This article discusses various business-related news and developments, including the launch of Meta's Threads app as a rival to Twitter, Apple's stock valuation reaching $3 trillion, the rally in tech stocks, Tesla's record-breaking vehicle deliveries, the approval of Alef Aeronautics' flying car, a temporary injunction on government officials discussing content removal with social media companies, Pakistan's bailout from the IMF, China's export curbs on semiconductor materials, leadership changes in China's central bank, Australia's decision to keep interest rates on hold, Saudi Arabia and Russia's efforts to lower oil supplies, Reliance Jio's launch of a cheap internet-connected phone in India, and Japan Airlines' clothing rental service for passengers.

Main topic: Apple's Q3 earnings and performance in the smartphone market

Key points:

- iPhone revenue declined from $40.66 billion to $39.67 billion compared to the same quarter last year

- Services revenue increased from $19.6 billion to $21.2 billion, beating analyst expectations

- Apple saw growth in China with sales up 8% year-over-year

- CEO Tim Cook highlighted the company's focus on AI and machine learning, including generative AI

- Apple plans to release its Vision Pro headset, a spatial computing device, early next year.

Main topic: Apple's financials in Q3 2023

Key points:

1. Apple's revenue from its Services segment reached an all-time high of $21.2 billion, growing 8% year-over-year.

2. iPhone, Mac, and iPad revenue declined compared to a year ago, with iPad sales experiencing the largest drop.

3. Overall, revenues dropped less than 2% year-over-year, while profits increased about 2% to $19.9 billion.

The article mentions the stock of Applied Materials, Inc. (NASDAQ: AMAT). The author gives a recommendation to buy the stock.

The author's core thesis is that Applied Materials has shown resilience in the semiconductor equipment industry and is expected to continue reporting resilient YoY growth rates. The author mentions that the company has a strong market position, comprehensive product portfolio, and revenue driven primarily by the semiconductor systems segment. They also highlight the company's commitment to research and development and its potential for long-term growth.

The key information and data mentioned in the article include Applied Materials' Q3 financial results, which beat Wall Street consensus and the author's own estimates. The company reported revenue of $6.43 billion, down 1.4% YoY but better than expected. The article also discusses the company's margin profile, earnings per share, cash flows, and dividend growth history. The author highlights the company's exposure to the ICAPS (IoT, communications, automotive, power, and sensors) segment, which has been driving its outperformance, and the growing importance of the services segment in stabilizing its revenue stream. The article also mentions the company's future outlook, guidance for Q4, and updated financial projections. The author provides a target price for the stock of $177, based on a forward P/E multiple of 20x and improved financial estimates.

Apple's iPhone sales in China have surpassed those in the United States for the first time, contributing to Apple potentially becoming the biggest player in the smartphone market this year, despite global smartphone shipments being on track to be the worst in a decade due to economic headwinds in China and the US, according to Counterpoint Research.

Apple and Nvidia are two Nasdaq-listed stocks that have the potential to lead your portfolio for years to come, with Apple's sustainable profits driven by their shift to a services-focused approach and Nvidia's dominance in the AI hardware market.

Apple stock rose more than 2% on Tuesday ahead of its Sept. 12 event where the company is expected to announce new products, including the iPhone 15 and new Apple watches.

The global smartphone market is expected to decline, but IDC predicts that Apple's iPhone market share will reach an all-time high due to trade-in deals, buy-now-pay-later schemes, and enticing features in their upcoming iPhone 15 Pro Max.

Investors are bullish on the market in 2023, with the Nasdaq Composite up 30% and two leading ultra-growth stocks, Amazon and Apple, poised to benefit from improving market conditions and their strong positions in multiple industries.

Salesforce surpasses Apple as the top-performing stock in the Dow Jones Industrial Average and continues to gain momentum after its latest earnings report.

September has historically been the worst month for stocks, but this year may be different as the excitement around AI, cash on the sidelines, and Apple's new iPhone could potentially drive positive market performance.

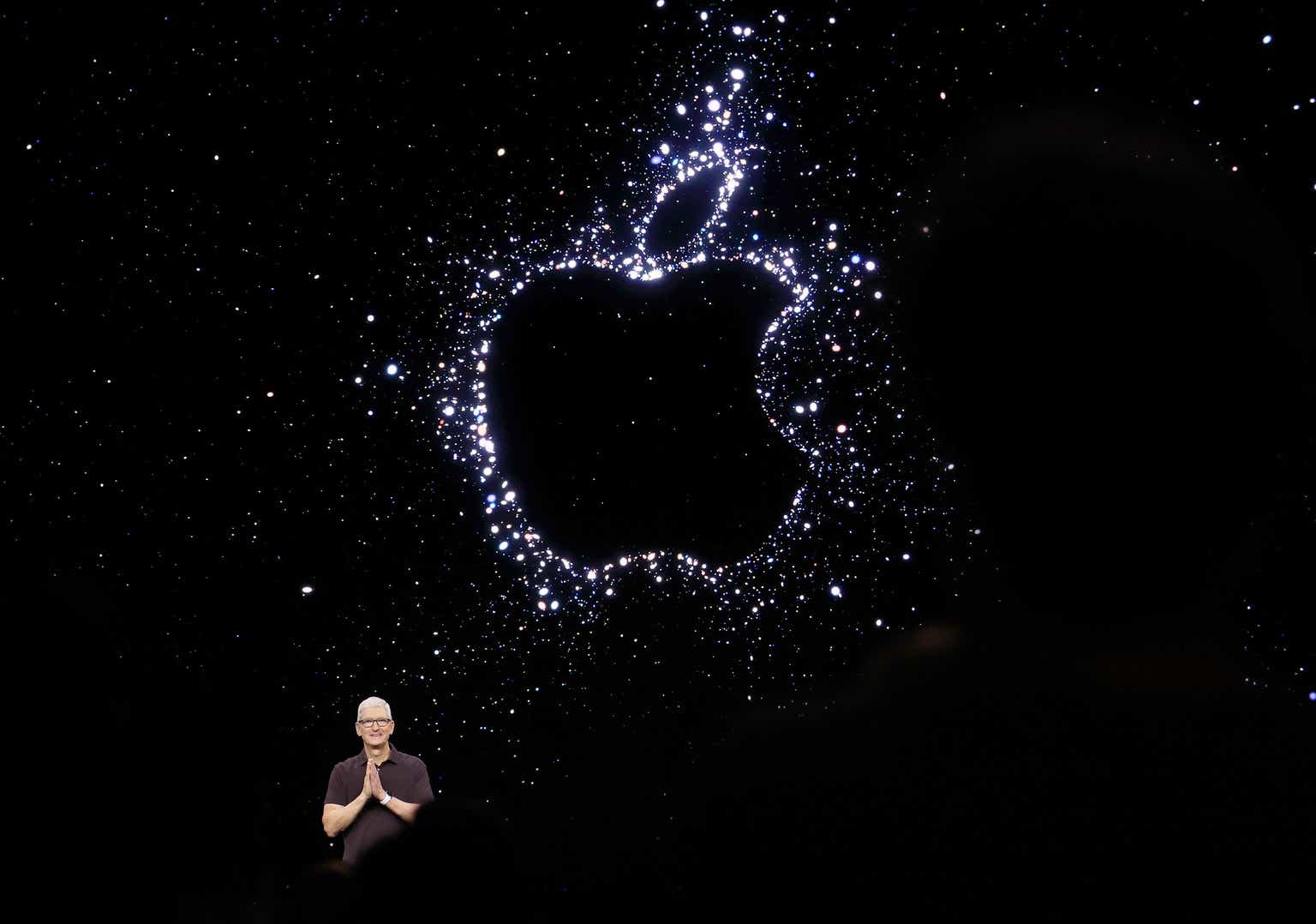

Apple's stock market value surpassed $3 trillion for the first time, driven by signs of improving inflation and expectations of successful expansion into new markets, with technology stocks rebounding on bets that the US Federal Reserve may slow its rate hikes.

Apple shares have declined due to falling revenue in its product segments, but the company's long-term outlook remains strong, driven by its booming services business and dominant market shares, with two reasons to buy Apple stock being the upcoming iPhone launch and its potential in high-growth industries like AI and virtual/augmented reality.

Big tech, including Apple, faced pressure as concerns grew over China potentially expanding its iPhone ban, while equity futures fell due to strong jobless claims figures, reinforcing the case for the Federal Reserve to maintain elevated interest rates.

Apple stock is experiencing a decline leading up to the release of the iPhone 15.

Apple's stock fell nearly 4% and triggered a tech stock selloff after reports that China has expanded restrictions on iPhone use by government employees, leading to concerns about the financial impact of escalating tensions between the US and China.

Apple's recent sell-off due to concerns about a Chinese crackdown on iPhone usage among government workers should not deter investors from the tech giant.

Apple shares face a downturn as China plans to extend its ban on iPhones to government agencies and state companies, potentially wiping out $200 billion of the company's market value, as China's economic crisis threatens demand for consumer electronics and rising US Treasury yields add to Apple's troubles.

Apple's iPhone 15 launch may face delays due to production issues, resulting in lower stock availability, while the iPhone 15 Pro Max is expected to be delayed by up to a month; leaked price details suggest a significant mark-up on the iPhone 15 Pro and Pro Max; Apple is rumored to be preparing a cheaper MacBook to rival the Chromebook, but it risks diluting its brand; the European Union has designated the App Store, Safari browser, and iOS as "gatekeepers" and plans to introduce regulations to prevent anti-competitive behavior; Apple's stock has fallen following restrictions on Chinese officials' use of iPhones.

The launch of the latest iPhones by Apple aims to boost consumers and investors amidst falling share prices caused by deteriorating international relations, with tensions between Beijing and Washington threatening sales in China, one of Apple's biggest markets.

Chinese government restrictions on the use of iPhones at work have caused Apple's stock to decline, but investors see this as a buying opportunity due to China's previous restrictions on foreign products and Apple's strong prospects, attractive valuation, and upcoming product releases.

Katie Stockton discusses the current outlook of the stock market, individual sectors, and cryptocurrencies using key technical indicators, while also highlighting the significance of Apple and Alphabet in light of the iPhone release and the antitrust suit against Google.

Investors hoping for a surge in Apple's stock on iPhone launch days may be disappointed, as historical data shows that the stock usually falls on the day of the announcement and the release, but gains in the months following the release.

Apple has increased the prices of its latest iPhones in countries like China, Japan, and India, while keeping prices the same in the U.S., as it aims to target premium users and reinvigorate growth in key markets. Although the price hikes are mainly for higher storage options and the more expensive models, Apple has also implemented price cuts in certain regions to target budget-conscious consumers.

Apple's highly anticipated iPhone 15 launch disappoints investors and Wall Street.

Apple's stock valuation is deemed unreasonable and reflective of a shrinking company by the Chairman of Miller Value Partners, highlighting the challenge for Apple to meet growth expectations given its size and current market capitalization.

If you had bought a top-of-the-line iPhone every time Apple released a new model instead of buying Apple stock, you would have spent around $16,000 on iPhones and made a profit of approximately $131,000 if you had bought the stock instead.

Arm stock is experiencing a second day of gains and is currently more popular than Apple.

Apple's latest iPhone, the iPhone 15 Pro, has shown better-than-expected lead times and pre-orders, dispelling investor concerns and suggesting strong early demand despite previous worries about a possible ban in China.

Despite lukewarm reception and concerns around a Chinese ban, pre-orders for Apple's iPhone 15 are exceeding expectations, especially for the iPhone 15 Pro/Pro Max models, which are expected to boost Apple's average selling prices by approximately $100 over the past year.

UBS analyst David Vogt's data suggests that initial demand for Apple's iPhone 15 Pro models is softer compared to last year's models, contradicting reports of strong sales, which caused Apple stock to fall.

Apple is expected to increase its share of India's smartphone sales with the release of its high-end iPhone 15 Pro and Pro Max models, projecting to account for 7% of all smartphone sales in the country from July to December, according to market researcher Counterpoint.

Apple is expected to achieve year-over-year growth in Q4 thanks to better than expected iPhone revenue and profit, with the iPhone 15 Pro Max and iPhone 15 Plus performing well, while the standard iPhone 15 and iPhone 15 Pro may face order cuts if their prices are not reduced, according to Ming-Chi Kuo's analysis based on supply chain sources.

Wedbush analyst Daniel Ives believes that lukewarm reviews for Apple's new iPhone 15 may be overshadowed by strong sales, driven by a large number of iPhone users who haven't upgraded their phones in four or more years and the fear of missing out (FOMO), leading to potential pre-order rise and higher average sales prices (ASPs), suggesting that consensus analyst estimates for Apple's sales growth in 2024 could be conservative and projecting a $240 price target with 37% profit potential for Apple stock.