned to positive territory in August as deflation pressures ease, but analysts warn that more policy support is needed to boost consumer demand in the economy.

China's Belt and Road Initiative, which has expanded global investments and trade, is facing challenges due to economic slowdown, defaults, and the impact of COVID-19, leading President Xi Jinping to prioritize profitability in projects and explore new approaches to economic assistance.

Chinese cities are removing restrictions on home buying as part of efforts to revive the economy and support the property sector, which accounts for a significant portion of the country's economic activity.

China is showing signs of a balance-sheet recession similar to Japan's, with accumulating debt and falling house prices, but there are key differences that suggest it may not face the same fate. State-owned enterprises and property developers account for much of China's debt, and households have low debt relative to their assets. However, the Chinese government's reluctance to increase spending could prolong the recession.

Insufficient domestic demand is labeled as a major challenge facing China's economy, and to address this issue, income distribution needs to be adjusted to increase purchasing power and consumption or stimulate investment.

China's economic recovery is being hindered by heavily indebted local government financial vehicles (LGFVs), which were created to build public infrastructure but are now a ticking time bomb that restrains the country's ability to spend its way out of the current economic slowdown. The options for President Xi Jinping are limited, but a harsher solution like a fire sale of LGFVs' assets may be necessary to address the debt overhang and revive economic growth.

China's central bank will take measures to boost demand, support price rebound, and create a favorable monetary and financial environment to enhance economic vitality, according to an unnamed senior central bank official.

China's economy is facing both cyclical and structural stress, but the government is well-equipped to manage the situation through incremental stimulus and reform, according to U.S.-China Business Council President Craig Allen.

Economic activity in China appears to improve in August as industrial production and retail sales show growth, however, the real estate sector continues to face challenges with property investment and sales declining, leading Moody's to downgrade its outlook for the sector.

Chinese economic data showed signs of improvement in August, with retail sales and industrial production exceeding expectations, and key commodities experiencing growth, although challenges remain in the property market.

China's economy is facing challenges due to its real estate crisis and high levels of mortgage debt, but the government is hesitant to provide fiscal stimulus or redistribute wealth, instead aiming to rely on lending to avoid a potential recession. Banks have cut interest rates and reserve requirements, but it is unlikely to stimulate borrowing. However, economists predict that policymakers will intensify efforts in the coming months, such as changing the definition of first-time home buyers and implementing property easing measures, to address the economic downturn.

Signs of improvement in China's economy, such as improving credit demand and easing deflationary pressures, may not be enough to stabilize the economy due to bigger concerns of decreasing affordability, tight wages, and rising costs that have not been addressed. A comprehensive policy revamp may be necessary for China's economy to recover.

China's economic data for August shows a mixed picture, with retail sales and production on the rise, property investment declining, and the urban jobless rate ticking downward, leading experts to believe that while there may be modest improvements in growth, a strong recovery is still unlikely.

China's credit is expanding rapidly, with total social financing increasing by over 3 trillion yuan in August, mainly driven by government financing, indicating positive signs of economic stabilization and recovery from the slump in the second quarter. Additionally, recent policy measures, particularly in fiscal and property sectors, are expected to further stimulate the economy.

China will accelerate the introduction of policies to consolidate its economic recovery, focusing on deepening reforms and further opening up, after the economy showed signs of stabilizing, according to state media.

China's middle class is becoming more conservative and cutting back on luxury spending and investing in order to prioritize saving, supporting parents, and preparing for potential health problems, indicating a shift towards safety and short-term sustainability rather than conspicuous consumption and long-term investment.