China's central bank has cut the main benchmark interest rate in an attempt to address falling apartment prices, weak consumer spending, and broad debt troubles, but the reduction was smaller than expected, signaling the potential ineffectiveness of traditional tools to stimulate the economy.

The recent rise in interest rates is causing credit to become more expensive and harder to obtain, which will have significant implications for various sectors of the economy such as real estate, automobiles, finance/banks, and venture capital/tech companies. Rising rates also affect the fair value of assets, presenting both opportunities and risks for investors.

Homebuyers looking to secure a lower mortgage interest rate in today's market can do so by improving their credit score, buying mortgage points, or locking in a rate.

The current housing market is facing challenges due to rising interest rates and higher prices, leading to a slowdown in home sales, but the market is more resilient and better equipped to handle these fluctuations compared to the Global Financial Crisis, thanks to cautious lending practices and stricter regulations.

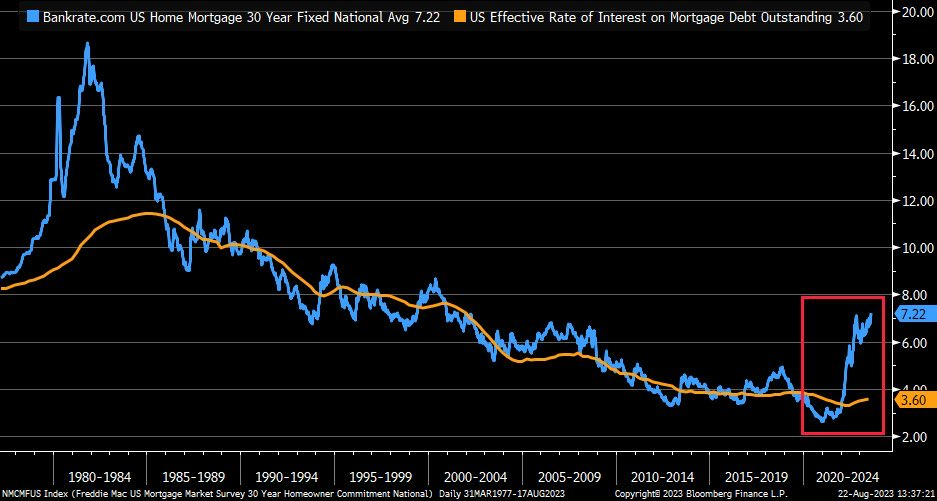

The interest rate on the most popular U.S. home loan reached its highest level since December 2000, leading to a significant drop in mortgage applications and contributing to the struggling housing market.

The surge in mortgage rates has caused housing affordability to reach the lowest level since 2000, leading to a slow fall in the housing market and a potential dip in home prices, although the current market differs from the conditions that preceded the 2008 crash, with low housing inventory and a lack of risky mortgage products, making mortgage rates the key lever to improve affordability.

Mortgage rates topping 7% have led to a significant drop in mortgage applications for home purchases, with last week seeing the smallest volume in 28 years. The increase in rates, driven by concerns of high inflation, has priced out many potential buyers and contributed to low housing supply and high home prices. As a result, sales of previously owned homes have declined, and homeowners are reluctant to sell their properties due to the higher rates. Some buyers are turning to adjustable-rate mortgages to manage the increased costs.

Despite concerns over rising deficits and debt, central banks globally have been buying government debt to combat deflationary forces, which has kept interest rates low and prevented a rise in rates as deficits increase; therefore, the assumption that interest rates must go higher may be incorrect.

Despite reaching record levels of total credit card debt and household debt, Americans are actually managing their debt better than in the past due to inflation masking the impact on balances and lower debt-to-deposit levels, according to an analysis by WalletHub. However, the rising trajectory of credit card debt and the increasing number of households carrying balances raise concerns, especially considering the high interest rates, which can take more than 17 years to pay off and cost thousands of dollars in interest. Meanwhile, savers have the opportunity to earn higher returns on cash due to higher inflation and interest rates.

Consumer debt, including auto-loans and credit card balances, is increasing in the United States, but strong government intervention and temporary relief measures have created a cushion of extra cash savings, leading to a positive outcome for Bitcoin (BTC) according to Cointelegraph analyst Marcel Pechman.

Mortgage rates have remained high despite bond yields and inflation being at average levels, largely due to the lack of refinancing activity and the longer duration of mortgage-backed securities, causing an unhealthy housing market.

Chinese state-owned banks are expected to lower interest rates on existing mortgages, with the quantum of the cut varying for different clients and cities, in an effort to revive the property sector and boost the country's economy.

Mortgage rates have increased recently due to inflation and the Federal Reserve's interest rate hikes, but experts predict rates will remain in the 6% to 7% range for now; homebuyers should focus on improving their credit scores and comparing lenders to get the best deal.

More Americans are struggling to keep up with car loan and credit card payments, particularly lower-income earners, as higher prices and rising borrowing costs put pressure on household budgets, signaling potential consumer stress; the situation is expected to worsen as interest rates continue to rise and paused student loan payments resume.

Summary: Rising interest rates have revealed issues in home loan markets, causing stagnation in housing markets and difficulties for borrowers in countries like the US, UK, Sweden, and New Zealand, highlighting the value of the Danish system of long-term fixed-rate mortgages with prepayable options and flexible transferability.

Americans facing high prices and interest rates are struggling to repay credit card and auto loans, leading to rising delinquencies and defaults with no immediate relief in sight, particularly for low-income individuals, as analysts expect the situation to worsen before it improves.

Surging interest rates in the UK have led to a slump in factory output, the biggest annual drop in house prices since the global financial crisis, and signals of distress in different sectors of the economy, posing a dilemma for the Bank of England as it decides whether to raise interest rates further.

Central banks across major developed and emerging economies took a breather in August with lower interest rate hikes amid diverging growth outlooks and inflation risks, while some countries like Brazil and China cut rates, and others including Turkey and Russia raised rates to combat currency weakness and high inflation.

The US housing market is experiencing high mortgage rates and low supply, causing home prices to remain high despite rising interest rates.

Private debt fundraising and deals in Europe are slowing down, indicating that aggressive interest rate rises may be causing funding stress and exacerbating economic pain. The European private credit industry has seen a 34% drop in new investment compared to the same period last year, and direct lenders are closing fewer transactions, leading to concerns about defaults and tighter liquidity in the future.

Major companies are becoming more cautious about borrowing in a higher interest rate environment, leading to a decrease in corporate bond issuances.

Investors now have the opportunity to earn high interest rates on their cash deposits, with some potentially earning as much as 5% or more, marking the highest rates in 15 years, prompting financial advisors to urge savers to shop around for the best rates and avoid holding too much cash.

The Wall Street Journal reports a notable shift in the stance of Federal Reserve officials regarding interest rates, with some officials now seeing risks as more balanced due to easing inflation and a less overheated labor market, which could impact the timing of future rate hikes. In other news, consumer credit growth slows in July, China and Japan reduce holdings of U.S. Treasury securities to record lows, and Russia's annual inflation rate reached 5.2% in August 2023.

U.S. consumers have accumulated $43 billion in additional credit card debt during Q2 2022, three times the average amount since the Great Recession, and credit card interest rates have soared to over 20%, raising concerns about the impact of inflation and rising interest rates on consumers' ability to pay off their balances. However, some economists argue that higher wages are helping consumers keep pace with their debt, and the overall rate of charge-offs remains low. Nonetheless, the combination of spent-down pandemic savings and the resumption of federal student loan payments could pose challenges for lower-income borrowers and hinder consumer spending.

Despite increased household wealth in the US, millions of households are struggling financially due to inflation, high interest rates, and rising living costs, which have led to record levels of debt and limited access to credit.

The European Central Bank has implemented its 10th consecutive interest rate increase in an attempt to combat high inflation, although there are concerns that higher borrowing costs could lead to a recession; however, the increase may have a negative impact on consumer and business spending, particularly in the real estate market.

Mortgage rates for home purchases and refinancing have fluctuated, with rates for 30-year terms increasing and rates for 10-year and 15-year terms decreasing. Borrowers have the option to choose a term that aligns with their financial goals and preferences.

Rising interest rates caused by the steepest monetary tightening campaign in a generation are causing financial distress for borrowers worldwide, threatening the survival of businesses and forcing individuals to consider selling assets or cut back on expenses.

The Federal Reserve is expected to hold off on raising interest rates, but consumers are still feeling the impact of previous hikes, with credit card rates topping 20%, mortgage rates above 7%, and auto loan rates exceeding 7%.

The Federal Reserve's decision to leave interest rates unchanged means that savers and individuals with surplus cash have the opportunity to earn a higher return on their money than in recent years, with online banks offering high-yield savings accounts that can provide a return above inflation.

The Federal Reserve has revised its interest rate forecast, planning for fewer rate cuts next year than previously anticipated, which may not be favorable for borrowers.

The Federal Reserve has decided to keep interest rates steady, giving borrowers a break after 11 rate hikes and aiming to tame inflation while avoiding a recession.

The Federal Reserve's decision not to raise interest rates has provided little relief for Americans struggling with the high costs of borrowing, particularly in the housing market where mortgage rates have reached their highest level in over two decades, leading to challenges for potential and current homeowners.

Opening a CD now can allow savers to earn a higher interest rate before inflation drops and interest rates decrease.

Credit card interest rates have reached historic highs, with the average rate hitting 20.68% in May, leading to concerns about the potential snowball effect and long-term financial consequences for consumers.

UK homeowners are feeling the strain as interest rates remain high, with many struggling to afford increased mortgage payments and considering drastic measures such as taking in lodgers or canceling expenses in order to make ends meet.

Portugal's government has announced that banks must reduce mortgage interest rates for borrowers struggling with rising interest rates, by discounting the benchmark six-month Euribor rate by 30%.

The Federal Reserve has paused its campaign of increasing interest rates, indicating that they may stabilize in the coming months; however, this offers little relief to home buyers in a challenging housing market.

Consumers can benefit from higher interest rates through increased savings rates, with some high-yield savings accounts now offering returns higher than the national inflation rate, providing a low-risk option for those seeking a lower-risk return.