### Summary

Many developing countries are frustrated with the dominance of the US dollar in the global financial system and are seeking alternatives, but no concrete proposals have emerged. The dollar's influence can destabilize economies and impose financial sanctions on adversaries. However, the alternatives to the dollar have not gained enough traction, and the dollar remains the most-used currency in global business.

### Facts

- The strength of the US dollar against the Nigerian currency has made imported goods, like garments, unaffordable for local consumers.

- The BRICS bloc, consisting of Brazil, Russia, India, China, and South Africa, along with other emerging market countries, are meeting to express their grievances about the dominance of the dollar in the global financial system.

- The BRICS countries have discussed expanding trade in their own currencies to reduce reliance on the dollar.

- The US dollar is the most-used currency in global business and has shrugged off past challenges to its preeminence.

- The alternatives to the dollar, such as the euro and China's yuan, have not gained enough international gravitas.

- The dollar's influence can impose financial sanctions and destabilize economies.

- Many developing countries, like Kenya and Zimbabwe, have expressed their frustrations with the dollar and are seeking alternatives.

- Despite the frustrations, the dollar still has its supporters and is seen as a stabilizing force in some economies.

### Summary

Many developing countries, including BRICS nations, are frustrated with the dominance of the U.S. dollar and will discuss alternatives at a summit in Johannesburg. However, the dollar's position as the dominant global currency remains unchallenged.

### Facts

- The strength of the U.S. dollar against local currencies in developing countries has caused prices of foreign goods to soar, leading to reduced sales and job layoffs.

- The BRICS bloc, consisting of Brazil, Russia, India, China, and South Africa, along with other emerging market countries, will discuss their grievances against the U.S. dollar's dominance at a summit in Johannesburg.

- The BRICS countries have previously talked about introducing their own currency, but no concrete proposals have emerged. However, they have discussed expanding trade in their own currencies to reduce reliance on the U.S. dollar.

- The U.S. dollar is the most widely used currency in global business and previous challenges to its dominance have failed.

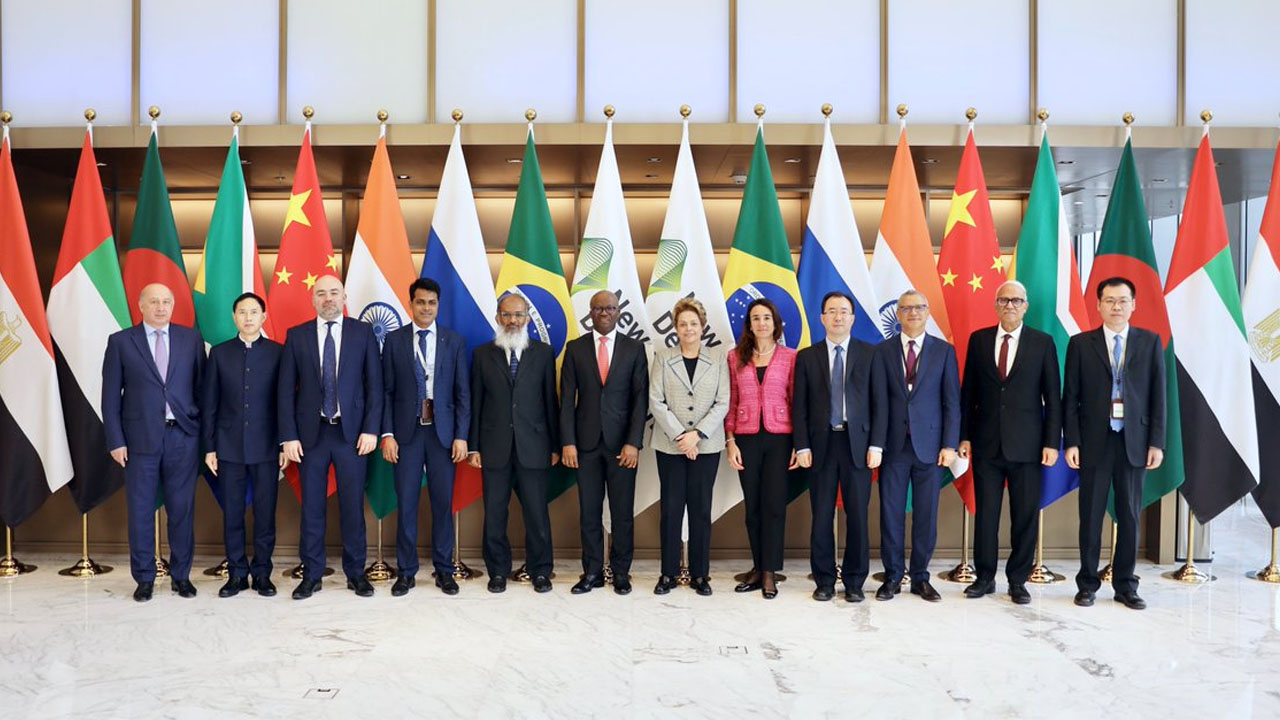

- The BRICS countries launched the New Development Bank in 2015 as an alternative to the U.S. and European-dominated International Monetary Fund and World Bank.

- Developing countries are concerned about the U.S.'s use of the dollar's global influence to impose financial sanctions and the destabilizing effects of fluctuations in the dollar on their economies.

- While the euro and China's yuan have gained some traction in recent years, they still do not rival the dollar in terms of international gravitas.

- The alternatives to the dollar have not been able to gain dominance, and any shift away from the dollar will take time and trust.

- Some countries, such as Argentina and Zimbabwe, have experienced economic turmoil and have turned to the U.S. dollar for stability.

### Summary

India is unlikely to endorse a common BRICS currency, as it fears China's dominance in the bloc and the strengthening of the yuan. However, it may not immediately block discussions on the proposed currency at the BRICS Summit.

### Facts

- 🚫 India is not interested in being part of the proposed BRICS currency, as it sees it as China's attempt to gain hegemony.

- 🔄 India may not use its veto power to stop the currency proposal immediately, but it has concerns about China's dominating role.

- 🤝 The proposed BRICS currency is expected to heavily benefit China, as it is the dominant economy in the bloc.

- 🌍 The plan for a common BRICS currency may take time due to the different levels of economic development among the members.

- 📅 The 15th BRICS Summit will be held in Johannesburg from August 22-24, with leaders from Brazil, Russia, India, China, and South Africa expected to attend.

- 💲 The US dollar accounts for 58.36% of global foreign exchange reserves, while the Chinese yuan only accounts for 2.7%.

- 💱 Determining the value of the proposed BRICS currency would be a challenge due to the differing economic situations of the member countries.

- 💼 Harmonizing financial rules and regulations, such as debt-to-GDP ratio, would also be difficult for the BRICS members.

- 💔 Weaker economies in the EU, like Greece and Portugal, faced difficulties when the euro was introduced, and BRICS countries lack sufficient social security to handle strict debt-to-GDP ratios.

### Summary

Global dedollarization efforts are facing a credibility challenge as currencies such as the Russian ruble, Chinese yuan, and Argentine peso suffer significant declines, highlighting the perceived stability and reliability of the US dollar.

### Facts

- 📉 The Chinese yuan, Russian ruble, and Argentine peso have all experienced significant declines in value recently, causing their respective central banks to take measures to stabilize their currencies.

- 🌍 These declines come at a time when countries like Russia and China are actively trying to reduce their reliance on the US dollar in trade and investments, a trend known as dedollarization.

- 💰 However, the recent exchange-rate turmoil and instability of these currencies against the US dollar could undermine the dedollarization efforts and raise questions about the feasibility of finding a common currency to combat the dominance of the dollar.

- 💱 Dedollarization efforts in Argentina have been limited, with some even advocating for adopting the US dollar as the local currency to combat hyperinflation.

- 🌎 While the share of the US dollar in global reserves has decreased over the years, it still makes up nearly 60% of the world's foreign-exchange holdings, highlighting its long-standing dominance as the world's reserve currency.

Note: The text provided is truncated, so the summary and bullet points may not capture the complete context of the original text.

### Summary

The strength of the U.S. dollar against other currencies, such as the Nigerian naira and Zimbabwean dollar, has made it difficult for local consumers to buy foreign goods, leading to economic troubles in these countries.

### Facts

- 💰 The strength of the U.S. dollar has pushed the price of foreign goods beyond the reach of local consumers in Nigeria.

- 💸 Many developing countries are unhappy with the dominance of the U.S. dollar in the global financial system.

- 🌍 The BRICS bloc, which includes Brazil, Russia, India, China, and South Africa, will discuss their grievances against the dollar at a meeting in Johannesburg, South Africa.

- 💵 The alternatives to the U.S. dollar, such as the euro and China's yuan, have not been able to rival its dominance.

- 🇦🇷 In Argentina, a presidential candidate is calling for the U.S. dollar to replace the country's troubled peso.

- 💼 In Zimbabwe, the U.S. dollar is widely used in transactions due to the instability of the Zimbabwean dollar.

- 💸 Vendors in Zimbabwe are even mending damaged U.S. dollar bills for a small fee due to a shortage.

### Credit

By: Dionne Searcey and Constant Méheut

Source: The Washington Post

While strategic competitors in emerging markets are calling for change and the share of the US dollar held as official foreign exchange reserves has declined, it is unlikely that there will be a major shift in the US dollar's role as the central global currency due to the stability and reputation of the US government, as well as the challenges and limitations of other options like the renminbi.

The inclusion of oil-producing countries like Saudi Arabia and the UAE into the BRICS alliance could lead to 90% of the world's oil trade being settled in local currencies instead of the USD, potentially triggering a shift away from the U.S. dollar and impacting the global finance system.

The Brics economic group, consisting of Brazil, Russia, India, China, and South Africa, is discussing the possibility of expanding its membership and promoting the use of local currencies for trade settlement, with aims to challenge the dominance of the US dollar, but analysts believe that the greenback is unlikely to lose its status as the international reserve currency.

Russian President Vladimir Putin stated at the BRICS Summit that the decline in the global role of the US dollar is an irreversible process, emphasizing the bloc's de-dollarization efforts.

The US Dollar strengthens as several BRIC countries express support for the currency, while Fed officials remain quiet on rate cuts, and geopolitical tensions boost the Greenback during US trading hours.

Russia has called on the BRICS alliance to abandon the US dollar for trade settlements and instead embrace local currencies, in a continuation of the bloc's de-dollarization efforts.

Brazil's President proposed the creation of a common currency for BRICS nations to reduce their vulnerability to dollar exchange rate fluctuations, although officials and economists have acknowledged the challenges of such a project.

Brazil's President, Luiz Inacio Lula Da Silva, announced at the BRICS Summit that the economic alliance will officially abandon the US dollar for trade settlements, aligning with de-dollarization efforts and expanding to include six additional countries by 2024.

The BRICS summit is aiming to reduce reliance on the U.S. Dollar, as the coalition confirms new members including UAE, Egypt, Ethiopia, Saudi Arabia, and Argentina, and discusses the possibility of a new payment system and currency backed by gold.

The BRICS bloc of developing nations, including Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates, has agreed to expand in an effort to reshape the world order it sees as outdated and tilted against them. However, the expansion faces challenges due to differing interests and concerns among the member countries. Additionally, the idea of a BRICS trading currency called BRICKs is seen as flawed and unlikely to be successful. The notion that the GDP of the BRICS bloc will surpass that of the G7 countries is also disputed, with China's demographics and debt bubble being seen as potential obstacles.

The US dollar will remain dominant in global trade, but China's yuan is gaining popularity among developing countries such as Russia, Brazil, India, and South Africa.

The BRICS summit focused on increasing the use of local currencies for trade, but there were no discussions about a digital currency; however, three non-BRICS countries also announced plans to use local currencies instead of the dollar for cross-border trade.

The BRICS nations are divided on the issue of de-dollarization, as statements from the bloc's leaders indicated, despite discussions about the creation of a common currency to rival the US dollar.

The dollar is not likely to lose its status as the global reserve currency despite the expansion of the BRICS group of nations and their aim to find an alternative, as technology and not commodity-based currencies are expected to be the driving force in the future.

The dollar's status as a global reserve currency is facing challenges as countries like China and India promote trade in their own currencies, digital currencies gain popularity, and geopolitical conflicts threaten the international monetary system dominated by the dollar.

The BRICS expansion and their de-dollarization efforts have been met with a relatively calm response from the US, Germany, and the European Union, emphasizing the importance of countries choosing partnerships based on their national interests.

JP Morgan predicts that the U.S. dollar is at risk of losing its global reserve status as BRICS countries increase their use of local currencies for trade settlement, although the chances of this happening in the near future are slim.

The biggest risk of de-dollarization is that the US could lose a key tool it's used to fight past economic crises, according to JPMorgan.

The residual impact of sanctions against Russia is causing divisions among the Group of 20 countries, with some nations resisting US-led efforts and forming alliances with Russia and China, while the BRICS nations are seeking to reduce reliance on the US dollar.

The rising U.S. dollar is causing concern among foreign officials and investors, but it remains uncertain if anything can be done to stop its rise or if it will negatively impact U.S. equities.

The U.S. dollar's share in global reserves has fallen below 60% for the first time in decades, as other currencies like the Euro, Pound, and Yen are on the rise due to a growing number of countries settling trade in their national currencies, driven by the de-dollarization process initiated by BRICS to end reliance on the U.S. dollar.

The Indian Rupee is weakening against the US dollar, causing concern for Indian authorities who fear that it could impact the country's import and export sectors, with suspicions that India may be taking measures to limit the dollar's growth; similarly, other BRICS member countries like China and Japan are also trying to curb the US dollar's growth.

The BRICS expansion, which includes countries like Saudi Arabia, the UAE, and Iran, has raised concerns in the U.S. and EU as it poses a threat to Western-dominated financial markets, while China's influence grows and the alliance aims for de-dollarization in global trade.

India and Saudi Arabia are discussing the possibility of trading in their local currencies, potentially ending their reliance on the US dollar for cross-border transactions.

China is unlikely to devalue its currency, the yuan, despite concerns that it could do so to boost exports, as such a move would risk intensifying capital flight and tightening financial conditions, according to the Institute of International Finance. Instead, the focus will be on domestic easing measures to maintain steady growth, although there is the challenge of balancing the yuan's stability against the strengthening US dollar and other major currencies.

Tesla CEO Elon Musk recently revealed that the one-sided foreign policy of the United States, including heavy-handed actions and economic sanctions, is causing countries in the BRICS and ASEAN alliances to move away from the US dollar and seek alternative currencies for global trade, potentially impacting the American economy.

Developing countries, including the BRICS alliance, are looking to end reliance on the US dollar due to increasing debt and the threat of inflation, which could lead to a decline in the dollar's value and a rise in prices. Economist Peter Schiff warns of a tragic ending for the US dollar if other countries continue to move away from it.

The BRICS bloc, including countries like India, China, and Russia, is slowly reducing its dependency on the US dollar and using their local currencies for trade, which could potentially weaken the US dollar's position as the dominant global currency.

The BRICS coalition, along with new members, aims to reduce the dominance of the US dollar by using their own currencies for oil trade, posing potential risks to the US's global leadership and economy.

BRICS countries are reducing their ties with the U.S. Treasury by selling off Treasury bonds, opting instead for gold, local currencies, and commodities like oil and gas, in order to hedge against U.S. economic policies that may limit the dollar's ability to fund its deficit. Data shows that BRICS has already offloaded $18.9 billion in U.S. Treasury bonds this month, with China leading the way by selling $117.4 billion worth of U.S. government debt this year. Other BRICS members, including Brazil, India, and the UAE, have also decreased their U.S. Treasury holdings. In total, BRICS has removed $122.7 billion worth of U.S. Treasury bonds in 2023.

The US economy's growing debt and slow growth may lead to a "long, slow grind," while regional blocs in Asia and Europe pose a threat to the dollar's status as the global currency.

The US dollar maintains its dominant position as the leading global currency, with a 58.9% share of global currency reserves, despite a gradual decline over the past 20 years.

Bitcoin and gold are expected to thrive amidst fiscal problems in the US economy and a potential pivot from the Federal Reserve, according to macro investor Luke Gromen. Gromen also suggests that the launch of a gold-backed currency by the BRICS alliance may weaken the US dollar as the world's reserve currency.

The American banking, trade, forex, tourism, and other sectors could be severely impacted if BRICS countries stop using the U.S. dollar for trade, leading to potential financial catastrophe and hyperinflation.

The BRICS New Development Bank has announced a 3-year de-dollarization plan to increase local currency transactions and reduce reliance on the US dollar for developing country investments, aligning with the alliance's strategy to move away from the dollar. Additionally, the bank's expansion may greatly affect its lending model and facilitate the alignment with the alliance's strategy.

China, Brazil, and Saudi Arabia are reducing their US Treasury holdings, with China selling nearly $500 billion in US Treasuries over the past decade.