Consumers in the U.S. are facing higher prices and turning to credit cards to make ends meet, resulting in a rise in credit card debt; however, the burden of credit card debt varies by state, with Louisiana, Mississippi, Oklahoma, and West Virginia being the most burdened states. Massachusetts, Minnesota, New Hampshire, California, and New Jersey have the least credit card debt burden. Interestingly, the most burdened states tend to lean toward Donald Trump, while the least burdened states lean Democratic. Strategies to tackle credit card debt include balance transfer cards, debt relief strategies, side hustles, expense reduction, and utilizing upcoming cash influxes.

Three midsize Hong Kong-listed real estate companies have announced billions of dollars in net losses, highlighting the severity of the financial damage to China's distressed property developers, while China Evergrande Group has withdrawn its bankruptcy filing in New York.

Maryland's unemployment rate rose for the third consecutive month in February, while Virginia's rate remained unchanged.

Economist Sanjeev Sanyal, a member of the Economic Advisory Council to the Prime Minister, believes that preparing for the UPSC exam is a waste of time and that aspiring to become a civil servant is a poverty of aspiration, as he encourages young people to channel their energy into other areas such as entrepreneurship or innovation. He also criticizes the Indian intellectual life and academia for not expanding the limits of knowledge.

Singapore's February core inflation accelerated to its highest level in seven months, driven by seasonal effects from the Lunar New Year, with services and food prices increasing.

Singapore's core inflation in February increased to 3.6%, the highest since July 2023, largely due to Chinese New Year spending, leading to higher services and food inflation.

The Bank of Ghana is expected to keep interest rates unchanged in order to address inflation and stabilize the cedi, which has weakened against the dollar.

The Bank of England is predicted to slash interest rates to 3% by the end of next year as inflation drops, which will benefit mortgage borrowers, while economists at KPMG warn that failing to cut rates would harm the economy. KPMG also expects a slow recovery from the recession, with low growth rates and concerns over demand, investment, and productivity. However, data from job search engine Adzuna suggests signs of recovery in the job market, with a smaller drop in vacancies and growing confidence in the UK economy.

European and global markets are starting the week slow due to the holiday, but the US will release the Federal Reserve's favored inflation measure, with hopes for a Fed rate cut in June being set back if the inflation rate is higher than expected. ECB President Lagarde and a member of the Bank of England are also scheduled to speak, and Sweden's central bank is expected to keep rates steady. The People's Bank of China has allowed the yuan to fall, but set a firmer fix on Monday.

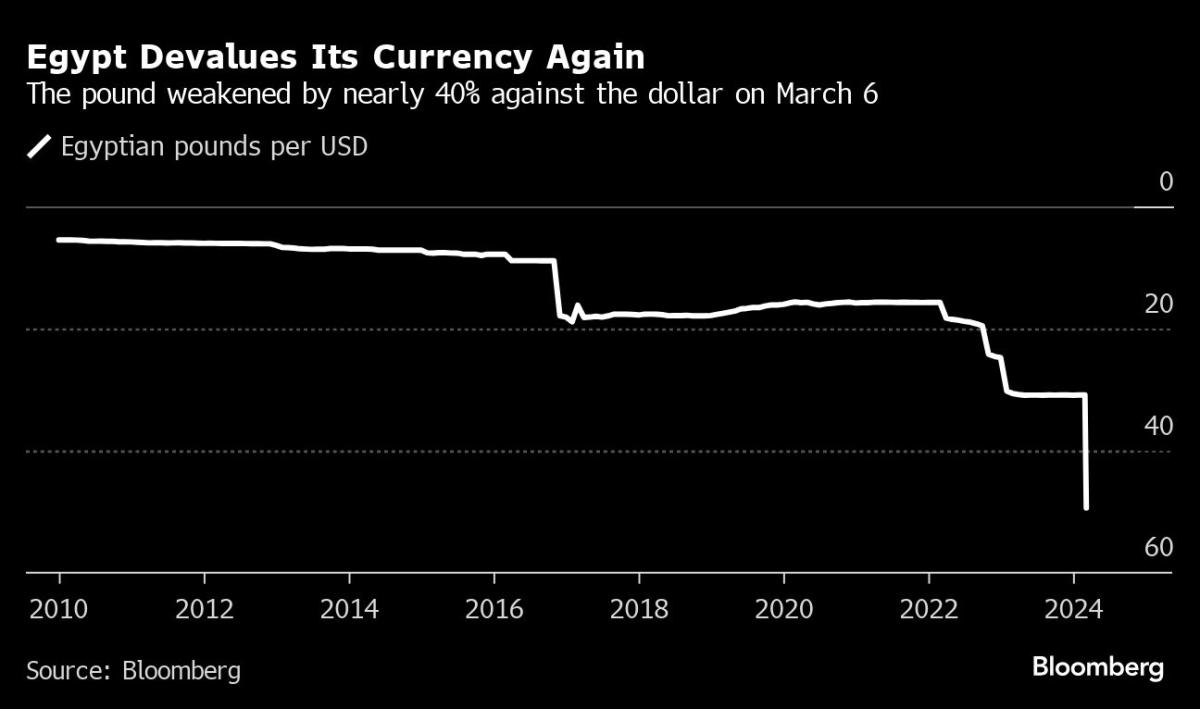

Egypt's recent international intervention and the influx of over $50 billion in investments and aid have not alleviated the economic crisis in the country, leaving many Egyptians to brace for harder times and question how much more pain they can endure after multiple currency devaluations and soaring inflation.

The UK has the highest housing costs among developed economies, spending more on housing as a proportion of total spending than any other country in the OECD, and having smaller, older, and poorer-quality homes compared to other nations.

Global business leaders at the China Development Forum expressed confidence in China's economic potential and praised its pursuit of high-quality development, emphasizing the importance of reforms for continued growth and global economic contribution.

Chinese Premier Li Qiang assures investors that Beijing will implement supportive measures for economic growth and downplays concerns about challenges facing the economy, as the International Monetary Fund calls for pro-market reforms.

The share of newly-created positions in Singapore's job market reached a record high of 47.3% in 2023, reflecting the evolving nature of the economy and the demand for skilled workers in sectors such as information and communications.

Southeast Asia is facing challenges in decarbonization as rising costs for metals and minerals due to the demand for electric vehicles have led to inflation and financing concerns in countries like Indonesia, Malaysia, and Vietnam.

According to the IMF, Asia's economic growth is expected to improve, but there are still concerns such as China's property market crisis and inflation, as well as geopolitical tensions in the Middle East that could impact global trade. Despite these challenges, companies such as JD.com, Reliance Industries, and SM Investments are driving economic growth in the region. The article also lists the 25 poorest countries in Asia based on GDP per capita, with Iran, Turkmenistan, and Azerbaijan among them.

Rising temperatures caused by climate change could lead to a 3.2% increase in food prices per year, exacerbating global food insecurity and disproportionately affecting low-income countries, according to a study by German researchers. The study also highlights how climate change is already impacting food availability and access in regions such as West Africa, where shifting seasons, pests, diseases, and reduced rainfall are making farming more challenging. The findings emphasize the need for greenhouse gas emissions reduction and economic diversification to protect vulnerable communities from the impacts of rising food prices.

China must reinvent itself with new economic policies to address the property market crisis, boost domestic consumption, and increase productivity, according to the Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva, who emphasized the need for a consumer-centered policy mix to add $3.5 trillion to China's economy over the next 15 years.

Pakistan's current financial crisis cannot be solved by reducing allocations to the provinces, as economic growth is the key to reducing debt burden and the problem lies in the increase of debt burden rather than the NFC award, with the federal government's failure to grow tax revenues and control expenditures being a major factor.

Leading social scientists have warned that adopting US-style executive pay packages in the UK could lead to higher inequality and lower levels of happiness, health, and wellbeing across society, despite business leaders and the London Stock Exchange arguing for higher pay awards to improve competitiveness. The call comes as the bosses of the 100 largest UK-listed companies saw a 16% increase in median average pay in 2022, reaching £4.4m, 118 times higher than the median UK worker, according to the High Pay Centre.

The UK has an "expensive, cramped and ageing" housing stock compared to other advanced nations, with households paying more but receiving inferior housing in terms of quantity and quality, according to analysis by the Resolution Foundation. The study found that homes in England have less average floor space per person than similar countries, and a high proportion of UK homes are old and poorly insulated. The report also highlighted the high cost of housing services in the UK compared to the OECD average.

Honeywell sees India as a key growth market in the energy sector, focusing on expanding its footprint in the country and supporting both fossil fuels and sustainable technologies, as India's energy landscape evolves towards sustainability-based applications across sectors.

Chinese officials are adopting a new strategy of making early disclosures on positive economic news to boost market confidence as the country faces a slowdown in its economy.

Pakistan's economic decline compared to India and Bangladesh can be attributed to political instability and the lack of a long-term growth strategy, resulting in reliance on IMF bailout packages and a limited range of low-value-added exports.

The federal government plans to advocate for minimum and award wage increases in line with inflation, citing ongoing high inflation and the financial strain faced by low-paid workers.

The Bank of Ghana reported a decrease in the average lending rate to 32.77% in February 2024, down from 33.75% in December 2023, marking a monthly rate of 2.73%, aligning with the country's disinflation efforts.

The Hurun India Rich List 2023 reveals that there are 1,319 individuals in the country with wealth exceeding Rs 1,000 crore, marking a significant increase and surpassing the 1,300 mark for the first time, indicating a contrast with declines in China and the UK and stagnant growth in Europe.

The Federal Reserve is signaling a willingness to cut interest rates to prevent a job-cutting spiral, even at the cost of slightly higher inflation, as unemployment rates rise and concerns about the labor market grow.

Despite signs of economic recovery, UK Prime Minister Boris Johnson may face challenges in the upcoming general election due to persistent issues with the cost of living crisis, including rising prices for everyday goods and services, high taxes, and stagnant wage growth.

Walmart has faced criticism for driving inflation through price increases on its house brands, with the retailer's revenue soaring and its net income spiking 93% to $10.5 billion, according to former U.S. labor secretary Robert Reich; however, the veracity of a viral TikTok video showing the price hikes has not been independently verified.

The annual U.S. Agricultural Market Outlook report predicts declining farm income and higher costs for producers due to low commodity prices, trade challenges, and increased expenses, which is concerning for the agriculture industry as Congress works on a new farm bill.

Germany's economy is facing significant weaknesses, including a potential recession, falling price competitiveness, slow growth, and a lack of fiscal policy flexibility, which could impact its role as a leader in Europe and hinder closer integration of the European Union.

Despite strong consumer spending in the years after the pandemic recession, new vehicle purchases in Oregon have remained stagnant, likely due to supply chain disruptions, inflation, and changes in driving habits; however, a rebound is expected as the auto industry recovers and more cars become readily available on dealers' lots.

Sugar taxes on soft drinks have shown promising results in reducing consumption and calorie intake, but experts argue that they need to be expanded to cover a broader range of unhealthy foods and beverages, such as high-salt foods and fruit juices, to effectively combat lifestyle-related illnesses and obesity. Furthermore, there is a need for stricter regulations on food advertising, clearer food labels, and making healthier alternatives more affordable to lower-income communities.

The Federal Reserve and analysts expect strong economic growth in the U.S. to continue without signs of a recession, thanks to robust corporate earnings, a resilient stock market, and potential productivity gains, despite interest rates being at their highest levels in two decades. However, the possibility of an economic shock or unexpected inflation could potentially lead to a downturn. In other news, social media company Reddit made its debut on the New York Stock Exchange, with shares surging on its first day of trading.

The content provided is incomplete and does not represent a text that can be summarized.

The input text does not contain enough information to generate a summary.

The battle for succession within LVMH, Europe's largest company, poses a high risk to the wider Continental economy as Bernard Arnault's five children compete for control, potentially destabilizing the French stock market and the overall European economy.

Turkey's central bank has raised its key interest rates by 500 basis points to 50% in an effort to combat high inflation and assert its independence from political influences. The rate hike led to a rally for the Turkish lira and an increase in the value of dollar-denominated bonds.

The Nigerian government spent $3.5 billion on debt service in 2023, with commercial loans accounting for the majority of the cost, as Nigeria's debt stock rose to N97.38 trillion by the end of the year.

Pawn shop inventory is increasing across the United States, signaling that the lowest-income Americans are still struggling despite President Biden's positive economic indicators, such as rising job growth and wages and a surging stock market.

China needs to reinvent its economic policies to address its property market crisis, boost domestic consumption, and increase productivity, according to the International Monetary Fund's Managing Director, Kristalina Georgieva.

Ghana's trade surplus has fallen by more than half in the first two months of 2024 due to a smaller cocoa harvest, posing a risk to the country's currency, the cedi.

Former Saskatchewan conservative premier Brad Wall suggests finding a "middle ground" on carbon reduction that considers affordability for families and technological solutions, amid concerns over the increasing federal carbon price in Canada. Wall points to American legislation that addresses climate change without an economy-wide carbon price as an alternative model. Conservative Leader Pierre Poilievre has pledged to eliminate the carbon price if the Conservatives form the next government, emphasizing technological measures like carbon capture and nuclear power.

Irish banks are making substantial profits from customer deposits due to higher interest rates, while paying low interest rates on savings, prompting consumers to consider moving their money to alternative banking options.

China needs to reinvent itself with economic policies to resolve the property market crisis and enhance domestic consumption and productivity, according to the International Monetary Fund's Managing Director Kristalina Georgieva, who stated that a shift towards a consumer-centered policy could add $3.5 trillion to China's economy over the next 15 years.

The average price of refilling cooking gas in Nigeria has increased by 19.75% for 5kg cylinders and 28.33% for 12.5kg cylinders, putting more financial strain on households in the country.

Pakistan seeks a fresh IMF loan of at least $8 billion, while the rupee is expected to face pressure due to increased imports and demand for dollars.

China's Premier Li Keqiang has assured foreign investors that the Chinese government is addressing issues related to market access, cross-border data flow, and public tendering, while also pledging to make government services more efficient and protect the rights and interests of businesses; Li also emphasized the potential for increasing China's urbanization rate to boost consumer spending and unlock opportunities, stating that every percentage increase in the urbanization rate would move around 14 million rural residents to cities, potentially unleashing 2 trillion yuan in spending.

China has the potential to achieve significant economic growth if it implements pro-market reforms, according to the International Monetary Fund (IMF) Managing Director Kristalina Georgieva, with an estimated 20% expansion of the real economy and the addition of $3.5 trillion to the Chinese economy over the next 15 years, through measures such as improving the sustainability of the property sector and focusing on domestic consumption.