Main Topic: U.S. consumer confidence increases to a two-year high in July, but mixed signals persist.

Key Points:

1. Consumers remain fearful of a recession due to interest rate hikes.

2. Consumers plan to buy motor vehicles and houses, but fewer anticipate purchasing major household appliances.

3. Consumers intend to spend less on discretionary services but expect to increase spending on healthcare and streaming services.

Fresh signs of stress in U.S. consumer spending are emerging as retailers like Macy's and Foot Locker lower profit forecasts, indicating that middle-income Americans are spending less due to high living costs and existing card debt.

As student loan payments resume, major retail and food chains in the US are warning investors about a potential slowdown in consumer spending, with retailers like Macy's, Target, and Ulta identified as particularly vulnerable due to their exposure to younger, low-income consumers with student loans.

US consumer spending is showing resilience and robust growth, although signs of a slowdown are emerging, potentially related to the public's perception of a deteriorating financial situation due to high inflation and rising interest rates, despite the fact that households still have higher deposits compared to pre-pandemic levels.

The US economy is expected to slow in the coming months due to the Federal Reserve's efforts to combat inflation, which could lead to softer consumer spending and a decrease in stock market returns. Additionally, the resumption of student loan payments in October and the American consumer's credit card addiction pose further uncertainties for the economy. Meanwhile, Germany's economy is facing a contraction and a prolonged recession, which is a stark contrast to its past economic outperformance.

The impending resumption of student loan payments after a three-year pause due to the pandemic is causing financial strain for borrowers, potentially leading to defaults and economic repercussions, despite some borrowers using the pause to pay down debt and improve their financial situation.

More Americans are struggling to keep up with car loan and credit card payments, particularly lower-income earners, as higher prices and rising borrowing costs put pressure on household budgets, signaling potential consumer stress; the situation is expected to worsen as interest rates continue to rise and paused student loan payments resume.

Americans facing high prices and interest rates are struggling to repay credit card and auto loans, leading to rising delinquencies and defaults with no immediate relief in sight, particularly for low-income individuals, as analysts expect the situation to worsen before it improves.

Struggling U.S. families relying on credit card loans to cover living expenses may face a spending correction soon, as consumers continue to spend despite rising rates and living costs, leading to potential unsustainable debt levels and limited access to credit.

U.S. consumer spending increased in July, boosting the economy and reducing recession risks, but the pace is likely unsustainable as households dip into their savings and face potential challenges from student debt repayments and higher borrowing costs.

Consumer spending has remained resilient, preventing the US economy from entering a recession, and this trend will likely continue due to low household debt-to-income levels.

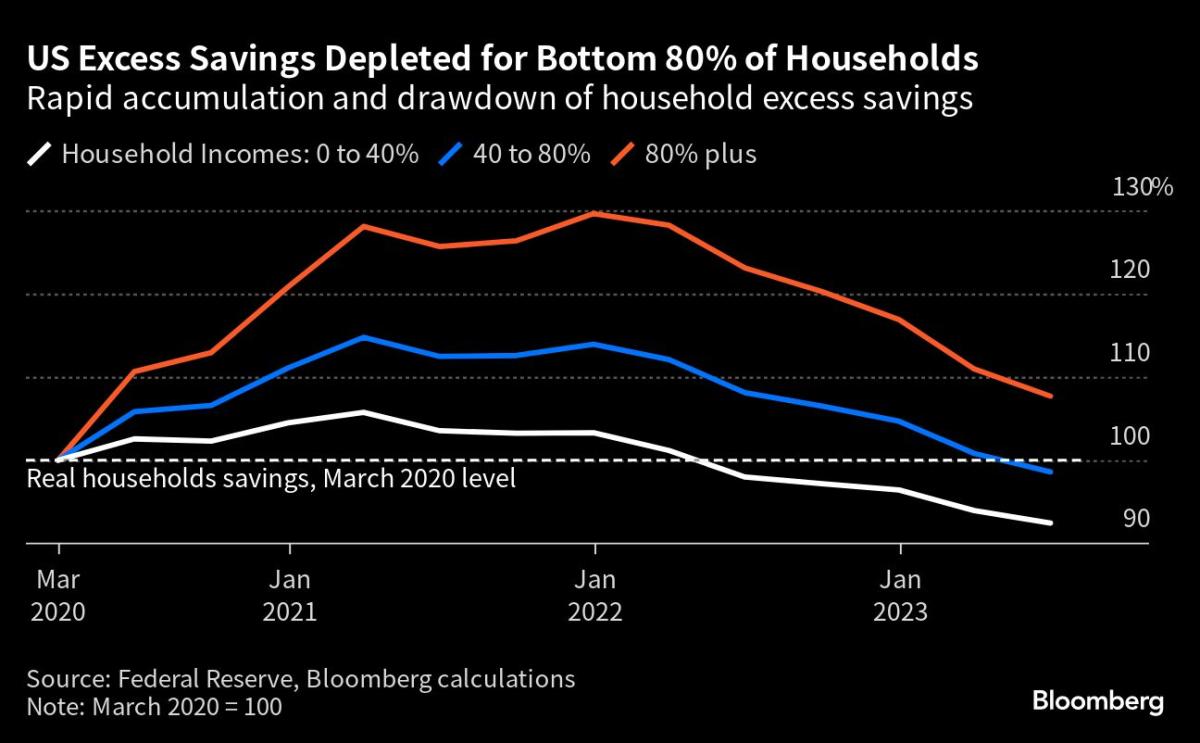

U.S. consumers have accumulated $43 billion in additional credit card debt during Q2 2022, three times the average amount since the Great Recession, and credit card interest rates have soared to over 20%, raising concerns about the impact of inflation and rising interest rates on consumers' ability to pay off their balances. However, some economists argue that higher wages are helping consumers keep pace with their debt, and the overall rate of charge-offs remains low. Nonetheless, the combination of spent-down pandemic savings and the resumption of federal student loan payments could pose challenges for lower-income borrowers and hinder consumer spending.

Despite increased household wealth in the US, millions of households are struggling financially due to inflation, high interest rates, and rising living costs, which have led to record levels of debt and limited access to credit.

Consumer spending in the US has supported the economy despite concerns of a recession, but rising interest rates, the resumption of student loan payments, and dwindling savings are predicted to put pressure on consumers and potentially lead to a shrinking of personal consumption.

Consumer spending in the US is showing signs of cooling, with retail sales expected to slow down in August, indicating that the resilience of the consumer may be waning due to increased borrowing, depleted savings, and the impact of inflation.

The US economy shows signs of weakness despite pockets of strength, with inflation still above the Fed's 2% target and consumer spending facing challenges ahead, such as the restart of student loan payments and the drain on savings from the pandemic.

Rising interest rates caused by the steepest monetary tightening campaign in a generation are causing financial distress for borrowers worldwide, threatening the survival of businesses and forcing individuals to consider selling assets or cut back on expenses.

Potential risks including an autoworkers strike, a possible government shutdown, and the resumption of student loan repayments are posing challenges to the Federal Reserve's goal of controlling inflation without causing a recession. These disruptions could dampen consumer spending, lead to higher car prices, and negatively impact business and consumer confidence, potentially pushing the economy off course.

The regional banking crisis in the U.S. during March of this year has had lasting effects on the industry and the economy, with tightened credit conditions and a risk of over-correction in interest rates, according to interviews with regional bank executives and economists.

The impending federal shutdown, combined with other economic challenges such as rising gas prices, student loan payments, and reduced pandemic savings, is expected to strain American households and potentially weaken economic growth in the last quarter of the year.

As federal student loan payments are set to resume, surveys indicate that the majority of borrowers plan to cut back on spending and will have difficulty saving for retirement, potentially leading to a drop in consumer spending and impacting economic growth. Some borrowers are already struggling with increased stress and debt from additional financial obligations taken on during the payment pause, while higher-earning households also anticipate difficulties in making payments. While there are options available, such as income-based repayment plans or a one-year grace period, the overall financial strain is expected to have significant repercussions.

Rising inflation and interest rates are causing financial hardship for consumers, potentially becoming a major election issue as it affects voters' take-home pay and purchasing power.

The current state of the consumer is concerning as wages are not keeping up with inflation, excess savings from the pandemic have been depleted, and increasing levels of credit card debt are making it difficult to maintain spending levels, leading to potential economic headwinds.

The resumption of student loan repayments will lead to a significant decrease in consumer spending, causing a contraction in real consumer spending growth and an increase in student loan delinquency rates, according to Fitch Ratings.

The strength of the US consumer, which has been propping up the economy, is starting to crack due to factors such as student loan payments, soaring gas prices, rising insurance premiums, dwindling personal savings, and potential disruptions like the United Auto Workers strike and a potential government shutdown, raising concerns about a possible recession.

Bank of America's data indicates a slowdown in consumer spending, with spending on their credit cards decreasing and other categories, particularly discretionary ones, slowing down as well. This suggests cracks in the resilient consumer narrative and could potentially prompt the Federal Reserve to hike interest rates.

The US may be at risk of a recession due to factors such as a potential auto strike, the resumption of student-loan repayments, rising oil prices, and a global economic slowdown.

Student loan repayments, which have resumed after a three-year pause, may not cause a recession in the US economy as the debt is concentrated among a small number of households, but it will likely impact consumer spending and potentially slow down economic growth.

The surge in long-term U.S. government borrowing costs is causing financial distress in global markets, with concerns about a government shutdown, the fading prospect of fiscal peace, and the Bank of Japan's battle to hold up the yen intensifying the situation.

Surging interest rates pose challenges for the US economy and threaten the Federal Reserve's efforts to control inflation without causing a deep recession, as borrowing costs rise for mortgages, auto loans, and credit card debt, and other factors such as higher gas prices, student loan payments, autoworker strikes, and the risk of a government shutdown loom large, potentially reducing consumer spending and slowing economic growth.

Despite efforts by Federal Reserve Chair Jerome Powell to curb borrowing and spending habits, many American companies, both investment-grade and sub-investment grade, have continued to borrow more money, potentially indicating that interest rates may need to be raised even higher to effectively break the cycle. Increased borrowing has raised concerns about the financial health and stability of businesses, with indicators of companies' ability to make payments deteriorating. The borrowing spree is primarily a North American phenomenon, as European and Asian companies have added far less debt or decreased their borrowing.

More than half of Americans are struggling to pay their bills as high costs, inflation, and stagnant or declining incomes continue to make consumers angry and dissatisfied.

The resumption of student loan payments in the US raises concerns about the financial vulnerability of borrowers, although the Biden administration's SAVE plan is expected to alleviate some of the burden by offering more generous repayment options. Black borrowers, who already have larger outstanding debts on average, face additional challenges in paying down their loans due to earning disparities in the labor market. The growth of student loan debt has slowed during the payment pause, but it remains to be seen how it will change once the pause ends.

US corporate bankruptcies are increasing due to higher interest rates set by the Federal Reserve, leading to higher borrowing costs and putting pressure on companies with high levels of debt.

American families are facing a variety of financial challenges, including inflation, high costs of living, and increasing mortgage rates, which are making it difficult for young families to buy homes; in addition, sudden job loss can lead to a financial doom spiral.

The cost of borrowing in the United States is expected to remain high for the foreseeable future, impacting businesses, homeowners, and public officials who may have to postpone big purchases and investments. This credit crunch is also affecting small banks and businesses, such as Liz Field's Cheesecakery, which are struggling to keep up with rising monthly loan payments and are being forced to make difficult financial decisions.

The US economy is at risk of significant damage due to a soaring national debt, with experts warning of a potential credit event and unsustainable interest payments exceeding half of the national budget.

The tightening of financial conditions in the US economy, driven by rising borrowing costs, is starting to have an impact on small and regional banks, potentially leading to a contraction in credit availability and a recession.

Americans are facing difficulty in paying off their debts as savings decline and interest rate hikes increase financing costs, leading to an increase in credit card, mortgage, and autopayment delinquencies.

US consumer spending exceeded expectations, rising 0.7% in September and contributing to the strong economic growth seen in the last quarter, fueled by solid wage growth and drawdown of savings accumulated during the pandemic, although the resumption of student loan repayments and higher borrowing costs pose potential challenges for future spending.