Cuba's socialist system, which once provided rations of food to its citizens, is facing an economic crisis that has led to food shortages and an exodus of people from the country.

Restaurants in Australia and New Zealand are experiencing a downturn as consumers reduce discretionary spending, leading to early closures and fewer patrons, due to economic uncertainties following the pandemic.

China's Premier Li Qiang announced that the country will issue new regulations on market access and cross-border data flows, while also welcoming foreign investment and promoting the development of emerging industries such as biological manufacturing, artificial intelligence, and the data economy.

China's Premier Li Qiang announced that the country will issue new regulations on market access and cross-border data flows and is actively promoting the development of emerging industries, such as biological manufacturing and AI, at the China Development Forum.

A report by the World Inequality Lab reveals that wealth inequality in India is at its highest level since 1922, with the top 1% of Indians holding one-fourth of the country's wealth, raising concerns about social and political repercussions. The report suggests implementing a super tax on billionaires and multimillionaires, along with restructuring the tax schedule, as potential solutions to address the growing inequality.

Pakistan must urgently develop a comprehensive economic growth strategy focused on privatization, attracting foreign investment, phasing out subsidies, dismantling cartels, and embracing free trade in order to unlock its true potential and secure its economic future.

Over 20 banks in Vietnam have reduced deposit interest rates recently, with the highest rate for 12-month deposits now at 5.3%, and bank executives and analysts expect the low rates to continue until mid-year.

Pakistan's exports to European countries have declined in the current fiscal year, mainly due to reduced demand in western, southern, and northern Europe, despite the country's GSP+ status that grants duty-free entrance to European markets. However, there has been an increase in exports to Eastern Europe.

The Pakistan Business Council praises progress on solvency but raises concerns about other aspects of economic reforms and calls for deeper engagement with the IMF to address issues such as inflation, borrowing costs, and energy tariffs.

The Iranian press is filled with complaints, criticism of the government, and dire economic forecasts as the new Iranian year begins, with prominent figures speaking out against the government's handling of economic hardships and warning of a high inflation rate and rising gasoline prices in the upcoming year.

The purchasing power of customers in Saudi Arabia during Ramadan reflects a unique blend of cultural traditions, religious observances, and economic factors, leading to a surge in local markets and online shopping for food, groceries, and other products.

Coal and lignite production in India reached the billion tonne mark, increasing by almost 7% from the previous fiscal year, with the government aiming to reduce imports and achieve self-sufficiency by March 2025. The achievement is attributed to reforms implemented since 2014, leading to an unprecedented growth in the coal mining sector and ensuring energy security for the nation.

India should shift its focus from traditional measures of economic growth, such as GDP, to a more qualitative evaluation of societal needs in order to tackle the unemployment problem and create dignified jobs, as the manufacturing sector faces challenges due to automation and robotics, while sectors like education, health, and public administration show strong growth potential. Additionally, India should consider incorporating Western best practices into its governance model, like China, the US, UK, and EU.

The Federal Reserve's preferred measure of underlying US inflation likely remained high in February, indicating caution in cutting interest rates too soon.

Navy Federal Credit Union, the largest credit union in the US, stated that an external review found no race-based decision making in its mortgage underwriting, countering previous reports of racial disparities in its mortgage approval rates.

Fixed mortgage rates are expected to fall below 4% in the coming weeks due to lower inflation figures and an optimistic outlook from the Bank of England, providing relief for homeowners and improving affordability. Lenders are anticipated to trim five-year mortgage rates, with some already announcing rate cuts, leading to a potential decrease in rates to around 4% in the next month. However, there is some caution as factors such as inflation and economic uncertainties may influence rates in the long term.

The federal government is under pressure to address the cost of living crisis in the upcoming budget, as economists warn that challenging economic conditions will persist for months to come.

Three tickets, including two in metro Atlanta, won $10,000 each in the Mega Millions drawing, while the jackpot for the next drawing reached $1.1 billion.

The reindustrialization of America, specifically focusing on energy and utility infrastructure, transportation, real estate, and steel and shipbuilding, is the top investment theme of the coming decade according to Richard Bernstein Advisors, as the US government's policies have undermined the country's economic independence and the pandemic has exposed vulnerabilities in global supply chains.

Despite Donald Trump's belief that tariffs on imported goods, particularly from China, would benefit the US economy and demonstrate American strength, economists warn that such a move could backfire, leading to an economic downturn and global consequences, including a surge in inflation and a significant decrease in global economic output. Moreover, Trump's broader economic policy plans, such as cutting federal spending to pay off the national debt, could also have severe negative impacts on the US economy.

Americans are skeptical about the state of the economy because rising interest rates, which are not included in official inflation measures, are affecting their borrowing costs and overall economic well-being, according to a new paper by economists from Harvard and the IMF.

The Denver housing market is experiencing an increase in active listings and rising prices, while buyers are waiting to see when the Federal Reserve will implement the predicted three interest rate cuts this year.

Cubans are protesting against their government as the country faces an economic crisis worsened by food shortages, power outages, and the ongoing impact of the Covid pandemic, US sanctions, and the US embargo.

High prices and social inequalities are the primary concerns for European voters ahead of the European Parliament elections, according to a poll by Ipsos for Euronews, with economic issues dominating the top five priorities for voters. Rising prices and social concerns, such as healthcare and pensions, ranked highest, reflecting the impact of inflation and slow economic growth in Europe.

Investors in Indian start-ups are becoming more cautious and reducing their investments following the falls in valuations of once-prominent firms like Paytm and Byju’s, signaling a slowdown in funding for Indian start-ups after a record-breaking year in 2021.

The number of working-age adults in the UK who are too sick to work has been steadily increasing since 2019, with 2.7 million adults currently unable to work due to long-term sickness, according to a report by the Resolution Foundation. This rise in long-term sickness is the longest sustained increase since the 1990s and is impacting both young and old workers. The report warns that stricter unemployment benefits may be pushing people towards claiming health-related benefits instead.

The number of economically inactive individuals in Britain due to long-term sickness has reached 2.7 million, attributed to the "legacy of the pandemic," leading to a surge in benefit claims and a potential crisis in the country's sickness levels.

Despite the focus on large macro numbers and development expenditure in Pakistan, the majority of these funds are allocated to schemes proposed by politicians rather than for genuine development, highlighting the issues of interest group capture and wasteful spending in the country's development efforts.

Short-term inflation in Pakistan decreased to 29.06% in the week ending March 21, mainly due to lower prices of tomatoes, onions, and potatoes.

In India, income inequality has worsened over the years, with the top 1% earning a historic peak share of the national income in 2022, surpassing levels seen in developed countries such as the United States and the United Kingdom. The bottom 50% of Indians earned only 15% of the national income, compared to 20.6% in 1951, while the middle 40% also experienced a significant decline in their share of income.

India's southern state of Tamil Nadu is experiencing a surge in overseas investment, particularly in the manufacturing sector, as global firms diversify their operations amid US-China rivalry and economic challenges in China. The state has attracted notable investments from companies like Foxconn, Pegatron, and Tata Group, as well as UPS and First Solar. With India's growing middle class and strong digital infrastructure, experts believe India has the potential to challenge China's manufacturing dominance in the future. However, India needs to address gaps in education, infrastructure, and labour laws to fully capitalize on this opportunity.

Despite predictions of a drop in high street spending due to record-breaking rainfall, retail sales in February remained flat, boosting the UK economy and giving experts confidence that the country has emerged from recession.

Central banks around the world are implementing diverse strategies in managing interest rates, with some opting for unexpected cuts, others for long-awaited hikes, and a few choosing to maintain the status quo.

A woman believes that the "know your worth" attitude among certain customer service workers, such as hairstylists and nail technicians, is contributing to inflation in the United States by causing them to charge unreasonably high prices for their services. While some agree with her argument, others argue that the rising cost of living is a bigger factor in increasing service costs.

Human Resources Minister Steven Sim has completed his 100 days in office, which marks the end of his probation period.

Federal Reserve Bank of Atlanta President Raphael Bostic expects only one interest-rate cut this year, which is likely to happen later in the year than previously anticipated, due to uncertainties surrounding inflation and the stronger-than-expected economy.

Austin, Scottsdale, and West Palm Beach are among the U.S. cities experiencing the fastest growth in millionaire residents, while traditional hubs like New York, Los Angeles, and Chicago are seeing more modest declines, according to a report by UK-based investment consultancy Henley & Partners.

California's unemployment rate has reached 5.3%, the highest in the country, due to slower job growth in the state last year than initially thought, with the federal government revealing that California added significantly fewer jobs than previously reported.

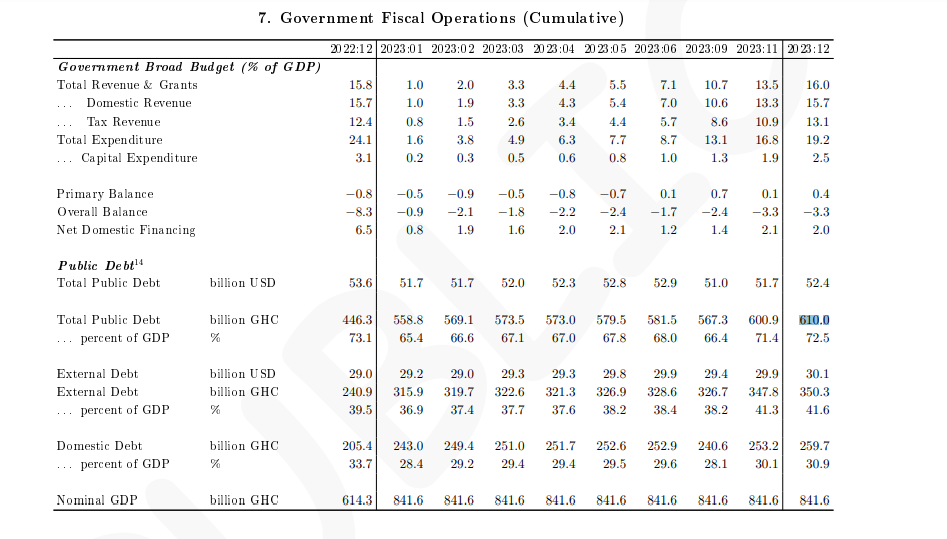

Ghana's public debt reached GH¢610 billion ($52.4 billion) at the end of 2023, equivalent to 72.5% of GDP, indicating that the country's debt situation has not improved despite completing the Domestic Debt Exchange Programme, with the domestic debt increasing by GH¢19.1 billion and the external debt increasing by GH¢23.6 billion due to cedi depreciation; however, the government's fiscal operations were on target, with a fiscal deficit-to-GDP ratio of 3.3% in December 2023.

California, the District of Columbia, and Nevada have unemployment rates higher than the national average, while the Dakotas have the lowest jobless rates in the country, despite the Federal Reserve's aggressive rate hikes and increased loan costs, according to the US Bureau of Labor Statistics.

A new report from the Federal Trade Commission reveals that grocery giants used inflation and supply chain disruptions during the pandemic to increase their profits and raise prices, prompting calls for Congress to investigate grocery profits.

Russia's central bank has kept interest rates unchanged at 16% as it faces inflation risks amid attacks on regions bordering Ukraine, and has stated that tight monetary conditions will be maintained for a long period.

Citadel CEO Ken Griffin warns that the rapidly expanding national debt poses a major risk to America's fiscal future, as the lack of daily dialogue about the issue allows the government to borrow at an irrational and dangerous rate.

The continued layoffs in the tech industry have contributed to the rising unemployment numbers in California, surpassing Nevada as the state with the highest unemployment rate in the nation.

Russian grain trader TD Rif's wheat exports have been disrupted after the country's agricultural watchdog found that its cargoes did not meet safety and quality standards, causing the company "huge losses."

The UK's PMI indicates economic growth despite a slight slowdown in March, with manufacturing activity reaching its highest level in nearly two years while the service sector saw a modest slowdown, and inflation concerns persist.

Higher interest rates and ongoing price and labor market pressures are straining the American agricultural industry and rural America, according to business and community leaders who spoke to Federal Reserve Chair Jerome Powell and fellow Fed governors at a "Fed Listens" event. Rising borrowing costs, increased energy and transportation prices, and rising wages are also impacting small and medium-sized manufacturers, while inflation is causing a perfect storm of increased costs for healthcare, childcare, transportation, insurance, groceries, and housing. However, there are signs of a cooling labor market in higher-paid sectors like technology.

Immigration is a critical factor that has been underestimated in boosting the U.S. economy's growth prospects for 2024, according to JPMorgan, with the impact of immigration on employment, consumer spending, and GDP contributing to a more optimistic outlook.

US journalist Victor Coglianese criticizes Bidenomics for increasing debt and leaving Americans poorer, while attorney Ethan Bearman argues that Trump is responsible for much of the spending; however, Bearman acknowledges that individual experiences may still be challenging despite the overall strong US economy.

Lower-income families are dining out less at chain restaurants like Olive Garden and LongHorn Steakhouse, while higher-income individuals are dining out more, indicating a two-track economy where lower-income consumers are pulling back and higher-income families are spending more.