Some Federal Reserve officials are reconsidering their previously projected rate cuts for this year, with four officials now seeing rates staying above 5% and only one seeing rates dipping below 4.5%; the decision on whether to cut rates depends on balancing the risks of losing control over inflation or triggering a recession.

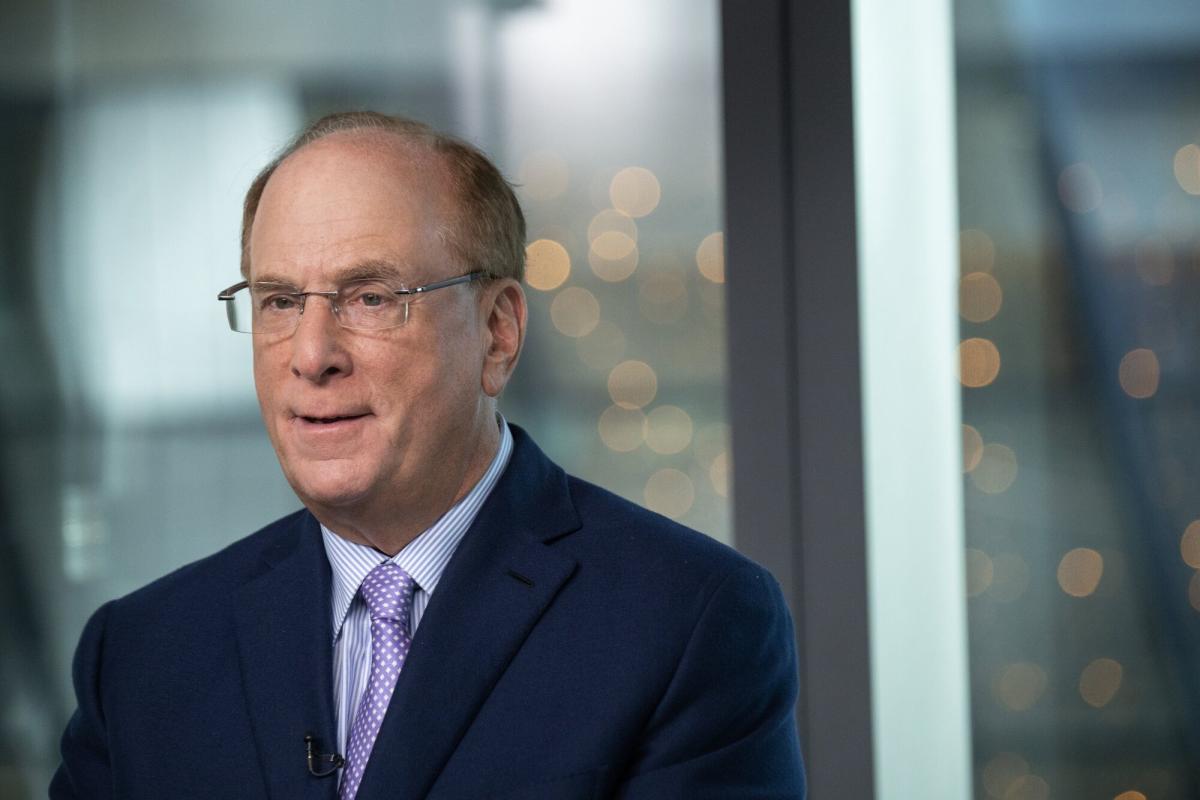

BlackRock CEO Larry Fink warns that the US public debt situation is urgent and calls for policies to stimulate economic growth.

Former Reserve Bank of India governor, Raghuram Rajan, believes that India needs to address major structural problems, such as improving education and workforce skills, in order to achieve its economic potential rather than believing in hype around its strong economic growth.

The founder of Pantheon Macroeconomics, Ian Shepherdson, predicts a significant slowdown in the US labor market starting in Q2 2024, leading to a weaker economy and the need for five rate cuts from the Federal Reserve instead of three.

India must take proactive measures to address declining fertility rates and the resulting demographic challenges, including providing social security and healthcare for the aging population and generating employment opportunities, in order to avoid economic slowdowns and capitalize on its youthful demographic advantage.

Former central bank Governor Raghuram Rajan warns that India's strong economic growth is misleading and highlights the need to address structural problems, particularly in the education system, in order to unlock the potential of its young workforce. He criticizes the focus on high-profile projects like chip manufacturing instead of investing in education and creating jobs. Rajan also emphasizes the importance of reducing inequality, increasing labor-intensive production, and devolving control to states for improved development.

Financial markets anticipate too many interest rate cuts from the Bank of England, with traders pricing in three quarter-point reductions by the end of the year, according to Dr. Catherine Mann, a policymaker at the central bank. Mann believes the market is pricing in too many cuts given the stronger wage dynamics in the UK compared to the US and eurozone, making it unlikely that the Bank of England will cut rates sooner than its counterparts.

Finland and the UK have the highest housing expenditure in Europe, with people in Finland spending 24% of their total expenditure on housing, while Poland has the lowest share of spending on housing. The price of housing is highest in the UK, followed by New Zealand, Australia, and Ireland, while Turkey has experienced the most significant increase in house prices in Europe. Rising house prices and rents are a major concern, particularly in Greece, where it is a significant issue for voters in the upcoming EU elections. The UK consumes less housing relative to its overall prosperity compared to other OECD countries.

China has designated the Nansha district in Guangdong province as the hub for its unmanned equipment industry, in line with its plans to lead in drones, autonomous vehicles, and civil aviation. Nansha will develop a citywide management system for unmanned vehicles and establish industry standards for the "low-altitude economy," which includes industries centered around manned and unmanned vehicles operating below 1,000 meters. The district is expected to generate pioneering experiences that will drive technological advancements on a national scale.

China's efforts to combat negative perceptions of its economy received support from CEOs of top global companies, including Apple's Tim Cook, who expressed enthusiasm for the Chinese market and praised its vibrancy, while attending the China Development Forum. The forum, along with other events this week, serves as an opportunity for China to attract foreign investment and showcase its economic recovery.

Private-sector wages in Argentina experienced the largest monthly decline in nearly three decades after President Javier Milei's currency devaluation, leading to a significant drop in consumer purchasing power and contributing to double-digit declines in small business spending every month since he took office.

Certain Western countries are using the pretext of an "overcapacity problem" to hinder China's development and international cooperation, while ignoring their own overcapacity issues in the military-industrial sector.

Australian consumer sentiment eases in March due to concerns about the economy and family finances, with pessimists outnumbering optimists, according to a survey by Westpac-Melbourne Institute.

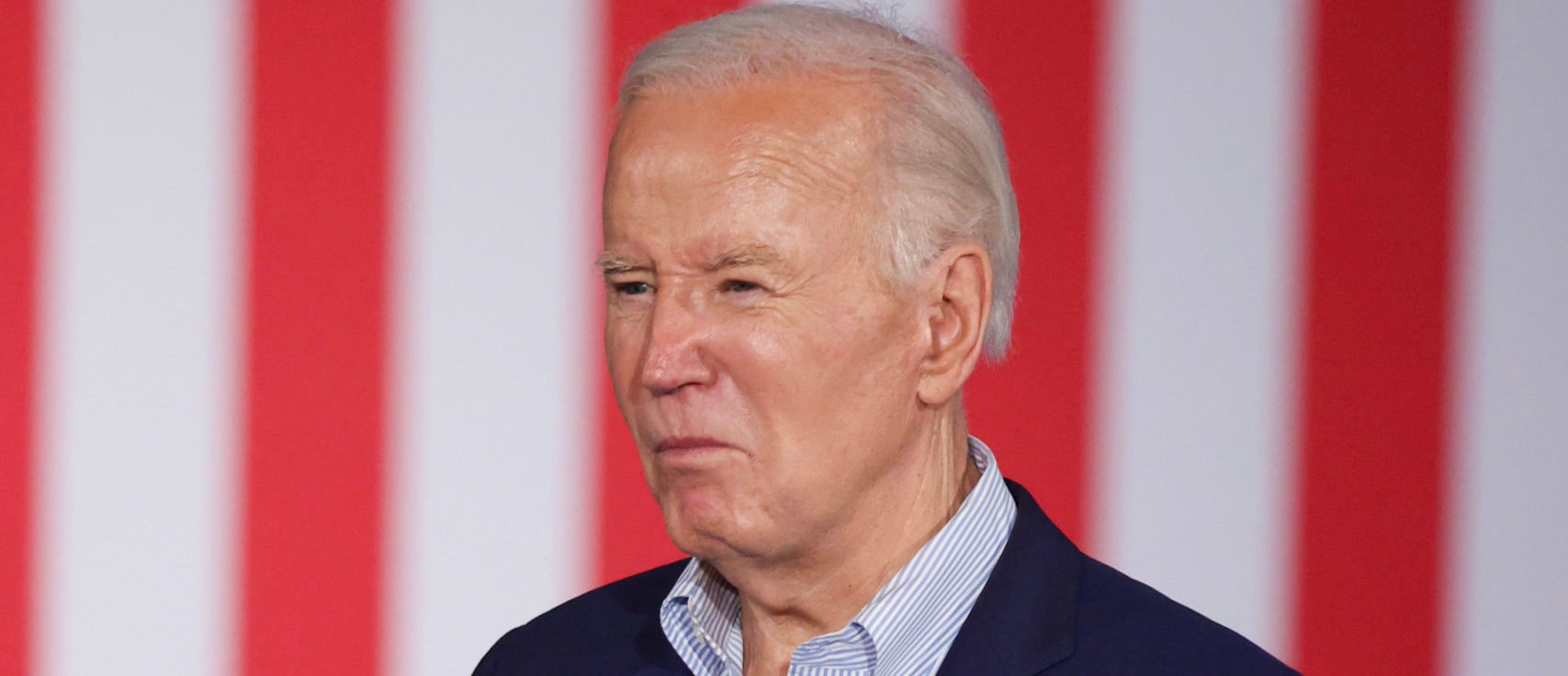

The unemployment rate increased in most states over the past year, with only three states experiencing statistically significant declines, despite President Biden's claims of a strong economy, according to the Bureau of Labor Statistics. California had the highest unemployment rate, while North Dakota had the lowest, and overall, the unemployment rate rose in 28 states. Inflation has also remained a concern, with prices increasing by 18.5% since Biden took office, although it has decelerated to 3.2% as of February. Immigration has recently overshadowed inflation as a top concern for voters.

Chicago Fed President Austan Goolsbee discusses recent inflation readings, confirms that three rate cuts are in line with his thinking, and emphasizes caution in relying solely on the Taylor Rule for Fed decision-making.

California's unemployment rate has reached 5.3%, the highest in the country, with a discrepancy in job creation numbers and indicators pointing to a slowdown in the state's economy, potentially due to over-hiring in the tech sector and the impact of the SAG-AFTRA strike.

Daily Kos is highlighting ways to get involved in upcoming elections and expressing solidarity with the Black community.

The pandemic has led to a retirement boom as older workers, particularly those without college degrees and white workers, choose to retire early due to COVID-19 vulnerabilities, a surging stock market, and concerns about safety and physical health; meanwhile, manufacturing in Texas weakened in March, indicating softening demand, though expectations for future production remain high; and there is a better balance between inflation and labor markets, according to Fed Governor Lisa Cook, who suggests a careful approach to future interest rate cuts.

:max_bytes(150000):strip_icc()/GettyImages-638770149web-574f6e973df78c9b463c8a39.jpg)

China's efforts to stimulate its economy by encouraging investments in the manufacturing sector could lead to higher inflation in the US, according to research from the New York Federal Reserve.

Rising global temperatures are driving inflation in food prices, both in hotter regions and in non-tropical countries, leading to potential climate-induced inflation increases in the future.

Big food manufacturers, like Kellogg's, are reducing the size of their products without reducing prices, a practice known as "shrinkflation," making it difficult for consumers to compare prices and exacerbating the cost-of-living crisis. Researchers at Deakin University found that several Kellogg's cereal boxes had shrunk since 2019, while pricing discrepancies were observed among different pack sizes. This trend raises concerns about the nutritional value and affordability of breakfast cereals.

Moody's Ratings has upgraded Detroit's credit rating to investment grade, marking a significant milestone for the once-bankrupt city.

Investment banks and Wall Street investors have shifted their outlook on the US economy, with a majority now believing in a "no landing" scenario of slightly above target inflation and robust economic growth, instead of a recession or "soft landing", as US consumers and businesses have proven to be resilient, according to Deutsche Bank's Global Markets Survey.

Sales of new homes in the Northeast and Midwest dropped in February due to high mortgage rates, leading to an overall decline in the national market, while the South and West saw some positive numbers; analysts blame the disappointing figures on rising mortgage rates.

Russia's economy is predicted to weaken due to a decrease in economic growth, challenges in controlling inflation, a decline in private consumption and investment, and a slowdown in wage growth, all influenced by the country's war against Ukraine.

Warren Buffett advocates for increasing access to the Earned Income Tax Credit (EITC) as a solution to support working-class families, stating that the wealthy are not responsible for the wealth gap and praising the effectiveness of the EITC in aiding those disadvantaged by the market system.

China's new economic reality under Xi Jinping prioritizes control over growth, with restrictions imposed on real estate, billionaire entrepreneurs, and foreign firms, as Xi prepares the economy for war and directs investment towards strategic needs, according to analysts from Garnaut Global.

China is unlikely to push Apple out of the country despite restrictions on US businesses, as the country values Apple's critical position in the supply chain and its importance in terms of jobs and access to technology, according to experts.

Pakistan is seeking another bailout from the IMF to tackle its economic crisis, as political instability, corruption, mismanagement, the COVID-19 pandemic, energy crisis, and climate change-induced disasters take a heavy toll on the economy. The IMF program is expected to bring stability rather than significant growth in the short run.

Argentina's economic activity is expected to have dropped by 5.5% in January, following President Javier Milei's devaluation of the peso currency and reduction in state spending to combat the country's economic crisis.

Despite positive economic indicators such as GDP growth and employment gains, there is a gap between public sentiment about the economy and its actual performance, with factors such as economic inequality, negative news coverage, and partisan affiliations playing a role. However, one crucial factor that influences public perception is inflation, as rising prices impact purchasing power and erode wages and incomes, ultimately shaping voters' economic sentiments.

Warren Buffett advocates for increasing access to the Earned Income Tax Credit (EITC) as a solution to support working-class families and narrow the wealth gap, believing that the rich are not responsible for the economic divide.

Ghana is facing a funding crisis as its cocoa crop shortage leaves it unable to secure the necessary funds, causing the country to turn to traders to bridge the gap.

The Federal Reserve's rate hikes have caused interest costs for junk-rated US companies to rise, putting a strain on their finances and posing a risk for investors in high-yield debt. The ratio between companies' earnings and their interest expense has fallen to its lowest level since the pandemic, making it more difficult for them to service their debt. This deterioration in debt-service coverage ratios could lead to ratings downgrades and corporate defaults.

The number of people living in absolute poverty in Italy reached its highest level in about a decade in 2023, despite the country's economic rebound since the easing of COVID restrictions.

Chicago Federal Reserve Bank President Austan Goolsbee revealed that he expects three rate cuts this year, aligning with the median estimate projected by policymakers at the Federal Reserve's policy meeting last week.

Federal Reserve Governor Lisa Cook urges caution in deciding when to cut interest rates, citing the need to balance the risks of easing too soon or too slowly, despite the improving balance between employment and inflation goals.

Federal Reserve Bank of Atlanta President, Raphael Bostic, expects one interest-rate cut this year and believes that the central bank can afford to be patient as long as the economy remains strong.

The Nigerian National Petroleum Company (NNPC) has reduced the depot price of petrol from N640 to N570 per litre, which is expected to lead to a drop in the cost of petrol for consumers.

Argentina's markets are experiencing a rally, supported by fiscal tightening and pro-investor measures implemented by President Javier Milei, despite economic challenges such as rising poverty and inflation.

Federal Reserve Bank of Chicago President Austan Goolsbee believes that three rate cuts in 2024 are in line with his thinking, although he emphasizes that these projections are not forward guidance, and he highlights the need for improvement in housing inflation. Goolsbee also states that interest rates and the balance sheet runoff should be on separate tracks and discusses the strength of the consumer and the importance of keeping decisions about the balance sheet separate from monetary policy decisions.

The cost of food has risen significantly in recent years, with a 25% increase between 2019 and 2023, leading to higher expenses for American households; however, there are several ways to keep food costs down, including limiting purchases of the most inflated items, choosing cheaper grocery stores, reducing food waste, looking for deals and coupons, and even growing some food of your own.

U.S. home prices are growing at a slower pace, returning to pre-pandemic trends, despite higher mortgage rates, but the market is still unaffordable for most buyers and inventory remains limited, leading to low levels of transactions and dissatisfaction among both sellers and buyers. The rate lock-in effect is starting to weaken, slightly boosting the supply of homes, and experts predict that mortgage rates will decline and home prices will remain flat or unchanged nationally.

Credible, a personal finance marketplace, provides information on today's mortgage rates and offers tips on obtaining the best rate by comparing lenders and loan offers.

The claim that the U.S. economy added 15 million jobs under President Biden is partially true, as while there was a gain of 14.9 million jobs from the start of his term to February 2024, 9 million of those jobs were lost during the COVID-19 pandemic, resulting in a net gain of 5.5 million jobs.

Goldman Sachs' chief US economist, David Mericle, believes that the chance of a recession is low, markets will continue to rally, and the recent increase in Federal Reserve oversight of United Airlines may result in project delays, according to recent interviews. Additionally, if lawmakers don't take action, millions of Americans could lose access to home internet.

The Bank of Ghana kept its benchmark interest rate unchanged at 29%, citing modest upside risks to inflation and the need for close monitoring.

UK energy regulator Ofgem is considering a "dynamic" price cap that would vary based on the time of day households use their appliances, as it becomes more difficult to retain a universal price cap suitable for everyone, amid changing energy consumption habits and a growing market for electric vehicles, heat pumps, and solar panels.

Charlotte Cardin, Talk, and the Beaches were the notable winners at the Juno Awards in Halifax, while Nelly Furtado flew through the event; meanwhile, Elon Musk's company X is funding legal bills for a Canadian doctor chastised over her COVID-19 tweets, a Calgary judge ruled in favor of a 27-year-old receiving medical assistance in dying despite her father's objections, a mother in Nova Scotia blames cannabis packaging for her child's hospitalization after consuming it, Diddy's homes were raided by federal agents, a retirement residence in Mississauga is closing down and evicting about 200 seniors, Rebel Wilson named Sacha Baron Cohen as the star trying to threaten her over her memoir, a woman has been charged after her dog seriously injured a child in Toronto, four men charged in the Moscow attack appeared in court showing signs of beatings, some women are using their phones to record the painful experience of getting an IUD, Prince William and Kate Middleton reportedly do not want any drama from Prince Harry, the NBA is investigating Jontay Porter of the Toronto Raptors amid gambling allegations, former Toronto mayor John Tory is set to rejoin the board of directors at Rogers Communications.

Sri Lankans Struggle to Afford Basics Despite Early Economic Recovery Signs Amid Harsh IMF Austerity

Sri Lankans are struggling to survive the burden of harsh austerity measures imposed by the IMF’s bailout program, as social welfare programs fail to include vulnerable individuals and tax reforms make it difficult for them to access support. Despite signs of economic recovery, many Sri Lankans continue to face dire economic situations and food insecurity.